PNC Bank 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

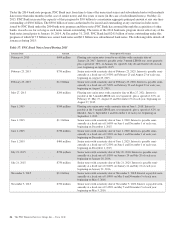

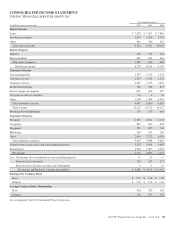

Provision For Credit Losses

The provision for credit losses totaled $273 million in 2014

compared with $643 million in 2013. The decrease in

provision reflected improved overall credit quality, including

lower consumer loan delinquencies. A contributing economic

factor was the increasing value of residential real estate, which

improved expected cash flows from our purchased impaired

loans.

Noninterest Expense

Noninterest expense was $9.5 billion for 2014, a decrease of

$.2 billion, or 2%, compared to 2013, reflecting overall

disciplined expense management. The decline was driven by a

decrease in personnel expense related to lower headcount and

benefits costs, partially offset by investments in technology

and infrastructure. Additionally, noncash charges in 2013 for

unamortized discounts related to redemption of trust preferred

securities contributed to the decline. See Note 14 Capital

Securities of Subsidiary Trusts and Perpetual Trust Securities

in Item 8 of our 2013 Form 10-K for additional detail on the

2013 redemption of trust preferred securities.

During 2014, we completed actions and exceeded our 2014

continuous improvement goal of $500 million in cost savings.

These cost savings funded investments in our infrastructure,

including those related to cybersecurity and our datacenters,

and investments in our diversified businesses, including our

Retail Banking transformation, consistent with our strategic

priorities.

Effective Income Tax Rate

The effective income tax rate was 25.1% for 2014 compared

with 25.9% for 2013. The effective tax rate is generally lower

than the statutory rate primarily due to tax credits PNC

receives from our investments in low income housing and new

markets investments, as well as earnings in other tax exempt

investments.

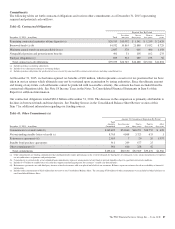

Consolidated Balance Sheet Review

Loans

Loans increased $9.2 billion to $204.8 billion as of

December 31, 2014 compared with December 31, 2013. The

increase in loans was driven by the increase in commercial

lending as a result of growth in commercial and commercial

real estate loans, primarily from new customers and organic

growth. The decline in consumer lending resulted from lower

home equity, education and residential mortgage loans,

partially offset by growth in automobile loans.

Average total loans increased by $9.7 billion to $199.6 billion

in 2014, which was driven by increases in average commercial

loans of $6.4 billion and average commercial real estate loans

of $3.2 billion. The overall increase in loans reflected organic

loan growth, primarily in our Corporate & Institutional

Banking segment. Average total loans were 70% and 73% of

average interest-earning assets in 2014 and 2013, respectively.

Loans represented 59% of total assets at December 31, 2014

and 61% at December 31, 2013. Commercial lending

represented 63% of the loan portfolio at December 31, 2014

and 60% at December 31, 2013. Consumer lending

represented 37% of the loan portfolio at December 31, 2014

and 40% at December 31, 2013. Commercial real estate loans

represented 11% of total loans at both December 31, 2014 and

December 31, 2013 and represented 7% of total assets at both

December 31, 2014 and December 31, 2013.

Total loans above include purchased impaired loans of $4.9

billion, or 2% of total loans, at December 31, 2014, and $6.1

billion, or 3% of total loans, at December 31, 2013.

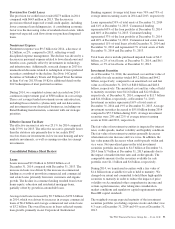

Investment Securities

As of December 31, 2014, the amortized cost and fair value of

available for sale securities totaled $43.2 billion and $44.2

billion, respectively, compared to an amortized cost and fair

value as of December 31, 2013 of $48.0 billion and $48.6

billion, respectively. The amortized cost and fair value of held

to maturity securities were $11.6 billion and $12.0 billion,

respectively, at December 31, 2014, compared to $11.7 billion

and $11.8 billion, respectively, at December 31, 2013.

Investment securities represented 16% of total assets at

December 31, 2014 and 19% at December 31, 2013. Average

investment securities decreased to $55.8 billion during 2014

compared to $57.3 billion during 2013. Average investment

securities were 20% and 22% of average interest-earning

assets in 2014 and 2013, respectively.

The fair value of investment securities is impacted by interest

rates, credit spreads, market volatility and liquidity conditions.

The fair value of investment securities generally decreases

when interest rates increase and vice versa. In addition, the

fair value generally decreases when credit spreads widen and

vice versa. Net unrealized gains in the total investment

securities portfolio increased to $1.5 billion at December 31,

2014 from $.7 billion at December 31, 2013 primarily due to

the impact of market interest rates and credit spreads. The

comparable amounts for the securities available for sale

portfolio were $1.1 billion and $.6 billion, respectively.

During 2014, we transferred securities with a fair value of

$1.4 billion from available for sale to held to maturity. We

changed our intent and committed to hold these high-quality

securities to maturity in order to reduce the impact of price

volatility on Accumulated other comprehensive income and

certain capital measures, after taking into consideration

market conditions and regulatory capital requirements under

Basel III capital standards.

The weighted-average expected maturity of the investment

securities portfolio (excluding corporate stocks and other) was

4.3 years at December 31, 2014 and 4.9 years at December 31,

2013.

The PNC Financial Services Group, Inc. – Form 10-K 93