PNC Bank 2015 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

real estate properties obtained in partial or total satisfaction of

loan obligations. After obtaining a foreclosure judgment, or in

some jurisdictions the initiation of proceedings under a power

of sale in the loan instruments, the property will be sold.

When we are awarded title or completion of deed in lieu of

foreclosure, we transfer the loan to foreclosed assets included

in Other assets on our Consolidated Balance Sheet. Property

obtained in satisfaction of a loan is initially recorded at

estimated fair value less cost to sell. Based upon the estimated

fair value less cost to sell, the recorded investment of the loan

is adjusted and, typically, a charge-off/recovery is recognized

to the Allowance for Loan and Lease Losses (ALLL). We

estimate fair values primarily based on appraisals, or sales

agreements with third parties. Subsequently, foreclosed assets

are valued at the lower of the amount recorded at acquisition

date or estimated fair value less cost to sell. Valuation

adjustments on these assets and gains or losses realized from

disposition of such property are reflected in Other noninterest

expense.

For certain mortgage loans that have a government guarantee,

we establish a separate other receivable upon foreclosure. The

receivable is measured based on the loan balance (inclusive of

principal and interest) that is expected to be recovered from

the guarantor.

Allowance for Loan and Lease Losses

We maintain the ALLL at a level that we believe to be

appropriate to absorb estimated probable credit losses incurred

in the loan and lease portfolios as of the balance sheet date.

Our determination of the allowance is based on periodic

evaluations of these loan and lease portfolios and other

relevant factors. This critical estimate includes significant use

of PNC’s own historical data and complex methods to

interpret this data. These evaluations are inherently subjective,

as they require material estimates and may be susceptible to

significant change, and include, among others:

• Probability of default (PD),

• Loss given default (LGD),

• Outstanding balance of the loan,

• Movement through delinquency stages,

• Amounts and timing of expected future cash flows,

• Value of collateral, which may be obtained from

third parties, and

• Qualitative factors, such as changes in current

economic conditions, that may not be reflected in

modeled results.

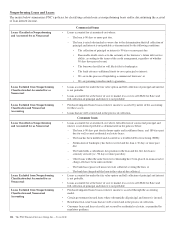

For all loans, except purchased impaired loans, the ALLL is

the sum of three components: (i) asset specific/individual

impaired reserves, (ii) quantitative (formulaic or pooled)

reserves and (iii) qualitative (judgmental) reserves.

The reserve calculation and determination process is

dependent on the use of key assumptions. Key reserve

assumptions and estimation processes react to and are

influenced by observed changes in loan portfolio performance

experience, the financial strength of the borrower, and

economic conditions. Key reserve assumptions are

periodically updated.

Asset Specific/Individual Component

Nonperforming loans that are considered impaired under ASC

310 – Receivables, which include all commercial and

consumer TDRs, are evaluated for a specific reserve. Specific

reserve allocations are determined as follows:

• For commercial nonperforming loans and

commercial TDRs greater than or equal to a defined

dollar threshold, specific reserves are based on an

analysis of the present value of the loan’s expected

future cash flows, the loan’s observable market price

or the fair value of the collateral.

• For commercial nonperforming loans and

commercial TDRs below the defined dollar

threshold, the individual loan’s loss given default

(LGD) percentage is multiplied by the loan balance

and the results are aggregated for purposes of

measuring specific reserve impairment.

• Consumer nonperforming loans are collectively

reserved for unless classified as consumer TDRs. For

consumer TDRs, specific reserves are determined

through an analysis of the present value of the loan’s

expected future cash flows, except for those instances

where loans have been deemed collateral dependent,

including loans where borrowers have been

discharged from personal liability through Chapter 7

bankruptcy and have not formally reaffirmed their

loan obligations to PNC. Once that determination has

been made, those TDRs are charged down to the fair

value of the collateral less costs to sell at each period

end.

Commercial Lending Quantitative Component

The estimates of the quantitative component of ALLL for

incurred losses within the commercial lending portfolio

segment are determined through statistical loss modeling

utilizing PD, LGD and outstanding balance of the loan. Based

upon loan risk ratings, we assign PDs and LGDs. Each of

these statistical parameters is determined based on internal

historical data and market data. PD is influenced by such

factors as liquidity, industry, obligor financial structure,

access to capital and cash flow. LGD is influenced by

collateral type, original and/or updated loan-to-value ratio

(LTV), facility structure and other factors.

Consumer Lending Quantitative Component

Quantitative estimates within the consumer lending portfolio

segment are calculated primarily using a roll-rate model based

on statistical relationships, calculated from historical data that

estimate the movement of loan outstandings through the

various stages of delinquency and ultimately charge-off over

our loss emergence period.

116 The PNC Financial Services Group, Inc. – Form 10-K