PNC Bank 2015 Annual Report Download - page 71

Download and view the complete annual report

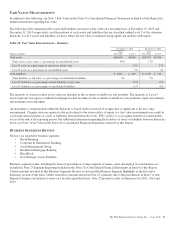

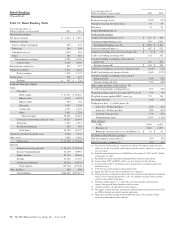

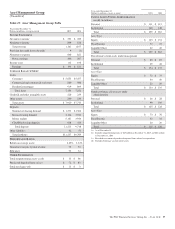

Please find page 71 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Retail Banking earned $907 million in 2015 compared with

earnings of $728 million in 2014. The increase in earnings

was driven by increased net interest income and noninterest

income, partially offset by higher noninterest expense. Retail

Banking continues to enhance the customer experience with

refinements to product offerings that drive product value for

consumers and small businesses. We are focused on growing

customer share of wallet through the sale of liquidity, banking,

and investment products that meet the broad range of financial

needs of our customers.

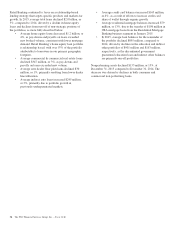

Retail Banking continued to focus on the strategic priority of

transforming the customer experience through transaction

migration, branch network transformation and multi-channel

sales and service strategies.

• In 2015, approximately 52% of consumer customers

used non-teller channels for the majority of their

transactions compared with 46% in 2014.

• Deposit transactions via ATM and mobile channels

increased to 43% of total deposit transactions in 2015

compared with 35% for 2014.

• Integral to PNC’s retail branch transformation

strategy, more than 375 branches operate under the

universal model designed to enhance sales

opportunities for branch personnel, in part, by driving

higher ATM and mobile deposits. During 2015, the

total branch network was reduced by 81 branches and

the ATM network was increased by 351 ATMs. PNC

had a network of 2,616 branches and 8,956 ATMs at

December 31, 2015.

• Instant debit card issuance, which enables us to print

a customer’s debit card in a matter of minutes, is now

available in nearly 700 branches, over 26% of the

branch network.

• Apple iPad™ technology is available in all of our

branches to demonstrate product capabilities to

customers and prospects.

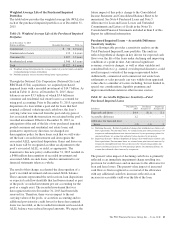

Total revenue for 2015 increased $400 million compared to

2014, which included a $302 million increase in net interest

income primarily from the enhancements to internal funds

transfer pricing methodology in the first quarter of 2015, as

well as increases in deposit balances and interest rate spread

on the value of deposits, partially offset by lower loan

balances and interest rate spread compression on the value of

loans.

Noninterest income increased $98 million in 2015 compared

to 2014. Execution on our share of wallet strategy resulted in

strong growth in consumer service fee income from payment-

related products, specifically in debit, credit and merchant

services, as well as increased brokerage fees. Noninterest

income included gains on sales of Visa Class B common

shares of $169 million on two million shares in 2015

compared to $209 million on 3.5 million shares in 2014.

Excluding these gains, noninterest income increased $138

million, or 7%, in the comparison.

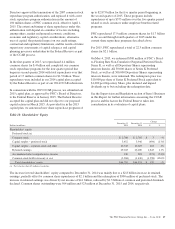

Provision for credit losses and net charge-offs in 2015

declined by $18 million and $114 million, respectively,

compared to 2014 due to improved credit quality.

Noninterest expense in 2015 increased $136 million over

2014. Increases in technology investments, sales-related and

other compensation, and customer transaction-related costs

were partially offset by reduced third party service expense

and non-credit losses, as well as lower branch network

expenses as a result of transaction migration to lower cost

digital and ATM channels.

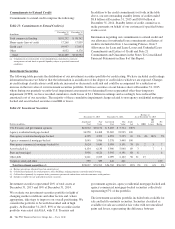

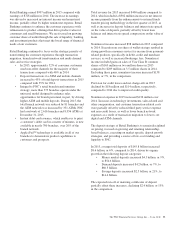

The deposit strategy of Retail Banking is to remain disciplined

on pricing, focused on growing and retaining relationship-

based balances, executing on market specific deposit growth

strategies, and providing a source of low-cost funding and

liquidity to PNC.

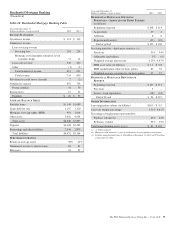

In 2015, average total deposits of $145.8 billion increased

$8.6 billion, or 6%, compared to 2014, driven by organic

growth in the following deposit categories:

• Money market deposits increased $4.3 billion, or 9%,

to $54.6 billion.

• Demand deposits increased $4.2 billion, or 7%, to

$60.3 billion.

• Savings deposits increased $2.5 billion, or 21%, to

$14.4 billion.

The expected run-off of maturing certificates of deposit

partially offset these increases, declining $2.4 billion, or 13%,

in the comparison.

The PNC Financial Services Group, Inc. – Form 10-K 53