PNC Bank 2015 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

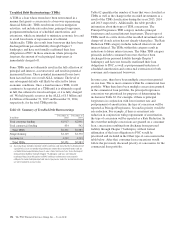

TDRs may result in charge-offs and interest income not being

recognized. The amount of principal balance charged off at or

around the time of modification for the twelve months ended

December 31, 2015 was not material. A financial effect of rate

reduction TDRs is that interest income is not recognized for

the difference between the original contractual interest rate

terms and the restructured terms. Interest income not

recognized that otherwise would have been earned in the

twelve months ended December 31, 2015 and 2014, related to

all commercial TDRs and consumer TDRs, was not material.

After a loan is determined to be a TDR, we continue to track

its performance under its most recent restructured terms. In

Table 63, we consider a TDR to have subsequently defaulted

when it becomes 60 days past due after the most recent date

the loan was restructured. The following table presents the

recorded investment of loans that both (i) were classified as

TDRs or were subsequently modified during each 12-month

period preceding January 1, 2015, 2014, and 2013

respectively, and (ii) subsequently defaulted during these

reporting periods.

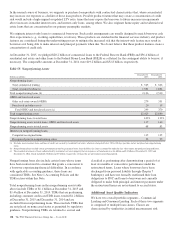

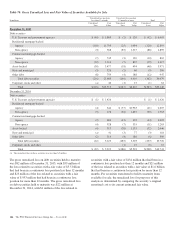

Table 63: TDRs that were Modified in the Past Twelve

Months which have Subsequently Defaulted

During the year ended

December 31, 2015

Dollars in millions Number of Contracts Recorded Investment

Commercial lending

Commercial 23 $ 9

Commercial real estate 13 13

Equipment lease financing 1 1

Total commercial lending 37 23

Consumer lending

Home equity 458 26

Residential real estate 150 22

Credit card 3,045 24

Other consumer 167 1

Total consumer lending 3,820 73

Total TDRs 3,857 $ 96

During the year ended

December 31, 2014

Dollars in millions Number of Contracts Recorded Investment

Commercial lending

Commercial 38 $ 26

Commercial real estate 43 80

Total commercial lending (a) 81 106

Consumer lending

Home equity 400 21

Residential real estate 155 24

Credit card 3,397 27

Other consumer 132 1

Total consumer lending 4,084 73

Total TDRs 4,165 $179

During the year ended

December 31, 2013

Dollars in millions Number of Contracts Recorded Investment

Commercial lending

Commercial 67 $ 47

Commercial real estate 38 59

Total commercial lending (a) 105 106

Consumer lending

Home equity 592 39

Residential real estate 255 35

Credit card 4,598 34

Other consumer 249 4

Total consumer lending 5,694 112

Total TDRs 5,799 $218

(a) During the twelve months ended December 31, 2014 and 2013, there were no loans

classified as TDRs in the Equipment lease financing loan class that have

subsequently defaulted.

The impact to the ALLL for commercial lending TDRs is the

effect of moving to the specific reserve methodology from the

quantitative reserve methodology, for those loans that were

not already classified as nonaccrual. There is generally an

impact to the ALLL as a result of the concession made, which

generally results in a reduction of expected future cash flows.

The decline in expected future cash flows, consideration of

collateral value, and/or the application of a present value

discount rate, when compared to the recorded investment,

results in either an increased ALLL or a charge-off. As TDRs

are individually evaluated under the specific reserve

methodology, which builds in expectations of future

performance, subsequent defaults generally do not

significantly impact the ALLL.

For consumer lending TDRs, except TDRs resulting from

borrowers that have been discharged from personal liability

through Chapter 7 bankruptcy and have not formally

reaffirmed their loan obligations to PNC as discussed in

Note 1 Accounting Policies under the Allowance for Loans

and Lease Losses section, the ALLL is calculated using a

discounted cash flow model, which leverages subsequent

default, prepayment, and severity rate assumptions based upon

historically observed data. Similar to the commercial lending

specific reserve methodology, the reduced expected cash

flows resulting from the concessions granted impact the

consumer lending ALLL. The decline in expected cash flows

due to the application of a present value discount rate or the

consideration of collateral value, when compared to the

recorded investment, results in either an increased ALLL or a

charge-off. Loans where a borrower has been discharged from

personal liability in bankruptcy and has not formally

reaffirmed its loan obligation to PNC are charged off to

collateral value less costs to sell, and any associated allowance

at the time of charge-off is reduced to zero.

138 The PNC Financial Services Group, Inc. – Form 10-K