PNC Bank 2015 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

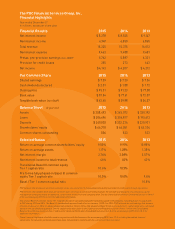

PNC’s Southeast markets are defined as Alabama, Georgia, North Carolina, South Carolina and Florida. Southeast markets revenue was $1.1 billion

in 2015 and represented 11 percent of total market revenue and 7 percent of total revenue. Total market revenue for 2015 was $10.4 billion, calculated

as total revenue of $15.2 billion less non-market revenue of $4.8 billion. Non-market revenue is the portion of total revenue derived from businesses

or activities that are not tied to particular markets (such as asset and liability management and our BlackRock stake) or that are managed financially

on a nationwide basis (most significantly the secured lending businesses in Corporate & Institutional Banking).

For more information regarding certain factors that could cause future results to differ, possibly materially, from historical performance or from

those anticipated in forward-looking statements, see the Cautionary Statement in Item 7 of our 2015 Form 10-K, which accompanies this letter. For

additional information regarding PNC’s Peer Group, see Item 5 of the accompanying 2015 Form 10-K, and for additional information on PNC’s tangible

book value and fee income, see the Statistical Information (Unaudited) section in Item 8 of the accompanying 2015 Form 10-K.

Before I close, I would like to thank three retiring board members — Paul Chellgren, Anthony Massaro and

Thomas Usher — whose contributions to the strategic direction and governance of our company have been

tremendous drivers of our success through the years. Paul, Tony and Tom have been wonderful advisors and

advocates for PNC’s shareholders, and I will miss their counsel. I also would like to welcome former Walgreens

Boots Alliance President and Chief Executive Officer Gregory Wasson, who joined our board in July, as well as

former Sprint Corporation President and Chief Executive Officer Daniel Hesse and CSX Corporation Chairman

and Chief Executive Officer Michael Ward, who joined our board in January of this year.

The year ahead is full of uncertainty. We don’t know exactly what the markets will do in response to China’s

slowing economy or how far oil prices might fall. Nor do we know if or when the Federal Reserve will raise

interest rates again. It is unclear just how disruptive companies reaching into the FinTech space will be. It also

is a presidential election year, which means our industry may find itself once again a favorite target for criticism

by politicians and pundits. Some might look at the landscape and see nothing but trouble. At PNC, we see

tremendous opportunity.

In times such as these, our customers need to know they are backed by a bank with a proven record of

consistent performance … a bank with a culture built on the idea that we must always strive to do what is right

… a bank that prides itself on knowing its customers and supporting its communities … a bank that continues to

work and invest to improve because we believe that just being good is not good enough for the people we serve.

We expect that interest rates will rise in 2016, and we are poised to benefit when they do. I am excited about the

work we are doing to enhance the customer experience and the progress we are making against our strategic

priorities. I am eager to see how our own investments in FinTech evolve into a competitive advantage while

solving real needs for the people we serve. I am proud to lead this organization. And I am more convinced than

ever that we have the right strategy, model, people and culture to capitalize on the opportunities ahead and

overcome the challenges we will face along the way.

Thank you for your continued confidence and investment in PNC.

Sincerely,

William S. Demchak

Chairman, President and Chief Executive Officer

Excitement and Opportunity Amid Uncertainty

and Challenges