PNC Bank 2015 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

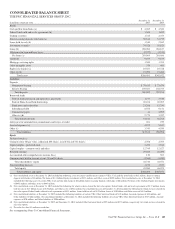

to absorb losses or the right to receive benefits that in either

case could potentially be significant to the VIE. Upon

consolidation of a VIE, we recognize all of the VIE’s assets,

liabilities and noncontrolling interests on our Consolidated

Balance Sheet. On a quarterly basis, we determine whether

any changes occurred requiring a reassessment of whether

PNC is the primary beneficiary of an entity.

In applying this guidance, we consolidate a credit card

securitization trust and certain tax credit investments. See

Note 2 Loan Sale and Servicing Activities and Variable

Interest Entities for information about VIEs that we

consolidate as well as those that we do not consolidate but in

which we hold a significant variable interest.

Revenue Recognition

We earn interest and noninterest income from various sources,

including:

• Lending,

• Securities portfolio,

• Asset management,

• Customer deposits,

• Loan sales and servicing,

• Brokerage services,

• Sale of loans and securities,

• Certain private equity activities, and

• Securities, derivatives and foreign exchange

activities.

We earn fees and commissions from:

• Issuing loan commitments, standby letters of credit

and financial guarantees,

• Selling various insurance products,

• Providing treasury management services,

• Providing merger and acquisition advisory and

related services, and

• Participating in certain capital markets transactions.

Revenue earned on interest-earning assets, including unearned

income and the amortization/accretion of premiums or

discounts recognized on acquired loans and debt securities, is

recognized based on the constant effective yield of the

financial instrument or based on other applicable accounting

guidance.

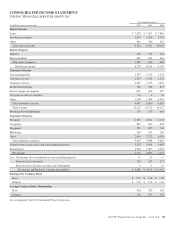

The Consolidated Income Statement caption Asset

management includes asset management fees, which are

generally based on a percentage of the fair value of the assets

under management. Additionally, Asset management

noninterest income includes our share of the earnings of

BlackRock recognized under the equity method of accounting.

Service charges on deposit accounts are recognized when

earned. Brokerage fees and gains and losses on the sale of

securities and certain derivatives are recognized on a trade-

date basis.

We record private equity income or loss based on changes in

the valuation of the underlying investments or when we

dispose of our interest.

We recognize gain/(loss) on changes in the fair value of

certain financial instruments where we have elected the fair

value option. These financial instruments include certain

commercial and residential mortgage loans originated for sale,

certain residential mortgage portfolio loans, resale agreements

and our investment in BlackRock Series C preferred stock. We

also recognize gain/(loss) on changes in the fair value of

residential and commercial mortgage servicing rights (MSRs).

We recognize revenue from servicing residential mortgages,

commercial mortgages and other consumer loans as earned

based on the specific contractual terms. These revenues are

reported on the Consolidated Income Statement in the line

items Residential mortgage, Corporate services and Consumer

services. We recognize revenue from securities, derivatives

and foreign exchange customer-related trading, as well as

securities underwriting activities, as these transactions occur

or as services are provided. We generally recognize gains

from the sale of loans upon receipt of cash. Mortgage revenue

recognized is reported net of mortgage repurchase reserves.

When appropriate, revenue is reported net of associated

expenses in accordance with GAAP.

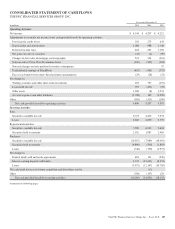

Cash And Cash Equivalents

Cash and due from banks are considered “cash and cash

equivalents” for financial reporting purposes.

Investments

We hold interests in various types of investments. The

accounting for these investments is dependent on a number of

factors including, but not limited to, items such as:

• Ownership interest,

• Our plans for the investment, and

• The nature of the investment.

Debt Securities

Debt securities are recorded on a trade-date basis. We classify

debt securities as held to maturity and carry them at amortized

cost if we have the positive intent and ability to hold the

securities to maturity. Debt securities that we purchase for

certain risk management activities or customer-related trading

activities are carried at fair value and classified as Trading

securities on our Consolidated Balance Sheet. Realized and

unrealized gains and losses on trading securities are included

in Other noninterest income.

Debt securities not classified as held to maturity or trading are

designated as securities available for sale and carried at fair

value with unrealized gains and losses, net of income taxes,

reflected in Accumulated other comprehensive income (loss).

110 The PNC Financial Services Group, Inc. – Form 10-K