PNC Bank 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

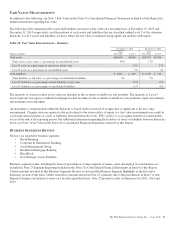

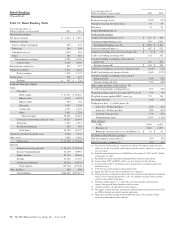

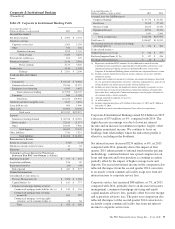

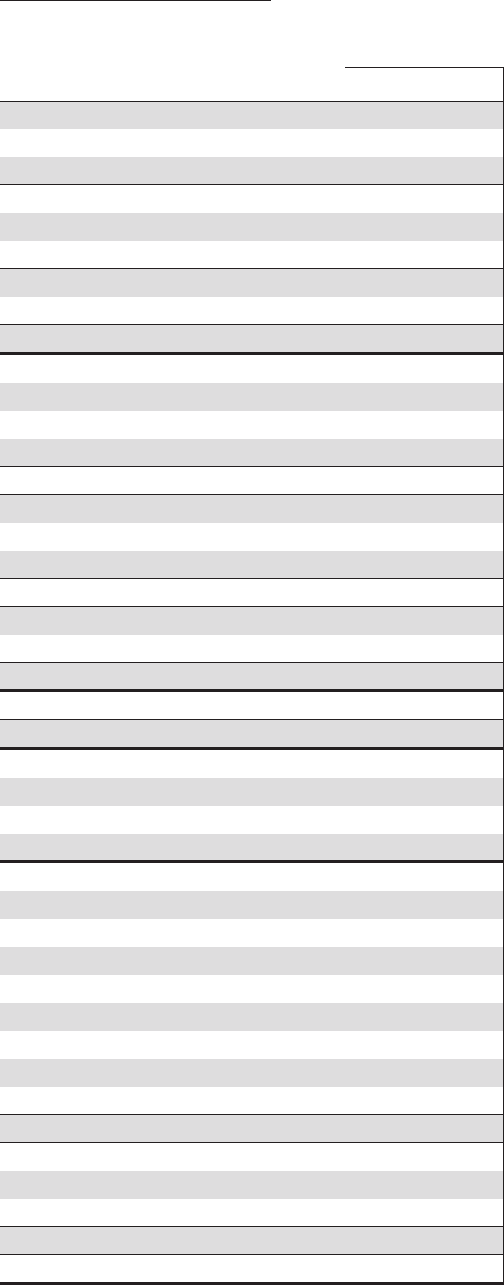

Non-Strategic Assets Portfolio

(Unaudited)

Table 26: Non-Strategic Assets Portfolio Table

Year ended December 31

Dollars in millions 2015 2014

I

NCOME

S

TATEMENT

Net interest income $ 392 $ 547

Noninterest income 53 40

Total revenue 445 587

Provision for credit losses (benefit) (114) (119)

Noninterest expense 83 125

Pretax earnings 476 581

Income taxes 175 214

Earnings $ 301 $ 367

A

VERAGE

B

ALANCE

S

HEET

Commercial Lending

Commercial/Commercial real estate $ 107 $ 180

Lease financing 630 675

Total commercial lending 737 855

Consumer Lending

Home equity 2,774 3,396

Residential real estate 3,877 4,812

Total consumer lending 6,651 8,208

Total portfolio loans 7,388 9,063

Other assets (a) (682) (725)

Total assets $6,706 $8,338

Deposits and other liabilities $ 186 $ 225

Total liabilities $ 186 $ 225

P

ERFORMANCE

R

ATIOS

Return on average assets 4.49% 4.40%

Noninterest income to total revenue 12 7

Efficiency 19 21

O

THER

I

NFORMATION

Nonperforming assets (b) (c) $ 529 $ 710

Purchased impaired loans (b) (d) $2,839 $3,943

Net (recoveries) charge-offs $ (4) $ 47

Net (recovery) charge-off ratio (.06)% .52%

Loans (b)

Commercial Lending

Commercial/Commercial real estate $ 75 $ 130

Lease financing 638 625

Total commercial lending 713 755

Consumer Lending

Home equity 2,203 3,091

Residential real estate 3,300 4,290

Total consumer lending 5,503 7,381

Total loans $6,216 $8,136

(a) Other assets includes deferred taxes, ALLL and other real estate owned (OREO).

Other assets were negative in both periods due to the ALLL.

(b) As of December 31.

(c) Includes nonperforming loans of $.4 billion at December 31, 2015 and $.6 billion at

December 31, 2014.

(d) Recorded investment of purchased impaired loans related to acquisitions. This

segment contained 81% of PNC’s purchased impaired loans at December 31, 2015

and 80% at December 31, 2014.

This business segment consists of non-strategic assets

primarily obtained through acquisitions of other companies.

The business activity of this segment is to manage the wind-

down of the portfolios while maximizing the value and

mitigating risk.

Non-Strategic Assets Portfolio had earnings of $301 million in

2015 compared with $367 million in 2014. Earnings decreased

year-over-year primarily due to a declining balance in the loan

portfolio.

Non-Strategic Assets Portfolio overview:

• Net interest income declined $155 million, or 28%, in

2015 compared with 2014, resulting from lower

purchase accounting accretion and the impact of the

declining average balance of the loan portfolio.

• Noninterest income increased $13 million, or 33%, in

2015 compared to 2014 driven by lower provision for

estimated losses on repurchase obligations.

• Provision for credit losses was a benefit in both 2015

and 2014, reflecting continued improvements in

credit quality.

• Noninterest expense declined $42 million, or 34%, in

2015 compared with 2014, due to lower costs of

managing and servicing the loan portfolio and a

release of legal reserves in December 2015.

• Average portfolio loans declined $1.7 billion, or

18%, in 2015 compared to 2014, due to customer

payment activity and portfolio management activities

to reduce under-performing assets.

• Effective December 31, 2015, PNC implemented its

change in the derecognition policy for purchased

impaired pooled consumer and residential real estate

loans, resulting in the derecognition of the recorded

investment balance included in total loans and the

associated allowance for loan losses balance each by

$468 million, 93% of which was recorded in the

Non-Strategic Assets Portfolio. The decline in

average loans in the year-over-year comparison

reflected the impact of this change.

The PNC Financial Services Group, Inc. – Form 10-K 61