Wells Fargo 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management - Asset/Liability Management (continued)

ensuring significant unobservable model inputs are appropriate

given observable market transactions or other market data

within the same or similar asset classes. This ensures modeled

approaches are appropriate given similar product valuation

techniques and are in line with their intended purpose. The

Corporate Model Risk Group provides oversight of model

validation and assessment processes.

All internal valuation models are subject to ongoing review

by business-unit-level management, and all models are subject

to additional oversight by a corporate-level risk management

department. Corporate oversight responsibilities include

evaluating the adequacy of business unit risk management

programs, maintaining company-wide model validation policies

and standards, and reporting the results of these activities to

management.

MARKET RISK - EQUITY INVESTMENTS We are directly and

indirectly affected by changes in the equity markets. We make

and manage direct equity investments in start-up businesses,

emerging growth companies, management buy-outs,

acquisitions and corporate recapitalizations. We also invest in

non-affiliated funds that make similar private equity

investments. These private equity investments are made within

capital allocations approved by management and the Board. The

Board’s policy is to review business developments, key risks and

historical returns for the private equity investment portfolio at

least annually. Management reviews these investments at least

quarterly and assesses them for possible OTTI. For

nonmarketable investments, the analysis is based on facts and

circumstances of each individual investment and the

expectations for that investment’s cash flows and capital needs,

the viability of its business model and our exit strategy.

Nonmarketable investments include private equity investments

accounted for under the cost method, equity method and fair

value option.

As part of our business to support our customers, we trade

public equities, listed/OTC equity derivatives and convertible

bonds. We have parameters that govern these activities. We also

have marketable equity securities in the available-for-sale

securities portfolio, including securities relating to our venture

capital activities. We manage these investments within capital

risk limits approved by management and the Board and

monitored by Corporate ALCO. Gains and losses on these

securities are recognized in net income when realized and

periodically include OTTI charges.

Changes in equity market prices may also indirectly affect

our net income by (1) the value of third party assets under

management and, hence, fee income, (2) borrowers whose

ability to repay principal and/or interest may be affected by the

stock market, or (3) brokerage activity, related commission

income and other business activities. Each business line

monitors and manages these indirect risks.

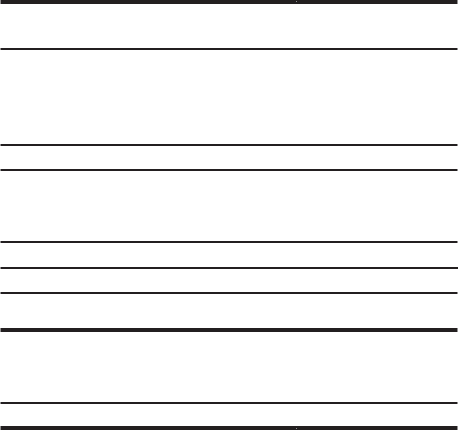

Table 54 provides information regarding our marketable

and nonmarketable equity investments as of December 31, 2014

and 2013.

Table 54: Nonmarketable and Marketable Equity

Investments

Dec 31, Dec 31,

(in millions) 2014 2013

Nonmarketable equity investments:

Cost method:

Private equity and other $ 2,300 2,308

Federal bank stock 4,733 4,670

Total cost method 7,033 6,978

Equity method:

LIHTC investments (1) 7,278 6,209

Private equity and other 5,132 5,782

Total equity method 12,410 11,991

Fair value (2) 2,512 1,386

Total nonmarketable equity

investments (3) $ 21,955 20,355

Marketable equity securities:

Cost $ 1,906 2,039

Net unrealized gains 1,770 1,346

Total marketable equity securities (4) $ 3,676 3,385

(1) Represents low income housing tax credit investments.

(2) Represents nonmarketable equity investments for which we have elected the

fair value option. See Note 7 (Premises, Equipment, Lease Commitments and

Other Assets) and Note 17 (Fair Values of Assets and Liabilities) to Financial

Statements in this Report for additional information.

(3) Included in other assets on the balance sheet. See Note 7 (Premises,

Equipment, Lease Commitments and Other Assets) to Financial Statements in

this Report for additional information.

(4) Included in available-for-sale securities. See Note 5 (Investment Securities) to

Financial Statements in this Report for additional information.

96