PNC Bank 2015 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

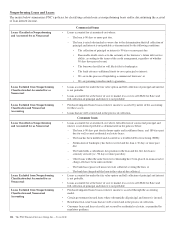

Nonperforming Loans and Leases

The matrix below summarizes PNC’s policies for classifying certain loans as nonperforming loans and/or discontinuing the accrual

of loan interest income.

Commercial loans

Loans Classified as Nonperforming

and Accounted for as Nonaccrual

• Loans accounted for at amortized cost where:

–The loan is 90 days or more past due.

–The loan is rated substandard or worse due to the determination that full collection of

principal and interest is not probable as demonstrated by the following conditions:

• The collection of principal or interest is 90 days or more past due;

• Reasonable doubt exists as to the certainty of the borrower’s future debt service

ability, according to the terms of the credit arrangement, regardless of whether

90 days have passed or not;

• The borrower has filed or will likely file for bankruptcy;

• The bank advances additional funds to cover principal or interest;

• We are in the process of liquidating a commercial borrower; or

• We are pursuing remedies under a guarantee.

Loans Excluded from Nonperforming

Classification but Accounted for as

Nonaccrual

• Loans accounted for under the fair value option and full collection of principal and interest

is not probable.

• Loans accounted for at the lower of cost or market less costs to sell (Held for Sale) and

full collection of principal and interest is not probable.

Loans Excluded from Nonperforming

Classification and Nonaccrual

Accounting

• Purchased impaired loans because interest income is accreted by nature of the accounting

for these assets.

• Loans that are well secured and in the process of collection.

Consumer loans

Loans Classified as Nonperforming

and Accounted for as Nonaccrual

• Loans accounted for at amortized cost where full collection of contractual principal and

interest is not deemed probable as demonstrated in the policies below:

–The loan is 90 days past due for home equity and installment loans, and 180 days past

due for well secured residential real estate loans;

–The loan has been modified and classified as a troubled debt restructuring (TDR);

–Notification of bankruptcy has been received and the loan is 30 days or more past

due;

–The bank holds a subordinate lien position in the loan and the first lien loan is

seriously stressed (i.e., 90 days or more past due);

–Other loans within the same borrower relationship have been placed on nonaccrual or

charge-offs have been taken on them;

–The bank has repossessed non-real estate collateral securing the loan; or

–The bank has charged-off the loan to the value of the collateral.

Loans Excluded from Nonperforming

Classification but Accounted for as

Nonaccrual

• Loans accounted for under the fair value option and full collection of principal and interest

is not probable.

• Loans accounted for at the lower of cost or market less costs to sell (Held for Sale) and

full collection of principal and interest is not probable.

Loans Excluded from Nonperforming

Classification and Nonaccrual

Accounting

• Purchased impaired loans because interest income is accreted through the accounting

model.

• Certain government insured loans where substantially all principal and interest is insured.

• Residential real estate loans that are well secured and in the process of collection.

• Consumer loans and lines of credit, not secured by residential real estate, as permitted by

regulatory guidance.

114 The PNC Financial Services Group, Inc. – Form 10-K