PNC Bank 2015 Annual Report Download - page 169

Download and view the complete annual report

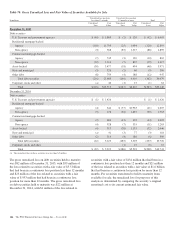

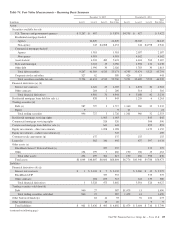

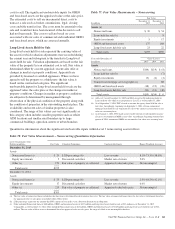

Please find page 169 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Certain infrequently traded debt securities within the State and

municipal and Other debt securities available-for-sale and

Trading securities categories are also classified in Level 3 and

are included in the Insignificant Level 3 assets, net of

liabilities line item in Table 76 (for the 2015 period). The

significant unobservable inputs used to estimate the fair value

of these securities include an estimate of expected credit

losses and a discount for liquidity risk. These inputs are

incorporated into the fair value measurement by either

increasing the spread over the benchmark curve or by

applying a credit and liquidity discount to the par value of the

security. Significant increases (decreases) in credit and/or

liquidity risk could result in a significantly lower (higher) fair

value estimate.

Financial Derivatives

Exchange-traded derivatives are valued using quoted market

prices and are classified as Level 1. However, the majority of

derivatives that we enter into are executed over-the-counter

and are valued using internal models. These derivatives are

primarily classified as Level 2 as the readily observable

market inputs to these models are validated to external

sources. The external sources for these inputs include industry

pricing services, or are corroborated through recent trades,

dealer quotes, yield curves, implied volatility or other market-

related data. Level 2 financial derivatives are primarily

estimated using a combination of Eurodollar future prices and

observable benchmark interest rate swaps to construct

projected discounted cash flows. Financial derivatives that are

priced using significant management judgment or assumptions

are classified as Level 3.

Fair value information for Level 3 financial derivatives is

presented separately for interest rate contracts and other

contracts. Interest rate contracts include residential and

commercial mortgage interest rate lock commitments and

certain interest rate options. Other contracts include risk

participation agreements, swaps related to the sale of certain

Visa Class B common shares and other types of contracts.

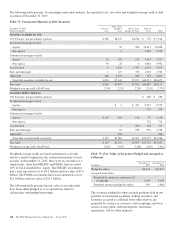

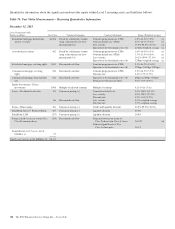

The fair values of residential mortgage loan commitment

assets as of December 31, 2015 and 2014 are included in the

Insignificant Level 3 assets, net of liabilities line item in

Table 76 in this Note 7. Significant unobservable inputs for

these commitments include the probability of funding and

embedded servicing. The probability of funding for residential

mortgage loan commitments represents the expected

proportion of loan commitments in the pipeline that will fund.

Additionally, embedded in the market price of the underlying

loan is a value for retaining servicing of the loan once it is

sold. Significant increases (decreases) in the fair value of a

residential mortgage loan commitment asset (liability) result

when the probability of funding increases (decreases) and

when the embedded servicing value increases (decreases).

The fair values of commercial mortgage loan commitment

assets and liabilities as of December 31, 2015 and 2014 are

included in the Insignificant Level 3 assets, net of liabilities

line item in Table 76 in this Note 7. Significant unobservable

inputs for these commitments include spread over the

benchmark interest rate and the estimated servicing cash flows

for loans sold to the agencies with servicing retained. The

spread over the benchmark curve reflects management

assumptions regarding credit and liquidity risks. Significant

increases (decreases) in the fair value of commercial mortgage

loan commitments result when the spread over the benchmark

curve decreases (increases) or the estimated servicing cash

flows for loans sold to the agencies with servicing retained

increases (decreases).

The fair values of interest rate option assets and liabilities as

of December 31, 2015 and 2014 are included in the

Insignificant Level 3 assets, net of liabilities line item in

Table 76 in this Note 7. The significant unobservable input

used in the fair value measurement of the interest rate options

is expected interest rate volatility. Significant increases

(decreases) in interest rate volatility would result in a

significantly higher (lower) fair value measurement.

The fair values of risk participation agreement assets and

liabilities as of December 31, 2015 and 2014 are included in

the Insignificant Level 3 assets, net of liabilities line item in

Table 76 in this Note 7. The significant unobservable inputs

used in the fair value measurement of risk participation

agreements are probability of default and loss severity.

Significant increases (decreases) in probability of default and

loss severity would result in a significantly higher (lower) fair

value measurement.

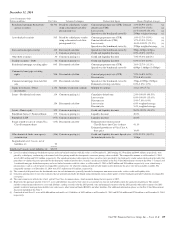

In connection with the sales of portions of our Visa Class B

common shares, we entered into swap agreements with the

purchasers of the shares to account for any future risk of

converting Class B common shares to Class A common shares

and to account for the corresponding change in value to the

Class B shares. These adjustments result from resolution of

the specified litigation or the changes in the amount in the

litigation escrow account funded by Visa as well as from

changes in the estimated litigation resolution date (see Note 20

Legal Proceedings and Note 21 Commitments and Guarantees

for additional information). These swaps also require

payments calculated by reference to the market price of the

Class A common shares and a fixed rate of interest. The swaps

are classified as Level 3 instruments and the fair values of the

liability positions totaled $104 million at December 31, 2015

and $135 million at December 31, 2014, respectively. The fair

values of the swap agreements are determined using a

discounted cash flow methodology. The significant

unobservable inputs to the valuations are estimated changes in

the conversion rate of the Class B common shares into

Class A common shares and the estimated growth rate of the

Class A share price. A decrease in the conversion rate will

have a negative impact on the fair value of the swaps and vice

versa. Independent of changes in the conversion rate, an

increase in the estimated growth rate of the Class A share

The PNC Financial Services Group, Inc. – Form 10-K 151