PNC Bank 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The PNC Financial Services Group

2015 Annual Report

Integrity.

Innovation.

Insight.

Table of contents

-

Page 1

Integrity. Innovation. Insight. The PNC Financial Services Group 2015 Annual Report -

Page 2

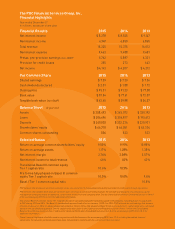

... Common Share Diluted earnings Cash dividends declared Closing price Book value Tangible book value (non-GAAP) 2015 $ 7.39 $ 2.01 $ 95.31 $ 81.84 $ 63.65 2014 $ 7.30 $ 1.88 $ 91.23 $ 77.61 $ 59.88 2013 $ 7.36 $ 1.72 $ 77.58 $ 72.07 $ 54.57 Balance Sheet Assets Loans Deposits At year end 2015... -

Page 3

... our risk appetite or mortgage the future of the company in pursuit of short-term gains. For the full year, in 2015 we grew loans by 1 percent, deposits were up 7 percent, fee income was up 3 percent, and noninterest income represented a higher percentage of our total revenue mix than in 2014. We... -

Page 4

... Long-Term Value and Returning Capital to Our Shareholders PNC's stock reached an all-time-high share price in 2015, ï¬nishing the year 4 percent higher than at the close of 2014. And over the three-year period ending December 31, 2015, PNC ranked ï¬rst among our peer group in total shareholder... -

Page 5

... (P-to-P) payments easily and securely using an email address or mobile phone number. Integrating the services and capabilities of these businesses and their related networks will enable us to create a secure, real-time solution for P-to-P payments and mobile check deposits that no single bank could... -

Page 6

...possible customer experiences each day. We took a fresh look at talent management and created new accountabilities for managers and employees at every level. We also built a framework for all employees to work with their managers to establish career development plans, thereby creating clear lines of... -

Page 7

... through our retail business, I am pleased to report that Chief Customer Ofï¬cer Karen Larrimer has been named to head our retail bank as Neil Hall prepares to retire After attending a PNC seminar to learn about the home buying process and then working with a PNC Mortgage loan ofï¬cer to identify... -

Page 8

... we have been working for a number of years now on an aggressive effort to make internal processes more effective and efï¬cient as well as to strengthen the technology backbone that supports the company's ability to grow. In 2015, we took major steps to modernize our data center strategy. Over the... -

Page 9

... development. PNC Grow Up Great - now entering its 12th year helping to increase access to quality early childhood education across our markets - distributed nearly $17 million in grants in 2015. Grow Up Great also expanded a $10.7 million community vocabulary collaborative pilot to seven new cities... -

Page 10

... and investment in PNC. Sincerely, William S. Demchak Chairman, President and Chief Executive Ofï¬cer PNC's Southeast markets are deï¬ned as Alabama, Georgia, North Carolina, South Carolina and Florida. Southeast markets revenue was $1.1 billion in 2015 and represented 11 percent of total market... -

Page 11

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2015 Commission file number 001-09718 FORM 10-K THE PNC FINANCIAL SERVICES GROUP, INC. (Exact name of ... -

Page 12

... Review Off-Balance Sheet Arrangements And Variable Interest Entities Fair Value Measurements Business Segments Review Critical Accounting Estimates And Judgments Status Of Qualified Defined Benefit Pension Plan Recourse And Repurchase Obligations Risk Management 2014 Versus 2013 Glossary Of Terms... -

Page 13

... Officers and Corporate Governance. Executive Compensation. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. Certain Relationships and Related Transactions, and Director Independence. Principal Accounting Fees and Services. Exhibits, Financial Statement... -

Page 14

... Purchased Impaired Loans Commitments to Extend Credit Investment Securities Weighted-Average Expected Maturity of Mortgage and Other Asset-Backed Debt Securities Loans Held For Sale Details Of Funding Sources Shareholders' Equity Basel III Capital Fair Value Measurements - Summary Retail Banking... -

Page 15

... for PNC and PNC Bank Contractual Obligations Other Commitments Interest Sensitivity Analysis Net Interest Income Sensitivity to Alternative Rate Scenarios (Fourth Quarter 2015) Alternate Interest Rate Scenarios: One Year Forward Enterprise-Wide Gains/Losses Versus Value-at-Risk Equity Investments... -

Page 16

... Related to Other Financial Instruments Goodwill by Business Segment Commercial Mortgage Servicing Rights Accounted for at Fair Value Commercial Mortgage Servicing Rights Accounted for Under the Amortization Method Residential Mortgage Servicing Rights Commercial Mortgage Loan Servicing Rights - Key... -

Page 17

... Plan Level 3 Assets Estimated Cash Flows Components of Net Periodic Benefit Cost Net Periodic Costs - Assumptions Other Pension Assumptions Effect of One Percent Change in Assumed Health Care Cost Estimated Amortization of Unamortized Actuarial Gains and Losses - 2016 Option Pricing Assumptions... -

Page 18

... 138 Net Operating Loss Carryforwards and Tax Credit Carryforwards Change in Unrecognized Tax Benefits Basel Regulatory Capital Commitments to Extend Credit and Other Commitments Internal Credit Ratings Related to Net Outstanding Standby Letters of Credit Resale and Repurchase Agreements Offsetting... -

Page 19

... financial assets, such as savings and liquidity deposits, loans and investable assets, including retirement assets. A strategic priority for PNC is to redefine the retail banking business in response to changing customer preferences. A key element of this strategy is to expand the use of lower-cost... -

Page 20

... regarding its business is available in its filings with the Securities and Exchange Commission (SEC). Non-Strategic Assets Portfolio includes a consumer portfolio of mainly residential mortgage and brokered home equity loans and lines of credit and a small commercial/commercial real estate loan and... -

Page 21

... For Loan And Lease Losses Average Amount And Average Rate Paid On Deposits Time Deposits Of $100,000 Or More Selected Consolidated Financial Data Short-term borrowings - not included as average balances during 2015, 2014, and 2013 were less than 30% of total shareholders' equity at the end of... -

Page 22

... of trust preferred securities as Tier 1 regulatory capital; required that deposit insurance assessments be calculated based on an insured depository institution's assets rather than its insured deposits; raised the minimum Designated Reserve Ratio (the balance in the Deposit Insurance Fund divided... -

Page 23

... related to both available for sale securities and pension and other post-retirement plans as a component of CET1 capital. The Basel III capital rule became effective on January 1, 2014 for PNC and PNC Bank, although many provisions are phased-in over a period of years. The second part of the rules... -

Page 24

... to avoid limitations on capital distributions (including dividends and repurchases of 6 The PNC Financial Services Group, Inc. - Form 10-K any Tier 1 capital instrument, including common and qualifying preferred stock) and certain discretionary incentive compensation payments. The multi-year phase... -

Page 25

... (such as PNC and PNC Bank) also will be subject to a new minimum 3.0% supplementary leverage ratio that becomes effective on January 1, 2018. The supplementary leverage ratio is calculated by dividing Tier 1 capital by total leverage exposure and takes into account on balance sheet assets as... -

Page 26

... Basel Committee included shortterm liquidity standards (the "Liquidity Coverage Ratio" or "LCR") and long-term funding standards (the "Net Stable Funding Ratio" or "NSFR"). The rules adopted by the U.S. banking agencies to implement the LCR took effect on January 1, 2015. The LCR rules are designed... -

Page 27

... expects capital plans submitted in 2016 to reflect conservative dividend payout ratios and net share repurchase programs, and that requests that imply common dividend payout ratios above 30% of projected after-tax net income available to common shareholders will receive particularly close scrutiny... -

Page 28

... of a bank or BHC to engage in new activities, grow, acquire new businesses, repurchase its stock or pay dividends, or to continue to conduct existing activities. The OCC, moreover, has established certain heightened risk management and governance standards for large banks, including PNC Bank, as... -

Page 29

... U.S. liabilities of foreign financial companies). OCC prior approval is required for PNC Bank to acquire another insured bank or savings association by merger or to acquire deposits or substantially all of the assets of such institutions. In deciding whether to approve such a transaction, the OCC... -

