PNC Bank 2015 Annual Report Download - page 225

Download and view the complete annual report

Please find page 225 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

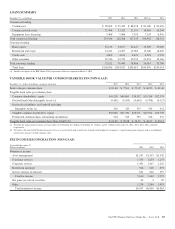

Recourse and Repurchase Obligations

As discussed in Note 2 Loan Sale and Servicing Activities and

Variable Interest Entities, PNC has sold commercial

mortgage, residential mortgage and home equity loans/lines of

credit directly or indirectly through securitization and loan

sale transactions in which we have continuing involvement.

One form of continuing involvement includes certain recourse

and loan repurchase obligations associated with the transferred

assets.

Commercial Mortgage Loan Recourse Obligations

We originate and service certain multi-family commercial

mortgage loans which are sold to FNMA under FNMA’s

Delegated Underwriting and Servicing (DUS) program. We

participated in a similar program with the FHLMC.

Under these programs, we generally assume up to a one-third

pari passu risk of loss on unpaid principal balances through a

loss share arrangement. At December 31, 2015 and

December 31, 2014, the unpaid principal balance outstanding

of loans sold as a participant in these programs was $12.9

billion and $12.3 billion, respectively. The potential maximum

exposure under the loss share arrangements was $3.8 billion at

December 31, 2015 and $3.7 billion at December 31, 2014.

If payment is required under these programs, we would not

have a contractual interest in the collateral underlying the

mortgage loans on which losses occurred, although the value

of the collateral is taken into account in determining our share

of such losses. Our exposure and activity associated with these

recourse obligations are reported in the Corporate &

Institutional Banking segment.

We maintain a reserve for estimated losses based upon our

exposure. The reserve for losses under these programs totaled

$27 million and $35 million at December 31, 2015 and

December 31, 2014, respectively, and was included in Other

liabilities on the Consolidated Balance Sheet.

Residential Mortgage Loan Repurchase Obligations

While residential mortgage loans are sold on a non-recourse

basis, we assume certain loan repurchase obligations

associated with mortgage loans we have sold to investors.

These loan repurchase obligations primarily relate to

situations where PNC is alleged to have breached certain

origination covenants and representations and warranties

made to purchasers of the loans in the respective purchase and

sale agreements. Repurchase obligation activity associated

with residential mortgages is reported in the Residential

Mortgage Banking segment.

Indemnifications and repurchase liabilities are initially

recognized when loans are sold to investors and are

subsequently evaluated by management. Initial recognition

and subsequent adjustments to the indemnification and

repurchase liability for the sold residential mortgage portfolio

are recognized in Residential mortgage revenue on the

Consolidated Income Statement.

Management’s subsequent evaluation of indemnification and

repurchase liabilities is based upon trends in indemnification

and repurchase requests, actual loss experience, risks in the

underlying serviced loan portfolios, and current economic

conditions. As part of its evaluation, management considers

estimated loss projections over the life of the subject loan

portfolio.

At December 31, 2015 and December 31, 2014, the residential

mortgage indemnification and repurchase liability for

estimated losses on indemnification and repurchase claims

totaled $94 million and $107 million, respectively, and was

included in Other liabilities on the Consolidated Balance

Sheet. The unpaid principal balance of loans associated with

our exposure to this repurchase obligation totaled $65.3 billion

and $68.3 billion at December 31, 2015 and December 31,

2014, respectively.

Management believes the indemnification and repurchase

liabilities appropriately reflect the estimated probable losses

on indemnification and repurchase claims for all loans sold

and outstanding as of December 31, 2015. In making these

estimates, we consider the losses that we expect to incur over

the life of the sold loans. While management seeks to obtain

all relevant information in estimating the indemnification and

repurchase liability, the estimation process is inherently

uncertain and imprecise and, accordingly, it is reasonably

possible that future indemnification and repurchase losses

could be more or less than our established liability. Factors

that could affect our estimate include the volume of valid

claims driven by investor strategies and behavior, our ability

to successfully negotiate claims with investors, housing prices

and other economic conditions. At December 31, 2015, we

estimate that it is reasonably possible that we could incur

additional losses in excess of our accrued indemnification and

repurchase liability of up to approximately $77 million for our

portfolio of residential mortgage loans sold. This estimate of

potential additional losses in excess of our liability is based on

assumed higher repurchase claims and lower claim rescissions

than our current assumptions.

Home Equity Loan/Line of Credit Repurchase Obligations

PNC’s repurchase obligations also include certain brokered

home equity loans/lines of credit that were sold to a limited

number of private investors in the financial services industry

by National City prior to our acquisition of National City.

PNC is no longer engaged in the brokered home equity

lending business, and our exposure under these loan

repurchase obligations is limited to repurchases of loans sold

in these transactions. Repurchase activity associated with

brokered home equity loans/lines of credit is reported in the

Non-Strategic Assets Portfolio segment.

Since PNC is no longer engaged in the brokered home equity

lending business, only subsequent adjustments are recognized

to the home equity loans/lines indemnification and repurchase

liability based on management evaluation. These adjustments

are recognized in Other noninterest income on the

Consolidated Income Statement.

The PNC Financial Services Group, Inc. – Form 10-K 207