PNC Bank 2015 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

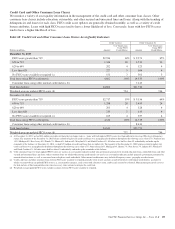

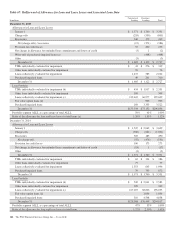

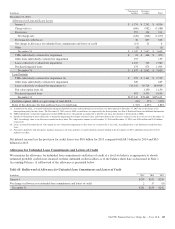

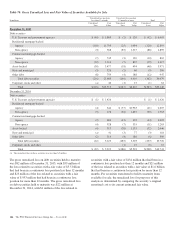

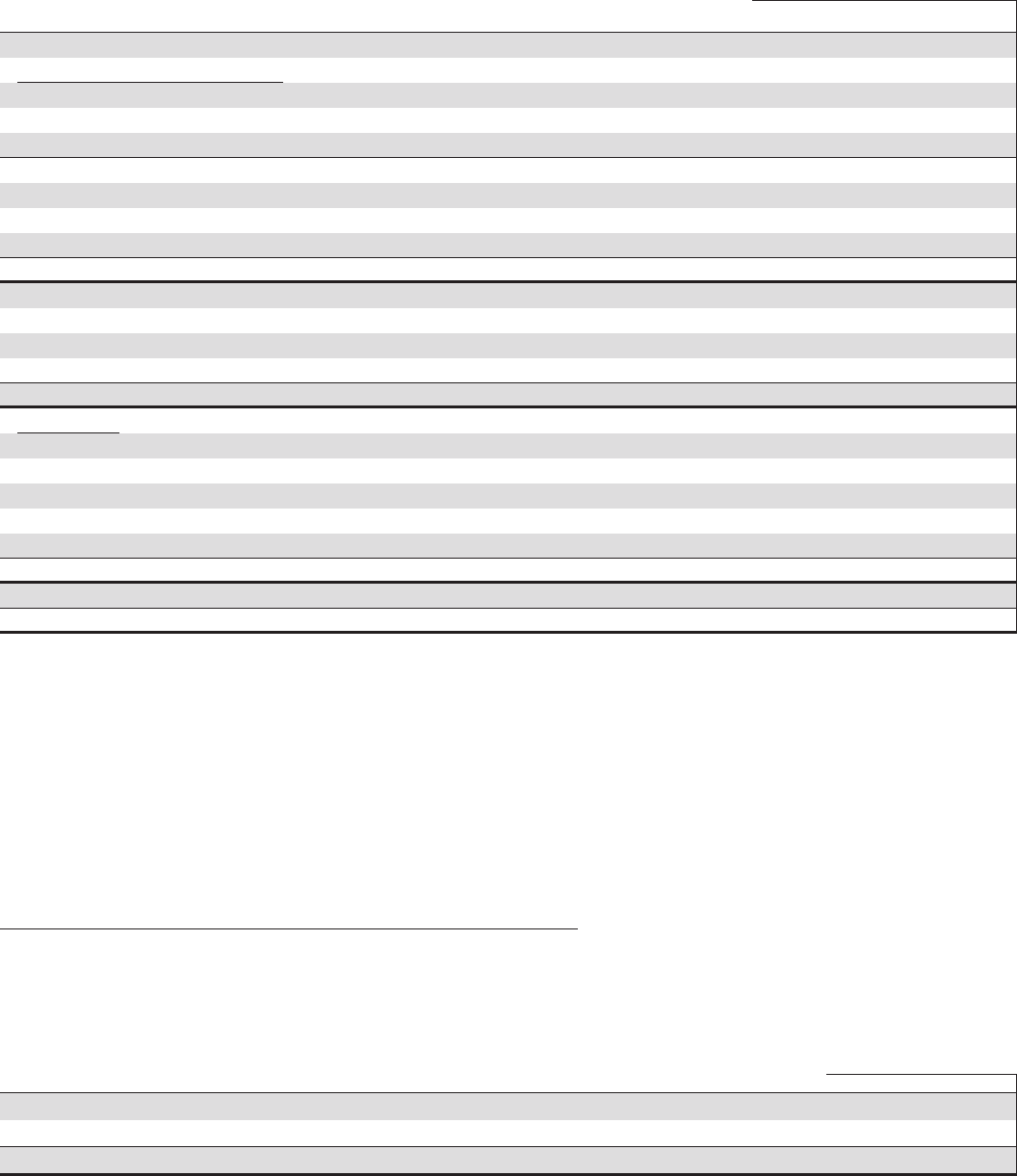

In millions

Commercial

Lending

Consumer

Lending Total

December 31, 2013

Allowance for Loan and Lease Losses

January 1 $ 1,774 $ 2,262 $ 4,036

Charge-offs (e) (606) (982) (1,588)

Recoveries 357 154 511

Net charge-offs (249) (828) (1,077)

Provision for credit losses 36 607 643

Net change in allowance for unfunded loan commitments and letters of credit (13) 21 8

Other (1) (1)

December 31 $ 1,547 $ 2,062 $ 3,609

TDRs individually evaluated for impairment $ 24 $ 446 $ 470

Other loans individually evaluated for impairment 155 155

Loans collectively evaluated for impairment 1,235 745 1,980

Purchased impaired loans 133 871 1,004

December 31 $ 1,547 $ 2,062 $ 3,609

Loan Portfolio

TDRs individually evaluated for impairment (b) $ 578 $ 2,161 $ 2,739

Other loans individually evaluated for impairment 649 649

Loans collectively evaluated for impairment (c) 115,245 69,724 184,969

Fair value option loans (d) 1,150 1,150

Purchased impaired loans 673 5,433 6,106

December 31 $117,145 $78,468 $195,613

Portfolio segment ALLL as a percentage of total ALLL 43% 57% 100%

Ratio of the allowance for loan and lease losses to total loans 1.32% 2.63% 1.84%

(a) A portion of the ALLL associated with purchased impaired pooled consumer and residential real estate loans was derecognized on December 31, 2015 due to the change in the

derecognition policy for these loans. The December 31, 2015 ratio of ALLL to total loans was impacted by the derecognition. See Note 4 Purchased Loans for additional information.

