PNC Bank 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

payments or loan repurchases; however, on occasion we may

negotiate pooled settlements with investors. In connection

with pooled settlements, we typically do not repurchase loans

and the consummation of such transactions generally results in

us no longer having indemnification and repurchase exposure

with the investor in the transaction.

An indemnification and repurchase liability for estimated

losses for which indemnification is expected to be provided or

for loans that are expected to be repurchased was established

at the acquisition of National City. Management’s evaluation

of these indemnification and repurchase liabilities is based

upon trends in indemnification and repurchase claims, actual

loss experience, risks in the underlying serviced loan

portfolios, current economic conditions and the periodic

negotiations that management may enter into with investors to

settle existing and potential future claims.

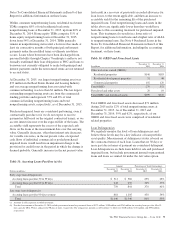

Indemnification and repurchase liabilities, which are included

in Other liabilities on the Consolidated Balance sheet, are

evaluated by management on a quarterly basis. Initial

recognition and subsequent adjustments to the indemnification

are recognized in Other noninterest income on the

Consolidated Income Statement. For more information

regarding our Home Equity Loan/Line of Credit Repurchase

Obligations, see Note 21 Commitments and Guarantees in the

Notes To Consolidated Statements in Item 8 of this Report.

R

ISK

M

ANAGEMENT

Enterprise Risk Management

PNC encounters risk as part of the normal course of operating

our business. Accordingly, we design risk management

processes to help manage this risk. PNC manages risk in light

of our risk appetite to optimize long term shareholder value

while supporting our employees, customers, and communities.

This Risk Management section describes our risk framework,

including risk appetite and strategy, culture, risk organization

and governance, risk identification and quantification, risk

controls and limits and risk monitoring and reporting. The

overall Risk Management section of this Item 7 also provides

an analysis of our key areas of risk, which include but are not

limited to credit, operational, compliance, market, liquidity

and model. Our use of financial derivatives as part of our

overall asset and liability risk management process is also

addressed within the risk management section.

PNC operates within a rapidly evolving regulatory

environment. Accordingly, we are actively focused on the

timely adoption of regulatory pronouncements within our

Enterprise Risk Management (ERM) Framework.

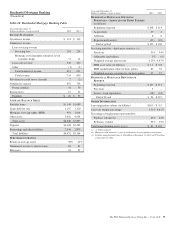

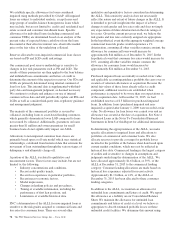

We view risk management as a cohesive combination of the

following risk elements which form PNC’s ERM Framework:

Risk Organization &

Governance

Risk

Monitor-

ing &

Reporting

Risk

Identi-

fication &

Quanti-

fication

Risk Controls &

Limits

Risk

Appetite

Statement

Risk Capacity,

Appetite &

Strategy

R

i

s

k

C

u

l

t

u

r

e

Risk Appetite and Strategy

PNC’s risk appetite represents the organization’s desired

enterprise risk position, set within our capital-based risk and

liquidity capacity to achieve our strategic objectives and

business plans. Reviewed periodically through the risk

reporting and Strategic Planning processes, the risk appetite

serves as an operating guide for making balanced risk

decisions that support our business strategies; it will adjust

over time to reflect the current and anticipated economic

environment, growth objectives, risk capacity and our risk

profile.

We establish guiding principles for each of the risks within

our taxonomy to support the Risk Appetite Statement. The

guiding principles are qualitative statements that guide risk-

taking activities and are supported by quantitative metrics, risk

limits, and risk appetite descriptions as defined in policy and

managed through the ERM framework.

Risk Culture

All employees are considered risk managers, and are

responsible for understanding PNC’s Risk Appetite Statement,

guiding principles and ERM framework and how they apply to

their respective roles. PNC’s governance structure establishes

clear roles and responsibilities for risk management throughout

the organization. All employees are encouraged to collaborate

across groups to identify and mitigate risks and elevate issues as

required. PNC reinforces risk management responsibilities

through a performance management system where employee

performance goals include risk management objectives and

incentives for employees to reinforce balanced measures of risk

adjusted performance.

Proactive communication, between groups and up to the Board

of Directors, facilitates timely identification and resolution of

risk issues. PNC’s multi-level risk committee structure provides

a formal channel to identify, decision, and report risk. Risk

The PNC Financial Services Group, Inc. – Form 10-K 69