PNC Bank 2015 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

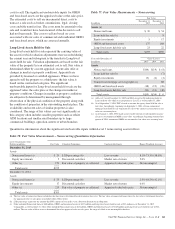

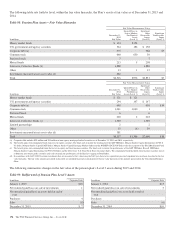

The following table presents the contractual rates and maturity

dates of our FHLB borrowings, bank notes, senior debt and

subordinated debt as of December 31, 2015.

Table 95: FHLB Borrowings, Bank Notes, Senior Debt and

Subordinated Debt

December 31, 2015 – Dollars

in millions Carrying Value Stated Rate Maturity

FHLB (a) $20,108 zero-6.50% 2016-2030

Bank notes and

senior debt

Bank notes $16,033 zero-3.30% 2016-2043

Senior debt 5,265 2.70%-6.70% 2016-2022

Total bank notes and

senior debt $21,298

Subordinated debt

Junior $ 205 .98% 2028

Other 8,351 .82%-6.88% 2016-2025

Total subordinated debt $ 8,556

(a) FHLB borrowings are generally collateralized by residential mortgage loans, other

mortgage-related loans and commercial mortgage-backed securities.

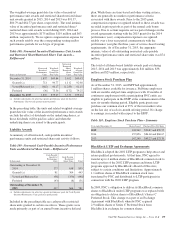

In the table above, the carrying values for bank notes, senior

debt and subordinated debt include basis adjustments of $36

million, $175 million and $246 million, respectively, related

to fair value accounting hedges as of December 31, 2015.

Also included in borrowed funds are repurchase agreements.

See Note 21 Commitments and Guarantees for additional

information on those agreements. Additionally, certain

borrowings are reported at fair value. Refer to Note 7 Fair

Value for more information on those borrowings.

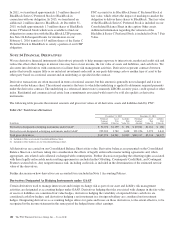

Junior Subordinated Debentures

PNC Capital Trust C, a wholly-owned finance subsidiary of

PNC, owns junior subordinated debentures issued by PNC

with a carrying value of $205 million. In June 1998, PNC

Capital Trust C issued $200 million of trust preferred

securities which bear interest at an annual rate of 3 month

LIBOR plus 57 basis points. The trust preferred securities are

due June 1, 2028 and are currently redeemable by PNC

Capital Trust C at par. At December 31, 2015, the interest rate

in effect was .98%. This carrying value and related net

discounts of $1 million comprise the $206 million principal

amount of junior subordinated debentures associated with

$200 million of trust preferred securities that were issued by

the Trust. In accordance with GAAP, the financial statements

of the Trust are not included in PNC’s consolidated financial

statements.

The obligations of PNC, as the parent of the Trust, when taken

collectively, are the equivalent of a full and unconditional

guarantee of the obligations of the Trust under the terms of the

trust preferred securities. Such guarantee is subordinate in

right of payment in the same manner as other junior

subordinated debt. There are certain restrictions on PNC’s

overall ability to obtain funds from its subsidiaries. For

additional disclosure on these funding restrictions, see Note 19

Regulatory Matters. PNC and PNC Bank are also subject to

restrictions on dividends and other provisions potentially

imposed by the REIT preferred securities, including under the

Exchange Agreement with PNC Preferred Funding Trust II, as

described in Note 16 Equity.

PNC is subject to certain restrictions, including restrictions on

dividend payments, in connection with the outstanding junior

subordinated debentures. Generally, if there is (i) an event of

default under the debenture, (ii) PNC elects to defer interest

on the debenture, (iii) PNC exercises its right to defer

payments on the related trust preferred securities, or (iv) there

is a default under PNC’s guarantee of such payment

obligations, then PNC would be subject during the period of

such default or deferral to restrictions on dividends and other

provisions protecting the status of the debenture holders

similar to or in some ways more restrictive than those

potentially imposed under the Exchange Agreement with PNC

Preferred Funding Trust II, as described in Note 16 Equity.

N

OTE

12 E

MPLOYEE

B

ENEFIT

P

LANS

Pension and Postretirement Plans

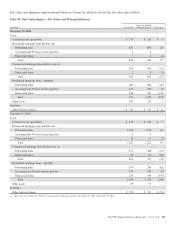

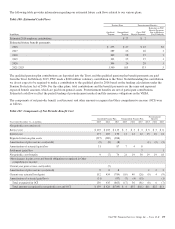

We have a noncontributory, qualified defined benefit pension

plan covering eligible employees. Benefits are determined

using a cash balance formula where earnings credits are a

percentage of eligible compensation. Earnings credit

percentages for those employees who were plan participants

on December 31, 2009 are frozen at the level earned to that

point. Earnings credits for all employees who become

participants on or after January 1, 2010 are a flat 3% of

eligible compensation. All plan participants earn interest on

their cash balances based on 30-year Treasury securities rates

with those who were participants at December 31, 2009

earning a minimum rate. New participants on or after

January 1, 2010 are not subject to the minimum rate. Any

pension contributions to the plan are based on an actuarially

determined amount necessary to fund total benefits payable to

plan participants. In February 2015, PNC made a voluntary

contribution of $200 million to the qualified pension plan.

We also maintain nonqualified supplemental retirement plans

for certain employees and provide certain health care and life

insurance benefits for qualifying retired employees

(postretirement benefits) through various plans. PNC reserves

the right to terminate or make changes to these plans at any

time. The nonqualified pension plan is unfunded. In

November of 2015, PNC established a voluntary employee

beneficiary association (VEBA) to partially fund

postretirement medical and life insurance benefit obligations.

PNC made a contribution of $200 million to the VEBA in

December 2015.

170 The PNC Financial Services Group, Inc. – Form 10-K