PNC Bank 2015 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.inputs are management’s assumption of the spread applied to

the benchmark rate and the estimated servicing cash flows for

loans sold to the agencies with servicing retained. The spread

over the benchmark curve includes management’s

assumptions of the impact of credit and liquidity risk.

Significant increases (decreases) in the spread applied to the

benchmark would result in a significantly lower (higher) asset

value. The wide range of the spread over the benchmark curve

is due to the varying risk and underlying property

characteristics within our portfolio. Significant increases

(decreases) in the estimated servicing cash flows would result

in significantly higher (lower) asset value. Based on the

significance of unobservable inputs, we classified this

portfolio as Level 3.

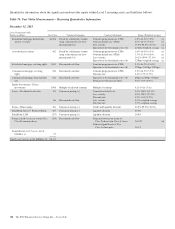

Equity Investments – Direct Investments

The valuation of direct and indirect private equity investments

requires significant management judgment due to the absence

of quoted market prices, inherent lack of liquidity and the

long-term nature of such investments. The carrying values of

direct and affiliated partnership interests reflect the expected

exit price and are based on various techniques including

multiples of adjusted earnings of the entity, independent

appraisals, anticipated financing and sale transactions with

third parties, or the pricing used to value the entity in a recent

financing transaction. A multiple of adjusted earnings

calculation is the valuation technique utilized most frequently

and the multiple of earnings is the primary and most

significant unobservable input used in such calculation. The

multiple of earnings is utilized in conjunction with portfolio

company financial results and our ownership interest in

portfolio company securities to determine PNC’s interest in

the enterprise value of the portfolio company. Significant

decreases (increases) in the multiple of earnings could result

in a significantly lower (higher) fair value measurement. The

magnitude of the change in fair value is dependent on the

significance of the change in the multiple of earnings and the

significance of portfolio company adjusted earnings.

Valuation inputs or analysis are supported by portfolio

company or market documentation. Due to the size, private

and unique nature of each portfolio company, lack of liquidity

and the long-term nature of investments, relevant

benchmarking is not always feasible. A valuation committee

reviews the portfolio company valuations on a quarterly basis

and oversight is provided by senior management of the

business. These investments are classified as Level 3.

Unfunded commitments related to direct investments totaled

$23 million and $28 million at December 31, 2015 and

December 31, 2014, respectively. Outstanding contractual

obligations to existing direct investments totaled $11 million

and $9 million at December 31, 2015 and December 31, 2014,

respectively. During 2015, $5 million of financial support was

provided to existing direct investments compared to $39

million during 2014.

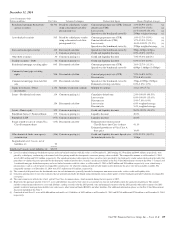

Equity Investments – Indirect Investments

We value indirect investments in private equity funds based

on net asset value (NAV) as provided in the financial

statements that we receive from their managers. Due to the

time lag in our receipt of the financial information and based

on a review of investments and valuation techniques applied,

adjustments to the manager-provided value are made when

available recent portfolio company information or market

information indicates a significant change in value from that

provided by the manager of the fund. In accordance with ASC

820-10, these investments are not classified in the fair value

hierarchy.

These indirect investments are not redeemable, however PNC

receives distributions over the life of the partnerships from

liquidation of the underlying investments by the investee,

which we expect to occur over the next twelve years. The

forced sale or restructuring of these investments would likely

result in PNC receiving less value than it would otherwise

have received in the ordinary course of business. Unfunded

commitments related to indirect investments totaled $103

million and $112 million at of December 31, 2015 and

December 31, 2014, respectively. During 2015, $17 million of

financial support was provided to indirect investments to

satisfy capital calls for commitments. The comparable amount

was $24 million during 2014.

Customer Resale Agreements

We have elected to account for structured resale agreements,

which are economically hedged using free-standing financial

derivatives, at fair value. The fair value for structured resale

agreements is determined using a model that includes

observable market data such as interest rates as inputs.

Readily observable market inputs to this model can be

validated to external sources, including yield curves, implied

volatility or other market-related data. These instruments are

classified as Level 2.

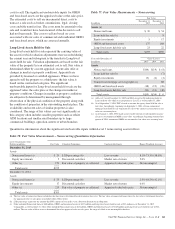

Loans

Loans accounted for at fair value consist primarily of

residential mortgage loans. These loans are generally valued

similarly to residential mortgage loans held for sale and are

classified as Level 2. However, similar to residential mortgage

loans held for sale, if these loans are repurchased and

unsalable, they are classified as Level 3. In addition,

repurchased VA loans, where only a portion of the principal

will be reimbursed, are classified as Level 3. The fair value is

determined using a discounted cash flow calculation based on

our historical loss rate. Due to the unobservable nature of this

pool level approach, these loans are classified as Level 3.

Additionally, we have elected to account for certain home

equity lines of credit at fair value. These loans are classified as

Level 3. This category also includes repurchased brokered

home equity loans. These loans are repurchased due to a

breach of representations or warranties in the loan sales

agreement and occur typically after the loan is in default.

The PNC Financial Services Group, Inc. – Form 10-K 153