Page 30

... days prior to closing of a mortgage loan. The CFPB is also engaged or expected to engage in rulemakings that impact products and services offered by PNC Bank, including regulations impacting prepaid cards, overdraft fees charged on deposit accounts and arbitration provisions included in customer... -

Page 31

... delegated responsibilities, the National Futures Association) will have a meaningful supervisory role with respect to PNC Bank's derivatives and foreign exchange businesses. Because of the limited volume of our security-based swap activities, PNC Bank has not registered with the SEC as a security... -

Page 32

... Savings and loan associations, • Credit unions, • Treasury management service companies, • Insurance companies, and • Issuers of commercial paper and other securities, including mutual funds. Our various non-bank businesses engaged in investment banking and alternative investment activities... -

Page 33

..., various SEC filings, including annual, quarterly and current reports and proxy statements, presentation materials associated with earnings and other investor conference calls or events, and access to live and recorded audio from earnings and other The PNC Financial Services Group, Inc. - Form 10... -

Page 34

... manage the risks presented by our business activities so that we can appropriately balance revenue generation and profitability. These risks include, but are not limited to, credit risk, market risk, liquidity risk, operational risk, model risk, technology, compliance and legal risk, and strategic... -

Page 35

..., tax and other policies of the government and its agencies, including the Federal Reserve, have a significant impact on interest rates and overall financial market performance. These governmental policies can thus affect the activities and results of operations of banking companies such as PNC... -

Page 36

... sales, investments and other transactions. PNC's customers could remove money from checking and savings accounts and other types of deposit accounts in favor of other banks or other types of investment products. Deposits are a low cost source of funds. Therefore, losing deposits could increase... -

Page 37

... laws and regulations restrict our ability to repurchase stock or to receive dividends from subsidiaries that operate in the banking and securities businesses and impose capital adequacy requirements. PNC's ability to service its obligations and pay dividends to shareholders is largely dependent... -

Page 38

...of December 31, 2015, PNC held interests in private equity and hedge funds that are covered funds subject to the final Volcker Rule totaling approximately $446 million, including $128 million of sponsored funds. Certain of PNC's REIT preferred securities also were issued by statutory trusts that, as... -

Page 39

... depend on how the markets and market participants (including PNC) adjust to the new rules. PNC also originates loans of a variety of types, including residential and commercial mortgages, credit card, auto, and student, that historically have commonly been securitized, and PNC is also a significant... -

Page 40

...on PNC. As our customers regularly use PNC-issued credit and debit cards to pay for transactions with retailers and other businesses, there is the risk of data security breaches at those other businesses covering PNC account information. When our customers use PNC-issued cards to make purchases from -

Page 41

...customers' card accounts, as well as for other costs related to data security compromise events, such as replacing cards associated with compromised card accounts. In addition, PNC provides card transaction processing services to some merchant customers under agreements we have with payment networks... -

Page 42

... credit, measuring interest rate and other market risks, predicting or estimating losses, assessing capital adequacy, and calculating economic and regulatory capital levels, as well as to estimate the value of financial instruments and balance sheet items. Poorly designed or implemented models... -

Page 43

... to the purchasers in the purchase and sale agreements. At this time PNC cannot predict the ultimate overall cost to or effect upon PNC from governmental, legislative or regulatory actions and private litigation or claims arising out of residential mortgage and home equity loan lending, servicing or... -

Page 44

... to customer satisfaction as it affects our ability to deliver the right products and services. Banks generally are facing the risk of increased competition from products and services offered by non-bank financial technology companies, particularly related to payment services. Another increasingly... -

Page 45

... executive and primary administrative offices are currently located at The Tower at PNC Plaza, Pittsburgh, Pennsylvania. The 33-story structure is owned by PNC Bank, National Association. We own or lease numerous other premises for use in conducting business activities, including operations centers... -

Page 46

... to being named to his current position, Mr. Hall led the delivery of sales and service to PNC's retail and small business customers, directed branch banking, business banking, community development and PNC Investments. Mr. Hall has announced that he will retire on July 1, 2016. Michael J. Hannon... -

Page 47

... the New York Stock Exchange and is traded under the symbol "PNC." At the close of business on February 17, 2016, there were 64,309 common shareholders of record. Holders of PNC common stock are entitled to receive dividends when declared by the Board of Directors out of funds legally available for... -

Page 48

... various employee benefit plans referenced in note (a). In the fourth quarter of 2015, in accordance with PNC's 2015 capital plan and under the share repurchase authorization in effect during that period, we repurchased 5.8 million shares of common stock on the open market, with an average price of... -

Page 49

... to be filed under the Exchange Act or the Securities Act. Dec11 Dec12 S&P 500 Index Dec13 S&P 500 Banks Dec14 Dec15 Peer Group Assumes $100 investment at Close of Market on December 31, 2010 5-Year Total Return = Price change plus Compound Base reinvestment Growth Period of dividends Rate Dec... -

Page 50

ITEM 6 - SELECTED FINANCIAL DATA Dollars in millions, except per share data 2015 (a) Year ended December 31 2014 (a) 2013 (a) 2012 (a) 2011 SUMMARY OF OPERATIONS Interest income Interest expense Net interest income Noninterest income Total revenue Provision for credit losses Noninterest expense ... -

Page 51

... RATIOS Net interest margin (g) Noninterest income to total revenue Efficiency Return on Average common shareholders' equity Average assets Loans to deposits Dividend payout Transitional Basel III common equity Tier 1 capital ratio (h) (i) (j) Transitional Basel III Tier 1 risk-based capital ratio... -

Page 52

... OF OPERATIONS (MD&A) EXECUTIVE SUMMARY Key Strategic Goals At PNC we manage our company for the long term. We are focused on the fundamentals of growing customers, loans, deposits and fee revenue and improving profitability, while investing for the future and managing risk, expenses and capital. We... -

Page 53

... Net interest income of $8.3 billion for 2015 decreased 3% compared to 2014 due to lower purchase accounting accretion and lower interestearning asset yields, partially offset by commercial and commercial real estate loan growth and higher securities balances. • The PNC Financial Services Group... -

Page 54

... 31, 2014. • PNC's balance sheet remained core funded with a loans to deposits ratio of 83% at December 31, 2015. • PNC maintained a strong liquidity position. • New regulatory short-term liquidity standards became effective for PNC and PNC Bank as advanced approaches banking organizations... -

Page 55

... offset by a decrease in average non-agency residential mortgage-backed securities. Total investment securities comprised 20% of average interest-earning assets in 2015 and 2014. Average loans grew in 2015, driven by increases in average commercial loans of $5.7 billion and average commercial real... -

Page 56

... change for prior periods. (b) Period-end balances for BlackRock. (c) "Other" average assets include investment securities associated with asset and liability management activities. (d) "Other" includes differences between the total business segment financial results and our total consolidated net... -

Page 57

... million compared to 2015. Corporate service fees increased in 2015 compared to 2014, driven by higher treasury management, commercial mortgage servicing and equity capital markets advisory fees, partially offset by lower mergers and acquisition advisory fees. The increase also reflected the impact... -

Page 58

... banks Loans held for sale Investment securities Loans Allowance for loan and lease losses Goodwill Mortgage servicing rights Other intangible assets Other, net Total assets Liabilities Deposits Borrowed funds Other Total liabilities Equity Total shareholders' equity Noncontrolling interests Total... -

Page 59

...31 2015 December 31 2014 Change $ % Commercial lending Commercial Manufacturing Retail/wholesale trade Service providers Real estate related (a) Health care Financial services Other industries Total commercial Commercial real estate Real estate projects (b) Commercial mortgage Total commercial real... -

Page 60

... of an increase in total commercial lending driven by commercial real estate loans, partially offset by a decline in consumer lending due to lower home equity, education, and automobile loans. Loans represented 58% of total assets at December 31, 2015 and 59% at December 31, 2014. Commercial lending... -

Page 61

... primarily consists of nonrevolving home equity products. Through the National City Corporation (National City) and RBC Bank (USA) acquisitions, we acquired purchased impaired loans with a recorded investment of $14.7 billion. As noted in Table 11 above, at December 31, 2015, those balances are now... -

Page 62

... 1 Accounting Policies, Note 5 Allowances for Loan and Lease Losses and Unfunded Loan Commitments and Letters of Credit and Note 21 Commitments and Guarantees in the Notes To Consolidated Financial Statements in Item 8 of this Report. Total commercial lending Home equity lines of credit Credit card... -

