PNC Bank 2015 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

costs to sell. The significant unobservable inputs for OREO

and foreclosed assets are the appraised value or the sales price.

The estimated costs to sell are incremental direct costs to

transact a sale such as broker commissions, legal, closing

costs and title transfer fees. The costs must be essential to the

sale and would not have been incurred if the decision to sell

had not been made. The costs to sell are based on costs

associated with our sales of commercial and residential OREO

and foreclosed assets, which are assessed annually.

Long-Lived Assets Held for Sale

Long-lived assets held for sale represent the carrying value of

the asset for which valuation adjustments were recorded during

the current year and subsequent to the transfer to Long-lived

assets held for sale. Valuation adjustments are based on the fair

value of the property less an estimated cost to sell. Fair value is

determined either by a recent appraisal, recent sales offer or

changes in market or property conditions. Appraisals are

provided by licensed or certified appraisers. Where we have

agreed to sell the property to a third party, the fair value is

based on the contractual sale price. The significant

unobservable inputs for Long-lived assets held for sale are the

appraised value, the sales price or the changes in market or

property conditions. Changes in market or property conditions

are subjectively determined by management through

observation of the physical condition of the property along with

the condition of properties in the surrounding market place. The

availability and recent sales of similar properties is also

considered. The range of fair values can vary significantly as

this category often includes smaller properties such as offsite

ATM locations and smaller rural branches up to large

commercial buildings, operation centers or urban branches.

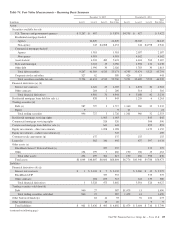

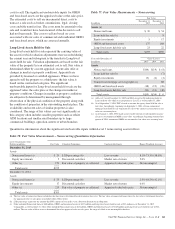

Table 77: Fair Value Measurements – Nonrecurring

Fair Value

In millions

December 31

2015

December 31

2014

Assets (a)

Nonaccrual loans $ 30 $ 54

Loans held for sale (b) 8

Equity investments 5 17

OREO and foreclosed assets 137 168

Long-lived assets held for sale 23 22

Total assets $195 $269

Year ended December 31 Gains (Losses)

In millions 2015 2014 2013

Assets

Nonaccrual loans $(44) $(19) $ (8)

Loans held for sale (b) (7)

Equity investments (3) (2) (1)

Commercial mortgage servicing rights (c) 88

OREO and foreclosed assets (18) (19) (26)

Long-lived assets held for sale (20) (14) (40)

Total assets $(85) $(54) $ 6

(a) All Level 3 as of December 31, 2015 and 2014 except for $8 million included in

Loans held for sale which was categorized as Level 2 as of December 31, 2014.

(b) As of September 1, 2014, PNC elected to account for agency loans held for sale at

fair value. Accordingly, beginning on September 1, 2014, all new commercial

mortgage loans held for sale originated for sale to the agencies are measured at fair

value on a recurring basis.

(c) As of January 1, 2014, PNC made an irrevocable election to subsequently measure

all classes of commercial MSRs at fair value. Accordingly, beginning with the first

quarter of 2014, commercial MSRs are measured at fair value on a recurring basis.

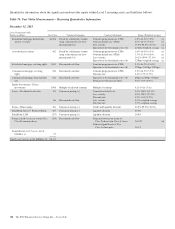

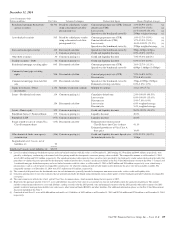

Quantitative information about the significant unobservable inputs within Level 3 nonrecurring assets follows.

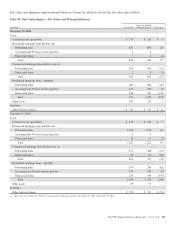

Table 78: Fair Value Measurements – Nonrecurring Quantitative Information

Level 3 Instruments Only

Dollars in millions Fair Value Valuation Techniques Unobservable Inputs Range (Weighted Average)

December 31, 2015

Assets

Nonaccrual loans (a) $ 20 LGD percentage (b) Loss severity 8.1%-73.3% (58.6%)

Equity investments 5 Discounted cash flow Market rate of return 5.0%

Other (c) 170 Fair value of property or collateral Appraised value/sales price Not meaningful

Total assets $195

December 31, 2014

Assets

Nonaccrual loans (a) $ 29 LGD percentage (b) Loss severity 2.9%-68.5% (42.1%)

Equity investments 17 Discounted cash flow Market rate of return 6.0%

Other (c) 215 Fair value of property or collateral Appraised value/sales price Not meaningful

Total assets $261

(a) The fair value of nonaccrual loans included in this line item is determined based on internal loss rates. The fair value of nonaccrual loans where the fair value is determined based on

the appraised value or sales price is included within Other, below.

(b) LGD percentage represents the amount that PNC expects to lose in the event a borrower defaults on an obligation.

(c) Other included Nonaccrual loans of $10 million, OREO and foreclosed assets of $137 million and Long-lived assets held for sale of $23 million as of December 31, 2015.

Comparably, as of December 31, 2014, Other included Nonaccrual loans of $25 million, OREO and foreclosed assets of $168 million and Long-lived assets held for sale of $22

million. The fair value of these assets is determined based on appraised value or sales price, the range of which is not meaningful to disclose.

The PNC Financial Services Group, Inc. – Form 10-K 161