PNC Bank 2015 Annual Report Download - page 238

Download and view the complete annual report

Please find page 238 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

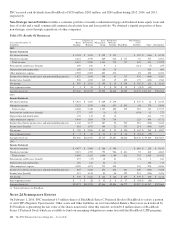

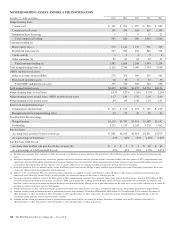

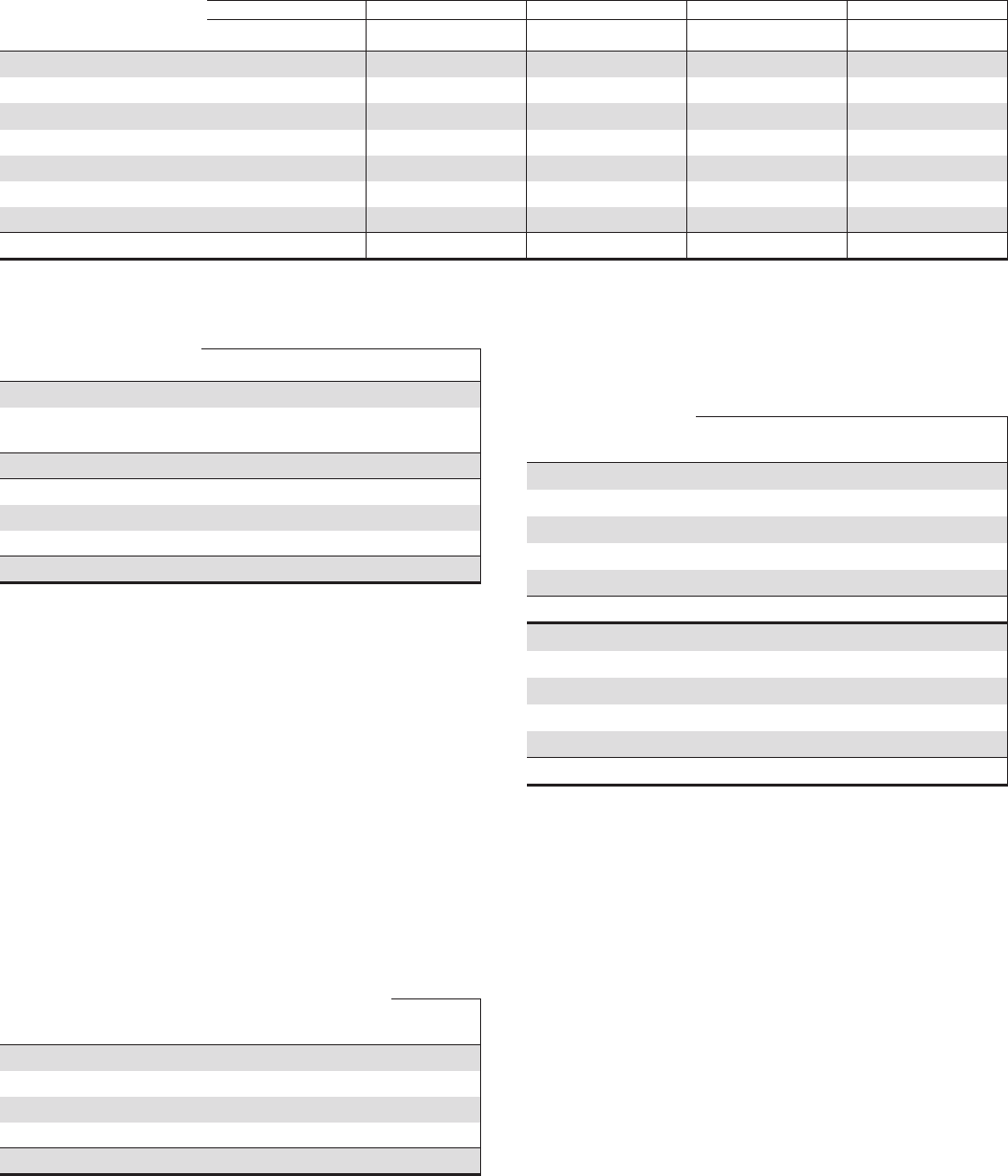

The following table presents the assignment of the allowance for loan and lease losses and the categories of loans as a percentage

of total loans. Changes in the allocation over time reflect the changes in loan portfolio composition, risk profile and refinements to

reserve methodologies.