Page 63

... Investment Securities and Note 7 Fair Value in the Notes To Consolidated Financial Statements included in Item 8 of this Report. Loans Held for Sale Table 16: Loans Held For Sale In millions December 31 2015 December 31 2014 Commercial mortgages at fair value Commercial mortgages at lower of cost... -

Page 64

... December 31 2015 December 31 2014 Change $ % Dollars in millions Deposits Money market Demand Savings Retail certificates of deposit Time deposits in foreign offices and other time deposits Total deposits Borrowed funds Federal funds purchased and repurchase agreements FHLB borrowings Bank notes... -

Page 65

... 18: Shareholders' Equity up to $2.875 billion for the five quarter period beginning in the second quarter of 2015. These programs include repurchases of up to $375 million over the five quarter period related to stock issuances under employee benefit-related programs. PNC repurchased 17.9 million... -

Page 66

... debt Trust preferred capital securities Allowance for loan and lease losses included in Tier 2 capital Other Total Basel III capital Risk-weighted assets Basel III standardized approach risk-weighted assets (e) Estimated Basel III advanced approaches risk-weighted assets (f) Average quarterly... -

Page 67

... bank holding companies, such as PNC, to maintain Transitional Basel III regulatory capital ratios of at least 6% Tier 1 risk-based and 10% for Total risk-based. The access to and cost of funding for new business initiatives, the ability to undertake new business initiatives including acquisitions... -

Page 68

... issued by PNC Preferred Funding Trust I and PNC Preferred Funding Trust II including information on contractual limitations potentially imposed on payments (including dividends) with respect to PNC and PNC Bank's equity capital securities. 50 The PNC Financial Services Group, Inc. - Form 10-K -

Page 69

... of assets recorded at fair value are included in the securities available for sale portfolio. The majority of Level 3 assets represent non-agency residential mortgage-backed securities in the securities available for sale portfolio, equity investments and mortgage servicing rights. An instrument... -

Page 70

... life of the loans. (i) Excludes satellite offices (e.g., drive-ups, electronic branches and retirement centers) that provide limited products and/or services. (j) Amounts include cash and money market balances. (k) Percentage of total consumer and business banking deposit transactions processed... -

Page 71

... on pricing, focused on growing and retaining relationshipbased balances, executing on market specific deposit growth strategies, and providing a source of low-cost funding and liquidity to PNC. In 2015, average total deposits of $145.8 billion increased $8.6 billion, or 6%, compared to 2014, driven... -

Page 72

... pay-downs and payoffs on loans exceeded new booked volume, consistent with lower mortgage demand. Retail Banking's home equity loan portfolio is relationship based, with over 97% of the portfolio attributable to borrowers in our primary geographic footprint. • Average commercial & commercial real... -

Page 73

... as noted 2015 2014 INCOME STATEMENT Net interest income Noninterest income Corporate service fees Other Noninterest income Total revenue Provision for credit losses Noninterest expense Pretax earnings Income taxes Earnings AVERAGE BALANCE SHEET Loans Commercial Commercial real estate Equipment... -

Page 74

...deposit balances, increased $100 million, or 8%, in 2015 compared with 2014, driven by growth in our commercial card, wholesale lockbox, PINACLE®, funds transfer fees and liquidity-related revenue. Capital markets-related products and services include foreign exchange, derivatives, securities, loan... -

Page 75

... $ 263 INCOME STATEMENT Net interest income Noninterest income Total revenue Provision for credit losses (benefit) Noninterest expense Pretax earnings Income taxes Earnings AVERAGE BALANCE SHEET Loans Consumer Commercial and commercial real estate Residential mortgage Total loans Goodwill and other... -

Page 76

.... The line of credit product is primarily secured by the market value of the client's underlying investment management account assets. Average deposits for 2015 increased $1.5 billion, or 15%, compared to the prior year, driven by an increase in money market products. 58 The PNC Financial Services... -

Page 77

... STATEMENT Net interest income Noninterest income Loan servicing revenue Servicing fees Mortgage servicing rights valuation, net of economic hedge Loan sales revenue Other Total noninterest income Total revenue Provision for credit losses (benefit) Noninterest expense Pretax earnings Income taxes... -

Page 78

... rights and lower noninterest expense were more than offset by lower loan sales and servicing revenue and decreased net interest income. The strategic focus of the business is the acquisition of new customers through a retail loan officer sales force with an emphasis on home purchase transactions... -

Page 79

...PNC's purchased impaired loans at December 31, 2015 and 80% at December 31, 2014. INCOME STATEMENT Net interest income Noninterest income Total revenue Provision for credit losses (benefit) Noninterest expense Pretax earnings Income taxes Earnings AVERAGE BALANCE SHEET Commercial Lending Commercial... -

Page 80

... Losses And Unfunded Loan Commitments And Letters Of Credit in the Credit Risk Management section of this Item 7, and • Note 1 Accounting Policies and Note 5 Allowances for Loan and Lease Losses and Unfunded Loan Commitments and Letters of Credit in the Notes To Consolidated Financial Statements... -

Page 81

... (as reported in comparable company public financial statements), adjusted for differences in risk characteristics between the comparable companies and the reporting unit. The PNC Financial Services Group, Inc. - Form 10-K 63 Goodwill Goodwill arising from business acquisitions represents the value... -

Page 82

... and related services, and participating in certain capital markets transactions. Revenue earned on interest-earning assets, including the accretion of discounts recognized on acquired or purchased loans recorded at fair value, is recognized based on the constant effective yield of the financial... -

Page 83

... for certain equity investments, the ASU also 1) requires that instrument-specific credit risk changes in the fair value of a financial liability accounted for under the fair value option be Income Taxes In the normal course of business, we and our subsidiaries enter into transactions for which... -

Page 84

... assets at their fair market value. On an annual basis, we review the actuarial assumptions related to the pension plan. The primary assumptions used to measure pension obligations and costs are the discount rate, mortality, compensation increase and expected long-term return on plan assets. Among... -

Page 85

...and Servicing Activities and Variable Interest Entities in the Notes To Consolidated Financial Statements in Item 8 of this Report, PNC has sold commercial mortgage, residential mortgage and home equity loans/lines of credit directly or indirectly through securitization and loan sale transactions in... -

Page 86

...home equity loans/lines of credit that were sold to a limited number of private investors in the financial services industry by National City prior to our acquisition of National City. PNC is no longer engaged in the brokered home equity lending business, and our exposure under these loan repurchase... -

Page 87

... course of operating our business. Accordingly, we design risk management processes to help manage this risk. PNC manages risk in light of our risk appetite to optimize long term shareholder value while supporting our employees, customers, and communities. This Risk Management section describes... -

Page 88

... we manage our day-to-day business activities and on our development and execution of more specific strategies to mitigate risks. Specific responsibilities include: Board of Directors - The Board oversees enterprise risk management. The Risk Committee of the Board of Directors evaluates PNC's risk... -

Page 89

... strategies where appropriate, to the Risk Committee of the Board of Directors, Corporate Committees, Working Committees and other designated parties for effective decision making. Risk reports are produced at the line of business, functional risk and the enterprise levels. The enterprise level risk... -

Page 90

... government insured or guaranteed loans, loans held for sale, loans accounted for under the fair value option and purchased impaired loans. (d) The December 31, 2015 ratio was impacted by the change in derecognition policy for purchased impaired pooled consumer and residential real estate loans... -

Page 91

... Financial Statements in Item 8 of this Report for additional information on these loans. Within consumer nonperforming loans, residential real estate TDRs comprise 68% of total residential real estate nonperforming loans at December 31, 2015, up from 60% at December 31, 2014. Home equity... -

Page 92

... 31, 2015, or 16% of the total loan portfolio. Of that total, $18.8 billion, or 59%, was outstanding under primarily variable-rate home equity lines of credit and $13.3 billion, or 41%, consisted of closed-end home equity installment loans. Approximately 4% of the home equity portfolio was purchased... -

