PNC Bank 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

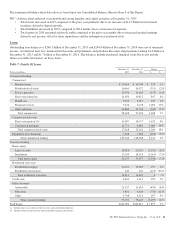

Provision For Credit Losses

The provision for credit losses totaled $255 million in 2015

compared with $273 million in 2014, reflecting improved

credit quality.

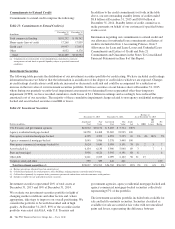

We expect our provision for credit losses in the first quarter of

2016 to be between $75 million and $125 million. The

performance of certain energy related loans during the first

quarter could result in provision for credit losses at the high

end of this range.

The Credit Risk Management portion of the Risk Management

section of this Item 7 includes additional information

regarding factors impacting the provision for credit losses.

Noninterest Expense

Noninterest expense decreased $25 million to $9.5 billion in

2015 compared to 2014, reflecting PNC’s focus on expense

management. Higher personnel expense associated with

higher business activity and investments in technology and

business infrastructure were more than offset by lower legal

and residential mortgage compliance costs and third party

expenses, as well as the impact of the fourth quarter 2014

contribution to the PNC Foundation.

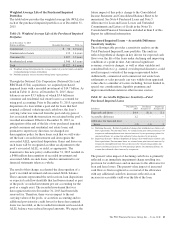

During 2015, we completed actions and exceeded our 2015

continuous improvement program goal of $500 million in cost

savings. The program focuses on reducing costs in part to fund

investments in technology and business infrastructure. In

2016, we have a goal of $400 million in cost savings through

our continuous improvement program, which we expect will

help to fund a significant portion of our business and

technology investments.

For the first quarter of 2016, we expect noninterest expense to

be down low-single digits, on a percentage basis, compared

with the fourth quarter of 2015. For full year 2016, we expect

total noninterest expense to be stable compared to 2015.

Effective Income Tax Rate

The effective income tax rate was 24.8% for 2015 compared

with 25.1% for 2014. The effective tax rate is generally lower

than the statutory rate primarily due to tax credits PNC

receives from our investments in low income housing and new

markets investments, as well as earnings in other tax exempt

investments.

The effective tax rate for 2015 included tax benefits

attributable to settling acquired entity tax contingencies.

We expect our 2016 effective tax rate to be between 25% and

26%.

C

ONSOLIDATED

B

ALANCE

S

HEET

R

EVIEW

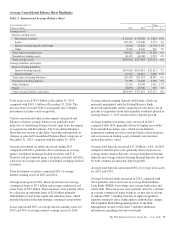

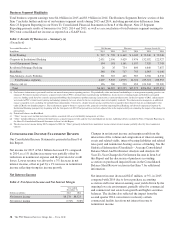

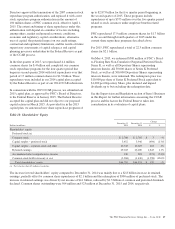

Table 6: Summarized Balance Sheet Data

Dollars in millions

December 31

2015

December 31

2014

Change

$%

Assets

Interest-earning deposits with banks $30,546 $31,779 $(1,233) (4)%

Loans held for sale 1,540 2,262 (722) (32)%

Investment securities 70,528 55,823 14,705 26%

Loans 206,696 204,817 1,879 1%

Allowance for loan and lease losses (2,727) (3,331) 604 (18)%

Goodwill 9,103 9,103 – –%

Mortgage servicing rights 1,589 1,351 238 18%

Other intangible assets 379 493 (114) (23)%

Other, net 40,839 42,775 (1,936) (5)%

Total assets $358,493 $345,072 $13,421 4%

Liabilities

Deposits $249,002 $232,234 $16,768 7%

Borrowed funds 54,532 56,768 (2,236) (4)%

Other 8,979 9,996 (1,017) (10)%

Total liabilities 312,513 298,998 13,515 5%

Equity

Total shareholders’ equity 44,710 44,551 159 –%

Noncontrolling interests 1,270 1,523 (253) (17)%

Total equity 45,980 46,074 (94) –%

Total liabilities and equity $358,493 $345,072 $13,421 4%

40 The PNC Financial Services Group, Inc. – Form 10-K