PNC Bank 2015 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

by the U.S. banking agencies, and final rules issued by the

Federal Reserve that make certain modifications to the Federal

Reserve’s capital planning and stress testing rules.

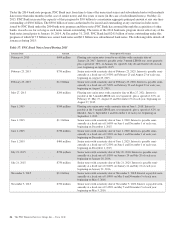

See Table 37 for information on an affiliate purchase of notes

issued by PNC Bank during 2015.

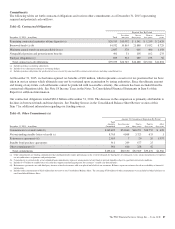

Parent Company Liquidity – Sources

The principal source of parent company liquidity is the

dividends it receives from its subsidiary bank, which may be

impacted by the following:

• Bank-level capital needs,

• Laws and regulations,

• Corporate policies,

• Contractual restrictions, and

• Other factors.

There are statutory and regulatory limitations on the ability of

a national bank to pay dividends or make other capital

distributions or to extend credit to the parent company or its

non-bank subsidiaries. The amount available for dividend

payments by PNC Bank to the parent company without prior

regulatory approval was approximately $1.7 billion at

December 31, 2015. See Note 19 Regulatory Matters in the

Notes To Consolidated Financial Statements in Item 8 of this

Report for a further discussion of these limitations. We

provide additional information on certain contractual

restrictions in Note 16 Equity in the Notes To Consolidated

Financial Statements in Item 8 of this Report.

In addition to dividends from PNC Bank, other sources of

parent company liquidity include cash and investments, as

well as dividends and loan repayments from other subsidiaries

and dividends or distributions from equity investments.

We can also generate liquidity for the parent company and

PNC’s non-bank subsidiaries through the issuance of debt and

equity securities, including certain capital instruments, in

public or private markets and commercial paper.

Total parent company senior and subordinated debt and hybrid

capital instruments decreased to $7.5 billion at December 31,

2015 from $10.1 billion at December 31, 2014 due to the

following activity in the period.

Table 40: Parent Company Senior and Subordinated Debt

and Hybrid Capital Instruments

In billions 2015

January 1 $10.1

Maturities (2.5)

Other (.1)

December 31 $ 7.5

The parent company has the ability to offer up to $5.0 billion

of commercial paper to provide additional liquidity. As of

December 31, 2015, there were no issuances outstanding

under this program.

Status of Credit Ratings

The cost and availability of short-term and long-term funding,

as well as collateral requirements for certain derivative

instruments, is influenced by PNC’s credit ratings.

In general, rating agencies base their ratings on many

quantitative and qualitative factors, including capital

adequacy, liquidity, asset quality, business mix, level and

quality of earnings, and the current legislative and regulatory

environment, including implied government support. In

addition, rating agencies themselves have been subject to

scrutiny arising from the most recent financial crisis and could

make or be required to make substantial changes to their

ratings policies and practices, particularly in response to

legislative and regulatory changes. Potential changes in the

legislative and regulatory environment and the timing of those

changes could impact our ratings, which as noted above, could

impact our liquidity and financial condition. A decrease, or

potential decrease, in credit ratings could impact access to the

capital markets and/or increase the cost of debt, and thereby

adversely affect liquidity and financial condition.

In March 2015, Moody’s Investors Service (Moody’s)

published a new bank ratings methodology which has been

implemented on a global basis and includes assessment of

expected loss ratings on instruments ranging from bank

deposits to preferred stock. In the second quarter of 2015,

Moody’s concluded its review for PNC and PNC Bank under

this new methodology. As a result, Moody’s upgraded PNC

Bank’s long-term deposit rating three notches to Aa2,

confirmed PNC Bank’s senior debt and issuer ratings at A2,

and confirmed PNC Bank’s Prime-1 short-term notes rating.

The Moody’s rating outlook for PNC and PNC Bank is stable.

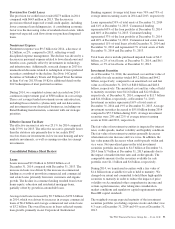

Table 41: Credit Ratings as of December 31, 2015 for PNC

and PNC Bank

Moody’s

Standard &

Poor’s Fitch

PNC

Senior debt A3 A- A+

Subordinated debt A3 BBB+ A

Preferred stock Baa2 BBB- BBB-

PNC Bank

Senior debt A2 A A+

Subordinated debt A3 A- A

Long-term deposits Aa2 A AA-

Short-term deposits P-1 A-1 F1+

Short-term notes P-1 A-1 F1

86 The PNC Financial Services Group, Inc. – Form 10-K