Page 93

... Report. A temporary modification, with a term between 3 and 24 months, involves a change in original loan terms for a period 2016 2017 2018 2019 2020 and thereafter Total (a) (b) $1,121 2,107 927 648 3,321 $8,124 $ 369 538 734 576 5,758 $7,975 (a) Includes all home equity lines of credit that... -

Page 94

... programs to assess their effectiveness in serving our borrowers' and servicing customers' needs while mitigating credit losses. Table 33 provides the number of bank-owned accounts and unpaid principal balance of modified consumer real estate related loans at the end of each year presented... -

Page 95

... Year ended December 31 Dollars in millions Net Gross Charge-offs / Percent of Charge-offs Recoveries (Recoveries) Average Loans 2015 Commercial Commercial real estate Equipment lease financing Home equity Residential real estate Credit card Other consumer Total 2014 Commercial Commercial real... -

Page 96

... loans discounted at their effective interest rate, observable market price or the fair value of the underlying collateral. Reserves allocated to non-impaired commercial loan classes are based on PD and LGD credit risk ratings. Our commercial pool reserve methodology is sensitive to changes in key... -

Page 97

... 1 Accounting Policies and Note 4 Purchased Loans in the Notes To Consolidated Financial Statements in Item 8 of this Report regarding changes in the ALLL and in the allowance for unfunded loan commitments and letters of credit. January 1 Total net charge-offs Provision for credit losses Net change... -

Page 98

... responsible for developing and maintaining the policies, methodologies, tools, and technology utilized across the enterprise to identify, assess, monitor, and report operational risks. ORM monitors enterprise-wide adherence with related policies and procedures and regularly assesses overall program... -

Page 99

..., Corporate Insurance management and the Insurance Risk Committee have primary oversight of reporting insurance related activities through the governance structure that allows management to fully vet risk information. Quarterly, an enterprise operational risk report is developed to report key... -

Page 100

..., to estimate certain financial values, and to support or inform certain business decisions. Models may be used in processes such as determining the pricing of various products, grading and granting loans, measuring interest rate risks and other market risks, predicting losses, and assessing capital... -

Page 101

... including market conditions, loan and deposit growth and balance sheet management activities. Of our total liquid assets of $89.4 billion, we had $3.2 billion of securities available for sale and trading securities pledged as collateral to secure public and trust deposits, repurchase agreements and... -

Page 102

... 2004 bank note program and those notes PNC Bank has assumed through the acquisition of other banks, in each case for so long as such notes remain outstanding. The terms of the 2014 bank note program do not affect any of the bank notes issued prior to January 16, 2014. At December 31, 2015, PNC Bank... -

Page 103

... adequate liquidity to fund discretionary activities such as paying dividends to PNC shareholders, share repurchases, and acquisitions. See Balance Sheet, Liquidity and Capital Highlights in the Executive Summary section of this Item 7 for information on our 2015 capital plan that was accepted... -

Page 104

...a global basis and includes assessment of expected loss ratings on instruments ranging from bank deposits to preferred stock. In the second quarter of 2015, Moody's concluded its review for PNC and PNC Bank under this new methodology. As a result, Moody's upgraded PNC Bank's long-term deposit rating... -

Page 105

... letters of credit that support remarketing programs for customers' variable rate demand notes. (d) Reinsurance agreements are with third-party insurers related to insurance sold to or placed on behalf of our customers. Balances represent estimates based on availability of financial information... -

Page 106

..., and reporting significant risks in the business to the Risk Committee of the Board. Market Risk Management - Interest Rate Risk Interest rate risk results primarily from our traditional banking activities of gathering deposits and extending loans. Many factors, including economic and financial... -

Page 107

... as loan servicing rights are directly affected by changes in market factors. The primary risk measurement for equity and other investments is economic capital. Economic capital is a common measure of risk for credit, market and operational risk. It is an estimate of the potential value depreciation... -

Page 108

... Liabilities on our Consolidated Balance Sheet. Note 2 Loan Sale and Servicing Activities and Variable Interest Entities in the Notes To Consolidated Financial Statements in Item 8 of this Report has further information on Tax Credit Investments. Private Equity The private equity portfolio is an... -

Page 109

... activities Total derivatives used for commercial mortgage banking activities Total derivatives used for customer-related activities Total derivatives used for other risk management activities Total derivatives not designated as hedging instruments Total Derivatives (a) Represents the net fair value... -

Page 110

... in investment securities balances and a reduction in purchase accounting accretion were partially offset by commercial and commercial real estate loan growth. Lower net interest income also included the impact from the second quarter 2014 correction to reclassify certain commercial facility fees... -

Page 111

... expected maturity of the investment securities portfolio (excluding corporate stocks and other) was 4.3 years at December 31, 2014 and 4.9 years at December 31, 2013. The PNC Financial Services Group, Inc. - Form 10-K 93 Consolidated Balance Sheet Review Loans Loans increased $9.2 billion to $204... -

Page 112

... for loans and lines of credit related to consumer lending. In the first quarter 2013, this alignment had the overall effect of (i) accelerating charge-offs, (ii) increasing nonperforming loans and (iii) in the case of loans accounted for under the fair value option, increasing nonaccrual loans. The... -

Page 113

... for total risk-based capital. We provide additional information on our 2014 risk-based capital ratios in the Capital portion of the Balance Sheet Review section in Item 7 of our 2014 Form 10-K. For additional information on our 2014 Transitional Basel III ratios and 2013 Basel I Tier 1 ratio, see... -

Page 114

...postretirement benefit plans, less goodwill, net of associated deferred tax liabilities, less other disallowed intangibles, net of deferred tax liabilities and plus/less other adjustments. Basel III common equity Tier 1 capital ratio - Common equity Tier 1 capital divided by period-end risk-weighted... -

Page 115

... include: federal funds sold; resale agreements; trading securities; interest-earning deposits with banks; loans held for sale; loans; investment securities; and certain other assets. Effective duration - A measurement, expressed in years, that, when multiplied by a change in interest rates, would... -

Page 116

...Loans accounted for at amortized cost for which we do not accrue interest income. Nonperforming loans include loans to commercial, commercial real estate, equipment lease financing, home equity, residential real estate, credit card and other consumer customers as well as TDRs which have not returned... -

Page 117

... loans to commercial customers for the construction or development of residential real estate including land, single family homes, condominiums and other residential properties. Return on average assets - Annualized net income divided by average assets. Return on average capital - Annualized net... -

Page 118

... and balance sheet values are affected by business and economic conditions, including the following: - Changes in interest rates and valuations in debt, equity and other financial markets. - Disruptions in the U.S. and global financial markets. 100 The PNC Financial Services Group, Inc. - Form 10... -

Page 119

... ABOUT MARKET RISK This information is set forth in the Risk Management section of Item 7 and in Note 1 Accounting Policies, Note 7 Fair Value, and Note 14 Financial Derivatives in the Notes To Consolidated Financial Statements in Item 8 of this Report. The PNC Financial Services Group, Inc. - Form... -

Page 120

... PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of The PNC Financial Services Group, Inc. In our opinion, the accompanying consolidated balance sheets and the related consolidated statements of income, of comprehensive income, of changes in equity, and of cash flows present fairly... -

Page 121

CONSOLIDATED INCOME STATEMENT THE PNC FINANCIAL SERVICES GROUP, INC. In millions, except per share data Year ended December 31 2015 2014 2013 Interest Income Loans Investment securities Other Total interest income Interest Expense Deposits Borrowed funds Total interest expense Net interest income ... -

Page 122

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME THE PNC FINANCIAL SERVICES GROUP, INC. In millions Year ended December 31 2015 2014 2013 Net income Other comprehensive income (loss), before tax and net of reclassifications into Net income: Net unrealized gains (losses) on non-OTTI securities Net ... -

Page 123

... BALANCE SHEET THE PNC FINANCIAL SERVICES GROUP, INC. In millions, except par value December 31 2015 December 31 2014 Assets Cash and due from banks (a) Federal funds sold and resale agreements (b) Trading securities Interest-earning deposits with banks (a) Loans held for sale (b) Investment... -

Page 124

... interests related to tax credit investments in the amount of $675 million during the second quarter of 2013. (f) Amount represents the cumulative impact of our January 1, 2014 irrevocable election to prospectively measure all classes of commercial MSRs at fair value. See Note 1 Accounting Policies... -

