PNC Bank 2015 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

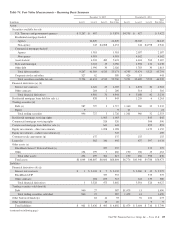

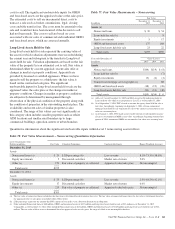

Financial Assets Accounted for at Fair Value on a

Nonrecurring Basis

We may be required to measure certain financial assets at fair

value on a nonrecurring basis. These adjustments to fair value

usually result from the application of lower of amortized cost

or fair value accounting or write-downs of individual assets

due to impairment and are included in Table 77 and Table 78.

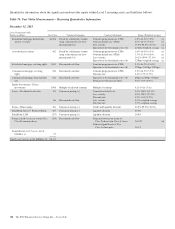

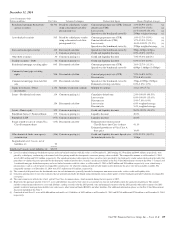

Nonaccrual Loans

Nonaccrual loans represent the fair value of those loans which

have been adjusted due to impairment. The impairment is

primarily based on the appraised value of the collateral or

LGD percentage. The LGD percentage is used to determine

the weighted average loss severity of the nonaccrual loans.

As part of the appraisal process, persons ordering or reviewing

appraisals are independent of the asset manager. Appraisals

must be provided by licensed or certified appraisers and

conform to the Uniform Standards of Professional Appraisal

Practice. For loans secured by commercial properties where the

underlying collateral is in excess of $250,000, appraisals are

obtained at least annually. In certain instances (e.g., physical

changes in the property), a more recent appraisal is obtained.

Additionally, borrower ordered appraisals are not permitted,

and PNC ordered appraisals are regularly reviewed. For loans

secured by commercial properties where the underlying

collateral is $250,000 and less, there is no requirement to obtain

an appraisal. In instances where an appraisal is not obtained, the

collateral value is determined consistent with external third-

party appraisal standards by an internal person independent of

the asset manager. PNC has a real estate valuation services

group whose sole function is to manage the real estate appraisal

solicitation and evaluation process for commercial loans. All

third-party appraisals are reviewed by this group, including

consideration of comments/questions on the appraisal by the

reviewer, customer relationship manager, credit officer, and

underwriter. Upon resolving these comments/questions through

discussions with the third-party appraiser, adjustments to the

initial appraisal may occur and be incorporated into the final

issued appraisal report.

If an appraisal is outdated due to changed project or market

conditions, or if the net book value is utilized, management

uses an LGD percentage which represents the exposure PNC

expects to lose in the event a borrower defaults on an

obligation. Accordingly, LGD, which represents the loss

severity, is a function of collateral recovery rates and loan-to-

value. Those rates are established based upon actual PNC loss

experience and external market data. In instances where we

have agreed to sell the property to a third party, the fair value

is based on the contractual sales price adjusted for costs to

sell. In these instances, the most significant unobservable

input is the appraised value or the sales price. The estimated

costs to sell are incremental direct costs to transact a sale such

as broker commissions, legal, closing costs and title transfer

fees. The costs must be essential to the sale and would not

have been incurred if the decision to sell had not been made.

The costs to sell are based on costs associated with our actual

sales of commercial and residential OREO and foreclosed

assets, which are assessed annually.

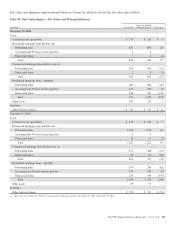

Loans Held for Sale

Loans held for sale includes syndicated commercial loan

inventory. The fair value of the syndicated commercial loan

inventory is primarily determined based on prices provided by

a third-party vendor. The third-party vendor prices are based

upon dealer quotes. For nonrecurring fair value measurements,

these instruments are classified within Level 2.

Prior to September 1, 2014, loans held for sale also included

the carrying value of commercial mortgage loans which are

intended to be sold to agencies with servicing retained. The

fair value of the commercial mortgage loans held for sale is

determined using discounted cash flows. Significant

observable market data includes the applicable benchmark

interest rates. These instruments are classified within Level 3.

Significant unobservable inputs include a spread over the

benchmark curve and the estimated servicing cash flows for

loans sold to the agencies with servicing retained. Significant

increases (decreases) to the spread over the benchmark curve

would result in a significantly lower (higher) carrying value of

the assets. Significant increases (decreases) in the estimated

servicing cash flows for loans sold to the agencies with

servicing retained would result in significantly higher (lower)

carrying value.

Refer to the Fair Value Measurement section of this Note 7 for

information on commercial mortgages held for sale to

agencies subsequent to our September 1, 2014 election of fair

value option.

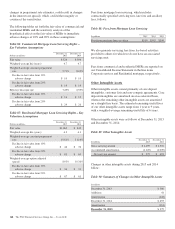

Equity Investments

Equity investments represent the carrying value of Low

Income Housing Tax Credit (LIHTC) investments held for

sale calculated using a discounted cash flow model. The

significant unobservable input is management’s estimate of

required market rate of return. The market rate of return is

based on comparison to recent LIHTC sales in the market.

Significant increases (decreases) in this input would result in a

significantly lower (higher) carrying value of the investments.

OREO and Foreclosed Assets

OREO and foreclosed assets represent the carrying value of

OREO and foreclosed assets for which valuation adjustments

were recorded subsequent to the transfer to OREO and

foreclosed assets. Valuation adjustments are based on the fair

value less cost to sell of the property. Fair value is based on

appraised value or sales price.

The appraisal process for OREO and foreclosed properties is

the same as described above for nonaccrual loans. In instances

where we have agreed to sell the property to a third party, the

fair value is based on the contractual sale price adjusted for

160 The PNC Financial Services Group, Inc. – Form 10-K