PNC Bank 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Total senior and subordinated debt of PNC Bank increased to

$25.5 billion at December 31, 2015 from $17.5 billion at

December 31, 2014 due to the following activity in the period.

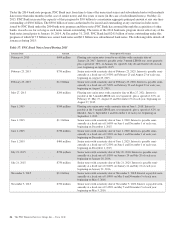

Table 38: PNC Bank Senior and Subordinated Debt

In billions 2015

January 1 $17.5

Issuances 8.8

Calls and maturities (.8)

December 31 $25.5

PNC Bank is a member of the FHLB-Pittsburgh and, as such,

has access to advances from FHLB-Pittsburgh secured

generally by residential mortgage loans, other mortgage-

related loans and commercial mortgage-backed securities. At

December 31, 2015, our unused secured borrowing capacity

was $19.4 billion with the FHLB-Pittsburgh. Total FHLB

borrowings increased to $20.1 billion at December 31, 2015

from $20.0 billion at December 31, 2014 due to the following

activity in the period.

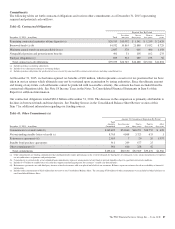

Table 39: FHLB Borrowings

In billions 2015

January 1 $20.0

Issuances 2.2

Calls and maturities (2.1)

December 31 $20.1

The FHLB-Pittsburgh also periodically provides standby

letters of credit on behalf of PNC Bank to secure certain

public deposits. PNC Bank began using standby letters of

credit issued by the FHLB-Pittsburgh for these purposes in

response to the regulatory liquidity standards finalized during

2014. If the FHLB-Pittsburgh is required to make payment for

a beneficiary’s draw, the payment amount is converted into a

collateralized advance to PNC Bank. At December 31, 2015,

standby letters of credit issued on our behalf by the FHLB-

Pittsburgh totaled $5.3 billion.

PNC Bank has the ability to offer up to $10.0 billion of its

commercial paper to provide additional liquidity. As of

December 31, 2015, there was $14 million outstanding under

this program.

PNC Bank can also borrow from the Federal Reserve Bank

discount window to meet short-term liquidity requirements.

The Federal Reserve Bank, however, is not viewed as the

primary means of funding our routine business activities, but

rather as a potential source of liquidity in a stressed

environment or during a market disruption. These potential

borrowings are secured by commercial loans. At

December 31, 2015, our unused secured borrowing capacity

was $14.4 billion with the Federal Reserve Bank.

Parent Company Liquidity

As of December 31, 2015, available parent company liquidity

totaled $4.6 billion. Parent company liquidity is primarily held

in short-term investments, the terms of which provide for the

availability of cash in 31 days or less. Investments with longer

durations may also be acquired, but if so, the related

maturities are aligned with scheduled cash needs, such as the

maturity of parent company debt obligations.

Parent Company Liquidity – Uses

The parent company’s contractual obligations consist

primarily of debt service related to parent company

borrowings and funding non-bank affiliates. As of

December 31, 2015, there were approximately $1.3 billion of

parent company borrowings with contractual maturities of less

than one year. Additionally, the parent company maintains

adequate liquidity to fund discretionary activities such as

paying dividends to PNC shareholders, share repurchases, and

acquisitions.

See Balance Sheet, Liquidity and Capital Highlights in the

Executive Summary section of this Item 7 for information on

our 2015 capital plan that was accepted by the Federal

Reserve. Our capital plan included a recommendation to

increase the quarterly common stock dividend in the second

quarter of 2015 and the ability to redeem the Series K

Preferred Stock, as further described below, and also included

share repurchase programs of up to $2.875 billion for the five

quarter period beginning in the second quarter of 2015. See

the Capital portion of the Consolidated Balance Sheet Review

in this Item 7 for more information on our share repurchase

programs.

On April 2, 2015, consistent with our 2015 capital plan, our

Board of Directors approved an increase to PNC’s quarterly

common stock dividend from 48 cents per common share to

51 cents per common share beginning with the May 5, 2015

dividend payment.

On May 4, 2015, we redeemed $500 million of PNC’s Fixed-

to-Floating Rate Non-Cumulative Perpetual Preferred Stock,

Series K, as well as all Depositary Shares representing

interests therein. Each Depositary Share represented a 1/10

interest in a share of the Series K Preferred Stock. All 50,000

shares of Series K Preferred Stock, as well as all 500,000

Depositary Shares representing interests therein, were

redeemed. The redemption price was $10,000 per share of

Series K Preferred Stock equivalent to $1,000 per Depositary

Share, plus declared and unpaid dividends up to but excluding

the redemption date.

See the Supervision and Regulation section in Item 1 of this

Report for additional information regarding the Federal

Reserve’s CCAR process and the factors the Federal Reserve

takes into consideration in evaluating capital plans, qualitative

and quantitative liquidity risk management standards proposed

The PNC Financial Services Group, Inc. – Form 10-K 85