Page 125

... 2015 2014 2013 Operating Activities Net income Adjustments to reconcile net income to net cash provided (used) by operating activities Provision for credit losses Depreciation and amortization Deferred income taxes Net gains on sales of securities Changes in fair value of mortgage servicing rights... -

Page 126

... STATEMENT OF CASH FLOWS THE PNC FINANCIAL SERVICES GROUP, INC. (continued from previous page) Year ended December 31 2015 2014 2013 In millions Financing Activities Net change in Noninterest-bearing deposits Interest-bearing deposits Federal funds purchased and repurchase agreements Commercial... -

Page 127

...mortgage banking, providing many of our products and services nationally, as well as other products and services in our primary geographic markets located in Pennsylvania, Ohio, New Jersey, Michigan, Illinois, Maryland, Indiana, Florida, North Carolina, Kentucky, Washington, D.C., Delaware, Virginia... -

Page 128

... terms. These revenues are reported on the Consolidated Income Statement in the line items Residential mortgage, Corporate services and Consumer services. We recognize revenue from securities, derivatives and foreign exchange customer-related trading, as well as securities underwriting activities... -

Page 129

... investments in private equity funds, at estimated fair value. These estimates are based on available information and may not necessarily represent amounts that we will ultimately realize through distribution, sale or liquidation of the investments. Fair values of publicly traded direct investments... -

Page 130

... when available recent portfolio company information or market information indicates significant changes in value from that provided by the manager of the fund. We include all private equity investments on the Consolidated Balance Sheet in the caption Equity investments. Changes in the fair value of... -

Page 131

... for investment based on a change in strategy. We transfer these loans at the lower of cost or estimated fair value; however, any loans originated or purchased for held for sale and designated at fair value remain at fair value for the life of the loan. The PNC Financial Services Group, Inc. - Form... -

Page 132

... all principal and interest is insured. Residential real estate loans that are well secured and in the process of collection. Consumer loans and lines of credit, not secured by residential real estate, as permitted by regulatory guidance. 114 The PNC Financial Services Group, Inc. - Form 10-K -

Page 133

... Certain small business credit card balances that are placed on nonaccrual status when they become 90 days or more past due are charged-off at 180 days past due. Consumer Loans Home equity installment loans, home equity lines of credit, and residential real estate loans that are not well-secured and... -

Page 134

...lower of the amount recorded at acquisition date or estimated fair value less cost to sell. Valuation adjustments on these assets and gains or losses realized from disposition of such property are reflected in Other noninterest expense. For certain mortgage loans that have a government guarantee, we... -

Page 135

... and other consumer loans. These contracts are either purchased in the open market or retained as part of a loan securitization or loan sale. All newly acquired or originated servicing rights are initially measured at fair value. Fair value is based on the present value of the expected future... -

Page 136

... carrying value, an impairment loss was recognized and a valuation reserve was established. For servicing rights related to residential real estate loans, we apply the fair value method. This election was made to be consistent with our risk management strategy to hedge changes in the fair value of... -

Page 137

... derivatives. We enter into commitments to originate residential and commercial mortgage loans for sale. We also enter into commitments to purchase or sell commercial and residential real estate loans. These commitments are accounted for as The PNC Financial Services Group, Inc. - Form 10-K 119 -

Page 138

... in Noninterest income. Recently Adopted Accounting Standards In May 2015, the Financial Accounting Standards Board (FASB) issued ASU 2015-07, Fair Value Measurements (Topic 820): Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or its Equivalent). The ASU... -

Page 139

... have a material effect on our results of operations or financial position. NOTE 2 LOAN SALE AND SERVICING ACTIVITIES AND VARIABLE INTEREST ENTITIES Loan Sale and Servicing Activities We have transferred residential and commercial mortgage loans in securitization or sales transactions in which we... -

Page 140

... with Loan Sale and Servicing Activities In millions Residential Mortgages Commercial Mortgages (a) Home Equity Loans/Lines (b) CASH FLOWS - Year ended December 31, 2015 Sales of loans (c) Repurchases of previously transferred loans (d) Servicing fees (e) Servicing advances recovered/(funded), net... -

Page 141

... Mortgages Commercial Mortgages (a) Home Equity Loans/Lines (b) Table 52: Consolidated VIEs - Carrying Value (a) (b) In millions Credit Card and Other Securitization Trusts Tax Credit Investments Total December 31, 2015 Assets Cash and due from banks Interest-earning deposits with banks Loans... -

Page 142

... syndication of these funds, generate servicing fees by managing the funds, and earn tax credits to reduce our tax liability. General partner or managing member activities include identifying, evaluating, structuring, negotiating, and closing the fund investments in operating limited partnerships or... -

Page 143

... provided returns in the form of tax credits. The outstanding financings and operating lease assets are reflected as Loans and Other assets, respectively, on our Consolidated Balance Sheet, whereas related liabilities are reported in Deposits and Other liabilities. The PNC Financial Services Group... -

Page 144

... each loan. Loans that are 30 days or more past due in terms of payment are considered delinquent. Loan delinquencies exclude loans held for sale, purchased impaired loans, nonperforming loans and loans accounted for under the fair value option which are on nonaccrual status, but include government... -

Page 145

... 31, 2014, respectively. (e) Future accretable yield related to purchased impaired loans is not included in the analysis of loan portfolio. (f) Past due loan amounts at December 31, 2015 include government insured or guaranteed Residential real estate mortgages totaling $56 million for 30 to 59 days... -

Page 146

... on nonperforming status. (b) Nonperforming loans exclude certain government insured or guaranteed loans, loans held for sale, loans accounted for under the fair value option and purchased impaired loans. (c) The recorded investment of loans collateralized by residential real estate property that... -

Page 147

... loan, including ongoing outreach, contact, and assessment of obligor financial conditions, collateral inspection and appraisal. Commercial Real Estate Loan Class We manage credit risk associated with our commercial real estate projects and commercial mortgage activities similar to commercial loans... -

Page 148

... of combined loan-to-value (CLTV) for first and subordinate lien positions): At least annually, we update the property values of real estate collateral and calculate an 130 The PNC Financial Services Group, Inc. - Form 10-K updated LTV ratio. For open-end credit lines secured by real estate in... -

Page 149

... of origination. These key factors are monitored to help ensure that concentrations of risk are managed and cash flows are maximized. See Note 4 Purchased Loans for additional information. Table 57: Home Equity and Residential Real Estate Balances In millions December 31 2015 December 31 2014 Home... -

Page 150

... purchased impaired loans of approximately $3.4 billion and $4.5 billion in recorded investment, certain government insured or guaranteed residential real estate mortgages of approximately $0.9 billion and $1.2 billion, and loans held for sale at December 31, 2015 and December 31, 2014, respectively... -

Page 151

Table 59: Home Equity and Residential Real Estate Asset Quality Indicators - Purchased Impaired Loans (a) December 31, 2015 - in millions Home Equity (b) (c) 1st Liens 2nd Liens Residential Real Estate (b) (c) Total Current estimated LTV ratios (d) Greater than or equal to 125% and updated FICO ... -

Page 152

... modeled property values. These ratios are updated at least semi-annually. The related estimates and inputs are based upon an approach that uses a combination of third-party automated valuation models (AVMs), broker price opinions (BPOs), HPI indices, property location, internal and external balance... -

Page 153

...days) delinquency status). The majority of the December 31, 2015 balance related to higher risk credit card loans was geographically distributed throughout the following areas: Ohio 17%, Pennsylvania 15%, Michigan 8%, New Jersey 8%, Florida 7%, Illinois 6%, Indiana 6%, Maryland 4% and North Carolina... -

Page 154

... Debt Restructurings In millions December 31 2015 December 31 2014 Table 62 quantifies the number of loans that were classified as TDRs as well as the change in the recorded investments as a result of the TDR classification during the years 2015, 2014 and 2013 respectively. Additionally, the table... -

Page 155

... 62: Financial Impact and TDRs by Concession Type (a) During the year ended December 31, 2015 Dollars in millions Number of Loans Pre-TDR Recorded Investment (b) Post-TDR Recorded Investment (c) Principal Rate Forgiveness Reduction Other Total Commercial lending Commercial Commercial real estate... -