(b) TDRs individually evaluated for impairment exclude TDRs that were subsequently accounted for as held for sale loans, but continue to be disclosed as TDRs.

(c) Includes $150 million of loans collectively evaluated for impairment based upon collateral values and written down to the respective collateral value less costs to sell at December 31,

2015. Accordingly, there is no allowance recorded for these loans. The comparative amounts as of December 31, 2014 and December 31, 2013 were $195 million and $252 million,

respectively.

(d) Loans accounted for under the fair value option are not evaluated for impairment as these loans are accounted for at fair value. Accordingly there is no allowance recorded on these

loans.

(e) Pursuant to alignment with interagency guidance on practices for loans and lines of credit related to consumer lending in the first quarter of 2013, additional charge-offs of $134

million were taken.

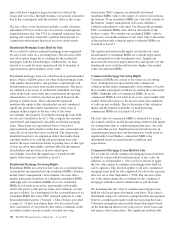

Net interest income less the provision for credit losses was $8.0 billion for 2015 compared with $8.3 billion for 2014 and $8.5

billion for 2013.

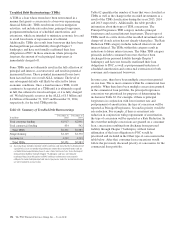

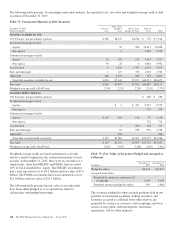

Allowance for Unfunded Loan Commitments and Letters of Credit

We maintain the allowance for unfunded loan commitments and letters of credit at a level we believe is appropriate to absorb

estimated probable credit losses incurred on these unfunded credit facilities as of the balance sheet date as discussed in Note 1

Accounting Policies. A rollforward of the allowance is presented below.

Table 68: Rollforward of Allowance for Unfunded Loan Commitments and Letters of Credit

In millions 2015 2014 2013

January 1 $259 $242 $250

Net change in allowance for unfunded loan commitments and letters of credit 2 17 (8)

December 31 $261 $259 $242

The PNC Financial Services Group, Inc. – Form 10-K 143