PNC Bank 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On at least a quarterly basis, we review all debt securities that

are in an unrealized loss position for other than temporary

impairment (OTTI). An investment security is deemed

impaired if the fair value of the investment is less than its

amortized cost. Amortized cost includes adjustments (if any)

made to the cost basis of an investment for accretion,

amortization, previous other-than-temporary impairments and

hedging gains and losses. After an investment security is

determined to be impaired, we evaluate whether the decline in

value is other-than-temporary. As part of this evaluation, we

take into consideration whether we intend to sell the security

or whether it is more likely than not that we will be required to

sell the security before expected recovery of its amortized

cost. We also consider whether or not we expect to receive all

of the contractual cash flows from the investment based on

factors that include, but are not limited to: the

creditworthiness of the issuer and, in the case of securities

collateralized by consumer and commercial loan assets, the

historical and projected performance of the underlying

collateral. In addition, we may also evaluate the business and

financial outlook of the issuer, as well as broader industry and

sector performance indicators. Declines in the fair value of

available for sale debt securities that are deemed other-than-

temporary and are attributable to credit deterioration are

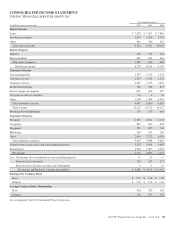

recognized in Other noninterest income on our Consolidated

Income Statement in the period in which the determination is

made. Declines in fair value which are deemed other-than-

temporary and attributable to factors other than credit

deterioration are recognized in Accumulated other

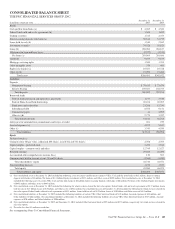

comprehensive income (loss) on our Consolidated Balance

Sheet.

We include all interest on debt securities, including

amortization of premiums and accretion of discounts on

investment securities, in net interest income using the constant

effective yield method. Effective yields reflect either the

effective interest rate implicit in the security at the date of

acquisition or the effective interest rate determined based on

improved cash flows subsequent to impairment. We compute

gains and losses realized on the sale of available for sale debt

securities on a specific security basis. These securities gains/

(losses) are included in the caption Net gains on sales of

securities on the Consolidated Income Statement.

In certain situations, management may elect to transfer certain

debt securities from the securities available for sale to the held

to maturity classification. In such cases, the securities are

reclassified at fair value at the time of transfer. Any unrealized

gain or loss included in Accumulated other comprehensive

income (loss) at the time of transfer is retained therein and

amortized over the remaining life of the security as a yield

adjustment, such that only the remaining initial discount/

premium from the purchase date is recognized in income.

Equity Securities and Partnership Interests

We account for equity securities and equity investments other

than BlackRock and private equity investments under one of

the following methods:

• Marketable equity securities are recorded on a trade-

date basis and are accounted for based on the

securities’ quoted market prices from a national

securities exchange. Those purchased with the

intention of selling in the near term are classified as

trading and included in Trading securities on our

Consolidated Balance Sheet. Both realized and

unrealized gains and losses on trading securities are

included in Noninterest income. Marketable equity

securities not classified as trading are designated as

securities available for sale with unrealized gains and

losses, net of income taxes, reflected in Accumulated

other comprehensive income (loss). Any unrealized

losses that we have determined to be other-than-

temporary on securities classified as available for

sale are recognized in current period earnings.

• For investments in limited partnerships, limited

liability companies and other investments that are not

required to be consolidated, we use either the equity

method or the cost method of accounting. We use the

equity method for general and limited partner

ownership interests and limited liability companies in

which we are considered to have significant influence

over the operations of the investee. Under the equity

method, we record our equity ownership share of net

income or loss of the investee in Noninterest income.

We use the cost method for all other investments.

Under the cost method, there is no change to the cost

basis unless there is an other-than-temporary decline

in value or dividends received are considered a return

on investment. If the decline is determined to be

other-than-temporary, we write down the cost basis

of the investment to a new cost basis that represents

realizable value. The amount of the write-down is

accounted for as a loss included in Noninterest

income. Distributions received from the income of an

investee on cost method investments are included in

Noninterest income. Investments described above are

included in the caption Equity investments on the

Consolidated Balance Sheet.

Private Equity Investments

We report private equity investments, which include direct

investments in companies, affiliated partnership interests and

indirect investments in private equity funds, at estimated fair

value. These estimates are based on available information and

may not necessarily represent amounts that we will ultimately

realize through distribution, sale or liquidation of the

investments. Fair values of publicly traded direct investments

are determined using quoted market prices and are subject to

various discount factors for lack of marketability, when

appropriate. The valuation procedures applied to direct

The PNC Financial Services Group, Inc. – Form 10-K 111