Page 156

... year ended December 31, 2015 Dollars in millions During the year ended December 31, 2013 Dollars in millions Number of Contracts Recorded Investment Commercial lending Commercial Commercial real estate Total commercial lending (a) Consumer lending Home equity Residential real estate Credit card... -

Page 157

... Balance Recorded Investment Associated Allowance (a) Average Recorded Investment (b) In millions December 31, 2015 Impaired loans with an associated allowance Commercial Commercial real estate Home equity Residential real estate Credit card Other consumer Total impaired loans with an associated... -

Page 158

...: Purchased Impaired Loans - Balances December 31, 2015 Outstanding Recorded Carrying Balance (a) Investment Value December 31, 2014 Outstanding Recorded Carrying Balance (a) Investment Value In millions Commercial lending Commercial Commercial real estate Total commercial lending Consumer lending... -

Page 159

...31, 2014, the ALLL on total purchased impaired loans was $.3 billion and $.9 billion, respectively. The decline in ALLL was primarily due to the change in our derecognition policy. For purchased impaired loan pools where an allowance has been recognized, subsequent increases in the net present value... -

Page 160

... Commercial Lending Consumer Lending Total December 31, 2015 Allowance for Loan and Lease Losses January 1 Charge-offs Recoveries Net (charge-offs) / recoveries Provision for credit losses Net change in allowance for unfunded loan commitments and letters of credit Write-offs of purchased impaired... -

Page 161

... facilities as of the balance sheet date as discussed in Note 1 Accounting Policies. A rollforward of the allowance is presented below. Table 68: Rollforward of Allowance for Unfunded Loan Commitments and Letters of Credit In millions 2015 2014 2013 January 1 Net change in allowance for unfunded... -

Page 162

... Other debt Total debt securities Corporate stocks and other Total securities available for sale SECURITIES HELD TO MATURITY (a) Debt securities U.S. Treasury and government agencies Residential mortgage-backed Agency Non-agency 144 The PNC Financial Services Group, Inc. - Form 10-K $ 9,764... -

Page 163

... Comprehensive Income, net of tax. The fair value of investment securities is impacted by interest rates, credit spreads, market volatility and liquidity conditions. Net unrealized gains and losses in the securities available for sale portfolio are included in Shareholders' equity as Accumulated... -

Page 164

... Loss Fair Value December 31, 2015 Debt securities U.S. Treasury and government agencies Residential mortgage-backed Agency Non-agency Commercial mortgage-backed Agency Non-agency Asset-backed State and municipal Other debt Total debt securities Corporate stocks and other Total December 31, 2014... -

Page 165

... 71: Gains (Losses) on Sales of Securities Available for Sale In millions Proceeds Gross Gains Gross Losses Net Gains Tax Expense For the year ended December 31 2015 2014 2013 $6,829 4,480 8,178 $ 56 33 146 $(13) (29) (47) $43 4 99 $15 1 35 The PNC Financial Services Group, Inc. - Form 10-K 147 -

Page 166

... securities, trading securities, and securities accepted as collateral from others that we are permitted by contract or custom to sell or repledge, and were used to secure public and trust deposits, repurchase agreements, and for other purposes. 148 The PNC Financial Services Group, Inc. - Form... -

Page 167

...assets and liabilities may include debt securities, equity securities and listed derivative contracts that are traded in an active exchange market and certain U.S. Treasury securities that are actively traded in over-the-counter markets. Level 2 Fair value is estimated using inputs other than quoted... -

Page 168

... Level 1 150 The PNC Financial Services Group, Inc. - Form 10-K of the hierarchy. Level 1 securities include certain U.S. Treasury securities and exchange-traded equities. When a quoted price in an active market for the identical security is not available, fair value is estimated using either an... -

Page 169

... risk participation agreements, swaps related to the sale of certain Visa Class B common shares and other types of contracts. The fair values of residential mortgage loan commitment assets as of December 31, 2015 and 2014 are included in the Insignificant Level 3 assets, net of liabilities line item... -

Page 170

...nonperformance risk. Our CVA is computed using new loan pricing and considers externally available bond spreads, in conjunction with internal historical recovery observations. Residential Mortgage Loans Held for Sale We account for certain residential mortgage loans originated for sale at fair value... -

Page 171

.... During 2015, $5 million of financial support was provided to existing direct investments compared to $39 million during 2014. Equity Investments - Indirect Investments We value indirect investments in private equity funds based on net asset value (NAV) as provided in the financial statements that... -

Page 172

... plan participants may also invest based on fixed income and equity-based funds. PNC utilizes a Rabbi Trust to hedge the returns by purchasing similar funds on which the participant returns are based. The Rabbi Trust balances are recorded in Other Assets at fair value using the quoted market price... -

Page 173

... Other contracts Total financial derivatives Residential mortgage loans held for sale (c) Trading securities (d) Debt (e) Equity Total trading securities Residential mortgage servicing rights Commercial mortgage servicing rights Commercial mortgage loans held for sale (c) Equity investments - direct... -

Page 174

... debt Total securities available for sale Financial derivatives Residential mortgage loans held for sale Trading securities - Debt Residential mortgage servicing rights Commercial mortgage servicing rights Commercial mortgage loans held for sale Equity investments - direct investments Loans Other... -

Page 175

... debt Total securities available for sale Financial derivatives Residential mortgage loans held for sale Trading securities - Debt Residential mortgage servicing rights Commercial mortgage servicing rights Commercial mortgage loans held for sale Equity investments -direct investments Loans Other... -

Page 176

... servicing rights Commercial mortgage loans held for sale Equity investments - Direct investments Loans - Residential real estate 1,063 526 641 1,098 123 Multiple of adjusted earnings Consensus pricing (c) 116 Loans - Home equity BlackRock Series C Preferred Stock BlackRock LTIP Swaps related... -

Page 177

... State and municipal securities Other debt securities Trading securities - Debt Residential mortgage servicing rights Commercial mortgage servicing rights Commercial mortgage loans held for sale Equity investments -Direct investments Loans - Residential real estate 506 Discounted cash flow 893... -

Page 178

... on commercial mortgages held for sale to agencies subsequent to our September 1, 2014 election of fair value option. Equity Investments Equity investments represent the carrying value of Low Income Housing Tax Credit (LIHTC) investments held for sale calculated using a discounted cash flow model... -

Page 179

... ATM locations and smaller rural branches up to large commercial buildings, operation centers or urban branches. Table 77: Fair Value Measurements - Nonrecurring Fair Value December 31 December 31 2015 2014 In millions Assets (a) Nonaccrual loans Loans held for sale (b) Equity investments OREO... -

Page 180

...credit risk for 2015 and 2014 were not material. Commercial Mortgage Loans Held for Sale Interest income on these loans is recorded as earned and reported on the Consolidated Income Statement in Other interest income. Changes in fair value due to instrumentspecific credit risk for both 2015 and 2014... -

Page 181

... borrowed funds December 31, 2014 Assets Customer resale agreements Residential mortgage loans held for sale Performing loans Accruing loans 90 days or more past due Nonaccrual loans Total Commercial mortgage loans held for sale (a) Performing loans Nonaccrual loans Total Residential mortgage loans... -

Page 182

...Amount Total Fair Value Level 1 Level 2 Level 3 December 31, 2015 Assets Cash and due from banks Short-term assets Securities held to maturity Loans held for sale Net loans (excludes leases) Other assets Total assets Liabilities Demand, savings and money market deposits Time deposits Borrowed funds... -

Page 183

... rates, net credit losses and servicing fees. For revolving home equity loans and commercial credit lines, this fair value does not include any amount for new loans or the related fees that will be generated from the existing customer relationships. Nonaccrual loans are valued at their estimated... -

Page 184

...: Commercial Mortgage Servicing Rights Accounted for at Fair Value Total In millions 2015 2014 Goodwill Changes in goodwill by business segment during 2015 and 2014 follow: Table 82: Goodwill by Business Segment (a) In millions Retail Banking Corporate & Institutional Banking Asset Management Group... -

Page 185

... increases). The fair value of residential MSRs is estimated by using a discounted cash flow valuation model which calculates the present value of estimated future net servicing cash flows, taking into consideration actual and expected mortgage loan prepayment rates, discount rates, servicing costs... -