ALLOCATION OF ALLOWANCE FOR LOAN AND LEASE LOSSES

2015 2014 2013 2012 2011

December 31

Dollars in millions Allowance

Loans to

Total Loans Allowance

Loans to

Total Loans Allowance

Loans to

Total Loans Allowance

Loans to

Total Loans Allowance

Loans to

Total Loans

Commercial $1,286 47.7% $1,209 47.6% $1,100 45.2% $1,131 44.7% $1,180 41.3%

Commercial real estate 281 13.3 318 11.4 400 10.8 589 10.0 753 10.2

Equipment lease financing 38 3.6 44 3.7 47 3.9 54 3.9 62 4.0

Home equity 484 15.5 872 16.9 1,051 18.6 1,044 19.3 1,095 20.8

Residential real estate 307 7.0 561 7.0 642 7.7 847 8.2 894 9.1

Credit card 167 2.4 173 2.3 169 2.3 199 2.3 202 2.5

Other consumer 164 10.5 154 11.1 200 11.5 172 11.6 161 12.1

Total $2,727 100.0% $3,331 100.0% $3,609 100.0% $4,036 100.0% $4,347 100.0%

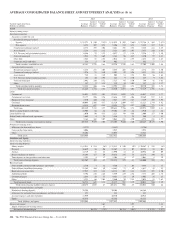

SELECTED LOAN MATURITIES AND INTEREST

SENSITIVITY

December 31, 2015

In millions

1 Year or

Less

1 Through

5 Years

After

5 Years

Gross

Loans

Commercial $27,251 $61,342 $10,015 $ 98,608

Commercial real estate –

Real estate projects 7,868 14,319 5,281 27,468

Total $35,119 $75,661 $15,296 $126,076

Loans with:

Predetermined rate $ 5,582 $10,866 $ 6,526 $ 22,974

Floating or adjustable rate 29,537 64,795 8,770 103,102

Total $35,119 $75,661 $15,296 $126,076

At December 31, 2015, we had no pay-fixed interest rate swaps

designated to commercial loans as part of fair value hedge

strategies. At December 31, 2015, $17.9 billion notional amount

of receive-fixed interest rate swaps were designated as part of

cash flow hedging strategies that converted the floating rate (1

month and 3 month LIBOR) on the underlying commercial

loans to a fixed rate as part of risk management strategies.

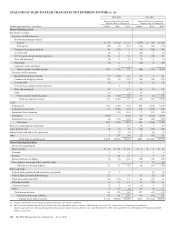

TIME DEPOSITS

The aggregate amount of time deposits with a denomination of

$100,000 or more was $9.4 billion at December 31, 2015 and

$8.8 billion at December 31, 2014. Time deposits of $100,000

or more included time deposits in foreign offices of $2.9

billion at December 31, 2015. Domestic time deposits of

$100,000 or more were $6.5 billion at December 31, 2015

with the following maturities:

December 31, 2015 – in millions

Domestic

Certificates

of Deposit

Three months or less $1,706

Over three through six months 1,089

Over six through twelve months 1,948

Over twelve months 1,793

Total $6,536

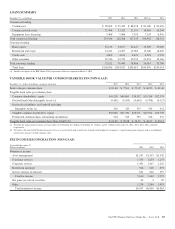

COMMON STOCK PRICES/DIVIDENDS DECLARED

The table below sets forth by quarter the range of high and

low sale and quarter-end closing prices for The PNC Financial

Services Group, Inc. common stock and the cash dividends

declared per common share.

High Low Close

Cash

Dividends

Declared (a)

2015 Quarter

First $ 96.71 $81.84 $93.24 $ .48

Second 99.61 90.42 95.65 .51

Third 100.52 82.77 89.20 .51

Fourth 97.50 84.93 95.31 .51

Total $2.01

2014 Quarter

First $ 87.80 $76.06 $87.00 $ .44

Second 89.85 79.80 89.05 .48

Third 90.00 80.43 85.58 .48

Fourth 93.45 76.69 91.23 .48

Total $1.88

(a) Our Board approved a first quarter 2016 cash dividend of $.51 per common share,

which was payable on February 5, 2016.

220 The PNC Financial Services Group, Inc. – Form 10-K