PNC Bank 2015 Annual Report Download - page 205

Download and view the complete annual report

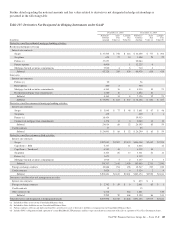

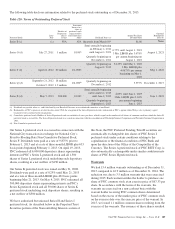

Please find page 205 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The table above includes over-the-counter (OTC) derivatives,

cleared derivatives, and exchange-traded derivatives. OTC

derivatives represent contracts executed bilaterally with

counterparties that are not settled through an organized

exchange or cleared through a central clearing house. Cleared

derivatives represent contracts executed bilaterally with

counterparties in the OTC market that are novated to a central

clearing house who then becomes our counterparty. Exchange-

traded derivatives represent standardized futures and options

contracts executed directly on an organized exchange.

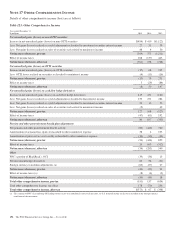

As of December 31, 2015, derivative fair values and related

cash collateral for derivatives cleared through a central

clearing house are, when appropriate, presented on a net basis.

The derivative fair values in the table not identified as cleared

or exchange-traded represent OTC derivatives, the majority of

which are governed by ISDA documentation or other legally

enforceable industry standard master netting agreements and

are subject to offsetting.

In addition to using master netting agreements and other

collateral agreements to reduce credit risk associated with

derivative instruments, we also seek to manage credit risk by

evaluating credit ratings of counterparties and by using

internal credit analysis, limits, and monitoring procedures.

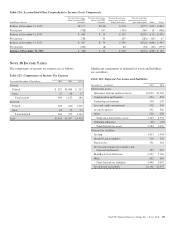

At December 31, 2015, we held cash, U.S. government

securities and mortgage-backed securities totaling $.9 billion

under master netting agreements and other collateral

agreements to collateralize net derivative assets due from

counterparties, and we pledged cash totaling $.9 billion under

these agreements to collateralize net derivative liabilities owed

to counterparties and to meet initial margin requirements.

These totals may differ from the amounts presented in the

preceding offsetting table because these totals may include

collateral exchanged under an agreement that does not qualify

as a master netting agreement or because the total amount of

collateral held or pledged exceeds the net derivative fair

values with the counterparty as of the balance sheet date due

to timing or other factors, such as initial margin. To the extent

not netted against the derivative fair values under a master

netting agreement, the receivable for cash pledged is included

in Other assets and the obligation for cash held is included in

Other borrowed funds on our Consolidated Balance Sheet.

Securities held from counterparties are not recognized on our

balance sheet. Likewise securities we have pledged to

counterparties remain on our balance sheet.

Certain derivative agreements contain various credit-risk

related contingent provisions, such as those that require PNC’s

debt to maintain a specified credit rating from one or more of

the major credit rating agencies. If PNC’s debt ratings were to

fall below such specified ratings, the counterparties to the

derivative instruments could request immediate payment or

demand immediate and ongoing full collateralization on

derivative instruments in net liability positions. The aggregate

fair value of all derivative instruments with credit-risk-related

contingent features that were in a net liability position on

December 31, 2015 was $.8 billion for which PNC had posted

collateral of $.6 billion in the normal course of business. The

maximum additional amount of collateral PNC would have

been required to post if the credit-risk-related contingent

features underlying these agreements had been triggered on

December 31, 2015 would be $.2 billion.

The PNC Financial Services Group, Inc. – Form 10-K 187