PNC Bank 2015 Annual Report Download - page 226

Download and view the complete annual report

Please find page 226 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

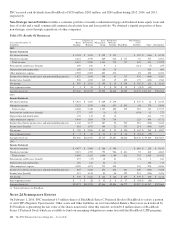

At December 31, 2015 and December 31, 2014, the home

equity indemnification and repurchase liability for estimated

losses on indemnification and repurchase claims totaled $20

million and $29 million, respectively, and was included in

Other liabilities on the Consolidated Balance Sheet. The

unpaid principal balance of the sold loan portfolio associated

with this repurchase obligation totaled $2.1 billion and $2.5

billion at December 31, 2015 and December 31, 2014,

respectively. At December 31, 2015 the reasonably possible

loss above our accrual for our portfolio of home equity loans/

lines of credit sold was not material.

Resale and Repurchase Agreements

We enter into repurchase and resale agreements where we

transfer investment securities to/from a third party with the

agreement to repurchase/resell those investment securities at a

future date for a specified price. These agreements are entered

into primarily to provide short-term financing for securities

inventory positions, acquire securities to cover short positions

and accommodate customers’ investing and financing needs.

Repurchase and resale agreements are treated as collateralized

financing transactions for accounting purposes and are

generally carried at the amounts at which the securities will be

subsequently reacquired or resold, including accrued interest.

Our policy is to take possession of securities purchased under

agreements to resell. We monitor the market value of

securities to be repurchased and resold and additional

collateral may be obtained where considered appropriate to

protect against credit exposure.

Repurchase and resale agreements are typically entered into

with counterparties under industry standard master netting

agreements which provide for the right to offset amounts

owed to one another with respect to multiple repurchase and

resale agreements under such master netting agreement

(referred to as netting arrangements) and liquidate the

purchased or borrowed securities in the event of counterparty

default. In order for an arrangement to be eligible for netting

under GAAP, we must obtain the requisite assurance that the

offsetting rights included in the master netting agreement

would be legally enforceable in the event of bankruptcy,

insolvency, or a similar proceeding of such third party.

Enforceability is evidenced by obtaining a legal opinion that

supports, with sufficient confidence, the enforceability of the

master netting agreement in bankruptcy.

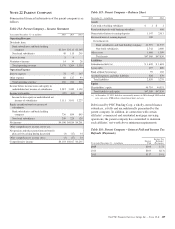

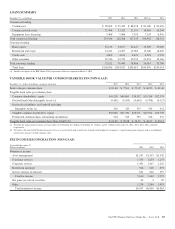

Table 133 shows the amounts owed under resale and repurchase agreements and the securities collateral associated with those

agreements where a legal opinion supporting the enforceability of the offsetting rights has been obtained. We do not present resale

and repurchase agreements entered into with the same counterparty under a legally enforceable master netting agreement on a net

basis on our Consolidated Balance Sheet or within Table 133.

Refer to Note 14 Financial Derivatives for additional information related to offsetting of financial derivatives.

Table 133: Resale and Repurchase Agreements Offsetting

In millions

Gross

Resale

Agreements

Amounts

Offset

on the

Consolidated

Balance Sheet

Net

Resale

Agreements (a)

Securities

Collateral

Held Under

Master Netting

Agreements (b)

Net

Amounts (c)

Resale Agreements

December 31, 2015 $1,082 $1,082 $1,008 $74

December 31, 2014 $1,646 $1,646 $1,569 $77

In millions

Gross

Repurchase

Agreements

Amounts

Offset

on the

Consolidated

Balance Sheet

Net

Repurchase

Agreements (a)

Securities

Collateral

Pledged Under

Master Netting

Agreements (b)

Net

Amounts (d)

Repurchase Agreements

December 31, 2015 $1,767(e) $1,767 $1,014 $753

December 31, 2014 $3,406 $3,406 $2,580 $826

(a) Resale agreements are included on the Consolidated Balance Sheet in Federal funds sold and resale agreements. Amounts in the table above exclude fair value adjustments of $4

million and $7 million at December 31, 2015 and December 31, 2014, respectively, related to structured resale agreements that we have elected to account for at fair value. See Note 7

Fair Value for additional information. Repurchase agreements are included on the Consolidated Balance Sheet in Federal funds purchased and repurchase agreements.

(b) Represents the fair value of securities collateral purchased or sold, up to the amount owed under the agreement, for agreements supported by a legally enforceable master netting

agreement.

(c) Represents certain long term resale agreements which are fully collateralized but do not have the benefits of a netting opinion and, therefore, might be subject to a stay in insolvency

proceedings and therefore are not eligible under ASC 210-20 for netting.

(d) Represents overnight repurchase agreements entered into with municipalities, pension plans, and certain trusts and insurance companies which are fully collateralized but do not have

the benefits of a netting opinion and, therefore, might be subject to a stay in insolvency proceedings and therefore are not eligible under ASC 210-20 for netting. There were no long

term repurchase agreements as of December 31, 2015 and December 31, 2014.

(e) Repurchase agreements have remaining contractual maturities that are classified as overnight or continuous. As of December 31, 2015, the collateral pledged under these agreements

consisted primarily of residential mortgage -backed agency securities.

208 The PNC Financial Services Group, Inc. – Form 10-K