Page 186

... Mortgage Loan Servicing In millions 2015 2014 2013 Fees from mortgage loan servicing $510 $503 $544 Fair value Weighted-average life (years) Weighted-average constant prepayment rate Decline in fair value from 10% adverse change Decline in fair value from 20% adverse change Effective discount... -

Page 187

... for capitalized internally developed software was as follows: Table 93: Depreciation and Amortization Expense Year ended December 31 In millions 2015 2014 2013 Depreciation Amortization Total depreciation and amortization $643 40 683 $618 30 648 $546 23 569 The PNC Financial Services Group... -

Page 188

.... PNC reserves the right to terminate or make changes to these plans at any time. The nonqualified pension plan is unfunded. In November of 2015, PNC established a voluntary employee beneficiary association (VEBA) to partially fund postretirement medical and life insurance benefit obligations. PNC... -

Page 189

...at beginning of year Service cost Interest cost Plan amendments Actuarial (gains)/losses and changes in assumptions Participant contributions Federal Medicare subsidy on benefits paid Benefits paid Settlement payments Projected benefit obligation at end of year Fair value of plan assets at beginning... -

Page 190

... the Code. Plan assets consist primarily of listed domestic and international equity securities, U.S. government and agency securities, corporate debt securities, and real estate investments. The Plan held no PNC common stock as of December 31, 2015 and December 31, 2014. The PNC Financial Services... -

Page 191

... 31, 2015 and December 31, 2014 follows: • Money market and mutual funds are valued at the net asset value of the shares held by the pension plan at year end. • U.S. government and agency securities, corporate debt, common stock and preferred stock are valued at the closing price reported on the... -

Page 192

...millions December 31, 2015 Fair Value Significant Unobservable Inputs (Level 3) Money market funds U.S. government and agency securities Corporate debt (a) Common stock Preferred stock Mutual funds Interest in Collective Funds (b) Other Investments measured at net asset value (d) Total $ 154 324... -

Page 193

... Benefits 2015 2014 2013 Year ended December 31 - in millions Net periodic cost consists of: Service cost Interest cost Expected return on plan assets Amortization of prior service cost/(credit) Amortization of actuarial (gain)/loss Settlement (gain)/loss Net periodic cost (benefit) Other changes... -

Page 194

... Increase Decrease Effect on year end benefit obligation $10 (9) Discount rate Qualified pension Nonqualified pension Postretirement benefits Rate of compensation increase (average) Assumed health care cost trend rate Initial trend Ultimate trend Year ultimate reached Expected long-term return... -

Page 195

... in 2014, PNC discontinued the use of stock options as a standard element of our long-term equity incentive compensation programs under our Incentive Plans and did not grant any options in 2015 and 2014. Prior to 2014, options were granted at exercise prices not less than the market value of a share... -

Page 196

... represents the stock option activity for 2015. Table 107: Stock Option Rollforward PNC WeightedAverage Exercise Price PNC Options Converted From National City WeightedAverage Exercise Price Total WeightedWeightedAverage Average Remaining Exercise Contractual Price Life Year ended December 31, 2015... -

Page 197

... participants may purchase our common stock at 95% of the fair market value on the last day of each six-month offering period. No charge to earnings is recorded with respect to the ESPP. Table 110: Employee Stock Purchase Plan - Summary Year ended December 31 Shares Issued Purchase Price Per Share... -

Page 198

... BlackRock Series C Preferred Stock is included in Note 7 Fair Value. NOTE 14 FINANCIAL DERIVATIVES We use derivative financial instruments (derivatives) primarily to help manage exposure to interest rate, market and credit risk and reduce the effects that changes in interest rates may have on net... -

Page 199

... Fair Fair Amount Value (a) Value (b) In millions Interest rate contracts: Fair value hedges: Receive-fixed swaps Pay-fixed swaps (c) Subtotal Cash flow hedges: Receive-fixed swaps Forward purchase commitments Subtotal Foreign exchange contracts: Net investment hedges Total derivatives designated... -

Page 200

... into foreign currency forward contracts to hedge non-U.S. Dollar (USD) net investments in foreign subsidiaries against adverse changes in foreign exchange rates. We assess whether the hedging relationship is highly effective in achieving offsetting changes in the value of the hedge and hedged item... -

Page 201

... Commercial mortgage loan commitments Subtotal Credit contracts Subtotal Derivatives used for customer-related activities: Interest rate contracts: Swaps Caps/floors - Sold Caps/floors - Purchased Swaptions Futures (c) Mortgage-backed securities commitments Subtotal Foreign exchange contracts Credit... -

Page 202

...fair value also takes into account the fair value of the embedded servicing right. We offer derivatives to our customers in connection with their risk management needs. These derivatives primarily consist of interest rate swaps, interest rate caps and floors, swaptions and foreign exchange contracts... -

Page 203

... Gains (losses) from commercial mortgage banking activities Derivatives used for customer-related activities: Interest rate contracts Foreign exchange contracts Equity contracts Credit contracts Gains (losses) from customer-related activities (c) Derivatives used for other risk management activities... -

Page 204

... Balance Sheet Fair Value Cash Offset Amount Collateral Securities Collateral Held/(Pledged) Under Master Netting Agreements December 31, 2015 In millions Gross Fair Value Net Fair Value Net Amounts Derivative assets Interest rate contracts: Cleared Over-the-counter Foreign exchange contracts... -

Page 205

... seek to manage credit risk by evaluating credit ratings of counterparties and by using internal credit analysis, limits, and monitoring procedures. At December 31, 2015, we held cash, U.S. government securities and mortgage-backed securities totaling $.9 billion under master netting agreements and... -

Page 206

... share data 2015 2014 2013 Basic Net income Less: Net income (loss) attributable to noncontrolling interests Preferred stock dividends and discount accretion and redemptions Net income attributable to common shares Less: Dividends and undistributed earnings allocated to participating securities Net... -

Page 207

... of this Note, the PNC Preferred Funding Trust II securities are automatically exchangeable into shares of PNC Series I preferred stock under certain conditions relating to the capitalization or the financial condition of PNC Bank and upon the direction of the Office of the Comptroller of the... -

Page 208

... 31, 2015. Other Shareholders' Equity Matters We have a dividend reinvestment and stock purchase plan. Holders of preferred stock and PNC common stock may participate in the plan, which provides that additional shares of common stock may be purchased at market value with reinvested dividends and... -

Page 209

...a cash payment representing the market value of such in-kind dividend, and PNC has committed to contribute such in-kind dividend to PNC Bank. (e) Except for: (i) purchases, redemptions or other acquisitions of shares of capital stock of PNC in connection with any employment contract, benefit plan or... -

Page 210

...prior service cost (credit) reclassified to other noninterest expense Net increase (decrease), pre-tax Effect of income taxes Net increase (decrease), after-tax Other PNC's portion of BlackRock's OCI Net investment hedge derivatives Foreign currency translation adjustments (a) Net increase (decrease... -

Page 211

... Compensation and benefits Partnership investments Loss and credit carryforward Accrued expenses Other Total gross deferred tax assets Valuation allowance Total deferred tax assets Deferred tax liabilities Leasing Goodwill and intangibles Fixed assets Net unrealized gains on securities and financial... -

Page 212

... ending balance of unrecognized tax benefits is as follows: Table 129: Change in Unrecognized Tax Benefits In millions 2015 2014 2013 Statutory tax rate Increases (decreases) resulting from State taxes net of federal benefit Tax-exempt interest Life insurance Dividend received deduction Tax credits... -

Page 213

... of other tax benefits associated with qualified investments in low income housing tax credits within Income taxes. Table 130: Basel Regulatory Capital (a) Amount December 31 Dollars in millions 2015 2014 Ratios 2015 2014 Risk-based capital Common equity Tier 1 (b) PNC PNC Bank Tier 1 PNC 35,522... -

Page 214

...PNC Bank, N.A.). The cases have been consolidated for pretrial proceedings in the U.S. District Court for the Eastern District of New York under the caption In re Payment Card Interchange Fee and Merchant-Discount Antitrust Litigation (Master File No. 1:05-md-1720-JG-JO). Those cases naming National... -

Page 215

.... PNC Bank, N.A. is not named a defendant in any of the Visa or MasterCard related antitrust litigation nor was it initially a party to the judgment or loss sharing agreements, but it has been subject to these indemnification obligations and became responsible for National City Bank's position in... -

