PNC Bank 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

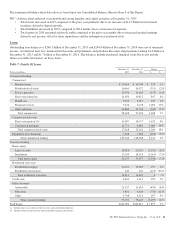

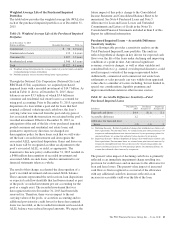

For additional detail, see the Credit Risk Management portion

of the Risk Management section and the Purchase Accounting

Accretion and Valuation of Purchased Impaired Loans portion

of the Consolidated Balance Sheet Review of this Item 7.

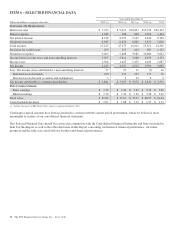

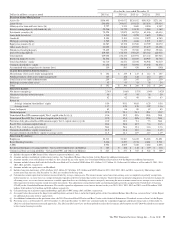

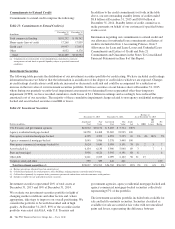

Balance Sheet, Liquidity and Capital Highlights

PNC’s balance sheet was well-positioned at December 31,

2015 reflecting strong liquidity and capital positions.

• Total loans increased by $1.9 billion to $206.7 billion

at December 31, 2015 compared to December 31,

2014.

• Total commercial lending grew $5.2 billion, or

4%, as a result of increases in commercial real

estate and commercial loans.

• Total consumer lending decreased $3.3 billion,

or 4%, due to declines in home equity,

education, and automobile loans, and included

declines in the non-strategic consumer loan

portfolio.

• Total deposits increased $16.8 billion, or 7%, to

$249.0 billion at December 31, 2015 compared with

December 31, 2014, reflecting overall strong deposit

growth.

• Investment securities increased $14.7 billion, or 26%,

to $70.5 billion at December 31, 2015 compared to

December 31, 2014.

• PNC’s balance sheet remained core funded with a

loans to deposits ratio of 83% at December 31, 2015.

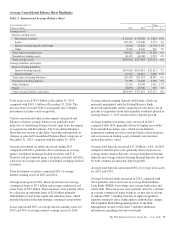

• PNC maintained a strong liquidity position.

• New regulatory short-term liquidity standards

became effective for PNC and PNC Bank as

advanced approaches banking organizations

beginning January 1, 2015, with a minimum

phased-in Liquidity Coverage Ratio (LCR)

requirement of 80% in 2015, calculated as of

month end.

• The Liquidity Coverage Ratio at December 31,

2015 exceeded 100% for both PNC and PNC

Bank.

• PNC maintained a strong capital position.

• The Transitional Basel III common equity Tier

1 capital ratio was 10.6% at December 31,

2015 and 10.9% at December 31, 2014,

calculated using the regulatory capital

methodologies applicable to PNC during 2015

and 2014, respectively.

• Pro forma fully phased-in Basel III common

equity Tier 1 capital ratio was an estimated

10.0% at both December 31, 2015 and

December 31, 2014 based on the standardized

approach rules. See the Capital discussion and

Table 19 in the Consolidated Balance Sheet

Review section of this Item 7 and the

December 31, 2014 capital ratio tables in the

Statistical Information (Unaudited) section in

Item 8 of this Report for more detail.

• PNC returned capital to shareholders during 2015.

• For full year 2015, PNC repurchased

22.3 million common shares for $2.1 billion.

• In April 2015, the Board of Directors raised the

quarterly cash dividend on common stock to 51

cents per share, an increase of 3 cents per

share, or 6%, effective with the May dividend.

• In May 2015, we redeemed $500 million of

PNC’s Fixed-to-Floating Rate Non-Cumulative

Perpetual Preferred Stock, Series K, as well as

all Depositary Shares representing interests

therein.

See the Capital portion of the Consolidated Balance Sheet

Review for more detail on the 2015 preferred stock

redemption and common share repurchases, including the

completion of share repurchases included in our 2014 capital

plan and repurchases authorized by our 2015 capital plan, and

the Liquidity Risk Management portion of the Risk

Management section of this Item 7 for more detail on our

other 2015 capital and liquidity actions.

Our ability to take certain capital actions, including plans to

pay or increase common stock dividends or to repurchase

shares under current or future programs, is subject to the

results of the supervisory assessment of capital adequacy

undertaken by the Federal Reserve as part of the CCAR

process. For additional information, see the Supervision and

Regulation section in Item 1 Business of this Report.

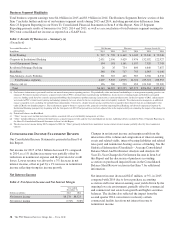

Our Consolidated Income Statement and Consolidated

Balance Sheet Review sections of this Item 7 describe in

greater detail the various items that impacted our results

during 2015 and 2014 and balances at December 31, 2015 and

December 31, 2014, respectively.

36 The PNC Financial Services Group, Inc. – Form 10-K