Page 216

... 2016, the district court denied our motion. Overdraft Litigation Beginning in October 2009, PNC Bank, National City Bank and RBC Bank (USA) have been named in lawsuits brought as class actions relating to the manner in which they charged overdraft fees on ATM and debit transactions to customers... -

Page 217

... PNC Financial Services Group, Inc. - Form 10-K 199 Fulton Financial In 2009, Fulton Financial Advisors, N.A. filed lawsuits against PNC Capital Markets, LLC and NatCity Investments, Inc. in the Court of Common Pleas of Lancaster County, Pennsylvania arising out of Fulton's purchase of auction rate... -

Page 218

... of Ohio, against PNC Bank and American Security Insurance Company (ASIC), a provider of property and casualty insurance to PNC for certain residential mortgages. In February and March 2014, two additional class action lawsuits were filed. One of them (Montoya, et al. v. PNC Bank, N.A., et al. (Case... -

Page 219

... Repurchase Litigation In December 2013, Residential Funding Company, LLC (RFC) filed a lawsuit in the U.S. District Court for the District of Minnesota against PNC Bank, N.A., as alleged successor in interest to National City Mortgage Co., NCMC Newco, Inc., and North Central Financial Corporation... -

Page 220

... out of trustee services provided by Allegiant Bank, a National City Bank and PNC Bank predecessor, with respect to Missouri trusts that held pre-need funeral contract assets. Under a pre-need funeral contract, a customer pays an amount up front in exchange for payment of funeral expenses following... -

Page 221

... to PNC include consumer protection, fair lending, mortgage origination and servicing, mortgage and non mortgage-related insurance and reinsurance, municipal finance activities, conduct by broker-dealers, automobile lending practices, and participation in government insurance or guarantee programs... -

Page 222

... of New York. The first two subpoenas, served in 2011, concern National City Bank's lending practices in connection with loans insured by the Federal Housing Administration (FHA) as well as certain non-FHA-insured loan origination, sale and securitization practices. A third, served in 2013, seeks... -

Page 223

... a higher degree of risk of default. Commitments to extend credit Total commercial lending Home equity lines of credit Credit card Other Total commitments to extend credit Net outstanding standby letters of credit (a) Reinsurance agreements (b) Standby bond purchase agreements (c) Other commitments... -

Page 224

... such costs. Visa Indemnification Our payment services business issues and acquires credit and debit card transactions through Visa U.S.A. Inc. card association or its affiliates (Visa). In October 2007, Visa completed a restructuring and issued shares of Visa Inc. common stock to its financial... -

Page 225

...home equity loans/lines of credit that were sold to a limited number of private investors in the financial services industry by National City prior to our acquisition of National City. PNC is no longer engaged in the brokered home equity lending business, and our exposure under these loan repurchase... -

Page 226

... Balance Sheet in Federal funds purchased and repurchase agreements. (b) Represents the fair value of securities collateral purchased or sold, up to the amount owed under the agreement, for agreements supported by a legally enforceable master netting agreement. (c) Represents certain long term... -

Page 227

...' net worth above minimum requirements. Table 136: Parent Company - Interest Paid and Income Tax Refunds (Payments) Interest Paid Income Tax Refunds / (Payments) $4,103 $4,167 $4,235 Year ended December 31 - in millions 2015 2014 2013 $106 $103 $117 $ 72 $(13) $ 91 The PNC Financial Services... -

Page 228

... corporate support functions within "Other" for financial reporting purposes. Net interest income in business segment results reflects PNC's internal funds transfer pricing methodology. Assets receive a funding charge and liabilities and capital receive a funding credit based on a transfer pricing... -

Page 229

... and investment management, receivables management, disbursement services, funds transfer services, information reporting and global trade services. Capital markets-related products and services include foreign exchange, derivatives, securities, loan syndications, mergers and acquisitions advisory... -

Page 230

... dividends from BlackRock of $320 million, $285 million, and $249 million during 2015, 2014, and 2013, respectively. Non-Strategic Assets Portfolio includes a consumer portfolio of mainly residential mortgage and brokered home equity loans and lines of credit and a small commercial/commercial real... -

Page 231

...SERVICES GROUP, INC. SELECTED QUARTERLY FINANCIAL DATA Dollars in millions, except per share data Fourth 2015 Third Second First Fourth 2014 Third Second First Summary Of Operations Interest income Interest expense Net interest income Noninterest income (a) Total revenue Provision for credit losses... -

Page 232

... Money market Demand Savings Retail certificates of deposit Time deposits in foreign offices and other time Total interest-bearing deposits Borrowed funds Federal funds purchased and repurchase agreements Federal Home Loan Bank borrowings Bank notes and senior debt Subordinated debt Commercial... -

Page 233

... for certain loans and borrowed funds accounted for at fair value, with changes in fair value recorded in trading noninterest income, are included in noninterest-earning assets and noninterest-bearing liabilities. (b) Loan fees for the years ended December 31, 2015, 2014 and 2013 were $106 million... -

Page 234

... Money market Demand Savings Retail certificates of deposit Time deposits in foreign offices and other time Total interest-bearing deposits Borrowed funds Federal funds purchased and repurchase agreements Federal Home Loan Bank borrowings Bank notes and senior debt Subordinated debt Commercial... -

Page 235

... of total company value. FEE INCOME RECONCILIATION (NON-GAAP) Year ended December 31 Dollars in millions 2015 2014 2013 Noninterest income Asset management Consumer services Corporate services Residential mortgage Service charges on deposits Total fee income Net gains on sales of securities Other... -

Page 236

... ASSETS AND RELATED INFORMATION December 31 - dollars in millions 2015 2014 2013 2012 2011 Nonperforming loans Commercial Commercial real estate Equipment lease financing Total commercial lending Consumer lending (a) Home equity (b) (c) Residential real estate (b) Credit card (d) Other consumer... -

Page 237

... Commercial Commercial real estate Equipment lease financing Home equity Residential real estate Credit card Other consumer Total recoveries Net charge-offs Provision for credit losses Net change in allowance for unfunded loan commitments and letters of credit Write-off of purchased impaired loans... -

Page 238

..., 2015, $17.9 billion notional amount of receive-fixed interest rate swaps were designated as part of cash flow hedging strategies that converted the floating rate (1 month and 3 month LIBOR) on the underlying commercial loans to a fixed rate as part of risk management strategies. TIME DEPOSITS The... -

Page 239

...). Our 2013 Form 10-K included additional information regarding our Basel I capital ratios. (b) Amounts have not been updated to reflect the first quarter 2014 adoption of ASU 2014-01 related to investments in low income housing tax credits. The PNC Financial Services Group, Inc. - Form 10-K 221 -

Page 240

... and Chief Executive Officer and the Executive Vice President and Chief Financial Officer, of the effectiveness of the design and operation of our disclosure controls and procedures and of changes in our internal control over financial reporting. 222 The PNC Financial Services Group, Inc. - Form 10... -

Page 241

... with directors, - Family relationships, and - Indemnification and advancement of costs" and "Related Person Transactions" in our Proxy Statement to be filed for the 2016 annual meeting of shareholders and is incorporated herein by reference. ITEM 14 - PRINCIPAL ACCOUNTING FEES AND SERVICES The... -

Page 242

..., President, Chief Executive Officer and Director (Principal Executive Officer) Executive Vice President and Chief Financial Officer (Principal Financial Officer) Senior Vice President and Controller (Principal Accounting Officer) Directors 224 The PNC Financial Services Group, Inc. - Form 10... -

Page 243

... Exhibit 3.1 of the Corporation's Current Report on Form 8-K filed September 21, 2012 The PNC Financial Services Group, Inc. - Form 10-K E-1 Method of Filing + Incorporated herein by reference to Exhibit 3.1 to the Corporation's Annual Report on Form 10-K for the year ended December 31, 2008 (2008... -

Page 244

... preferred stock Deposit Agreement, dated May 7, 2013, between the Corporation, Computershare Trust Company, N.A., Computershare Inc. and the holders from time to time of the Depositary Receipts representing interests in the Series R preferred stock Form of PNC Bank, National Association Global Bank... -

Page 245