Wells Fargo 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

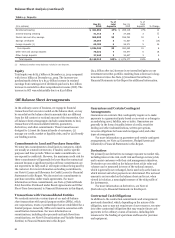

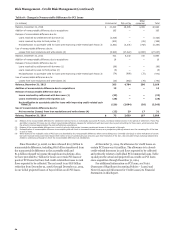

Risk Management - Credit Risk Management (continued)

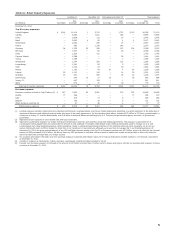

Table 18: Changes in Nonaccretable Difference for PCI Loans

Other

(in millions) Commercial Pick-a-Pay consumer Total

Balance, December 31, 2008 $ 10,410 26,485 4,069 40,964

Addition of nonaccretable difference due to acquisitions 195 — — 195

Release of nonaccretable difference due to:

Loans resolved by settlement with borrower (1) (1,426) — — (1,426)

Loans resolved by sales to third parties (2) (303) — (85) (388)

Reclassification to accretable yield for loans with improving credit-related cash flows (3) (1,531) (3,031) (792) (5,354)

Use of nonaccretable difference due to:

Losses from loan resolutions and write-downs (4) (6,923) (17,222) (2,882) (27,027)

Balance, December 31, 2012 422 6,232 310 6,964

Addition of nonaccretable difference due to acquisitions 18 — —

Release of nonaccretable difference due to:

Loans resolved by settlement with borrower (1) (86) — — (86)

Loans resolved by sales to third parties (2) (5) — — (5)

Reclassification to accretable yield for loans with improving credit-related cash flows (3) (74) (866) (31) (971)

Use of nonaccretable difference due to:

Losses from loan resolutions and write-downs (4) (10) (662) (79) (751)

Balance, December 31, 2013 265 4,704 200 5,169

Addition of nonaccretable difference due to acquisitions 13 — — 13

Release of nonaccretable difference due to:

Loans resolved by settlement with borrower (1) (33) — — (33)

Loans resolved by sales to third parties (2) (28) — — (28)

Reclassification to accretable yield for loans with improving credit-related cash

flows (3) (129) (2,094) (20) (2,243)

Use of nonaccretable difference due to:

Net recoveries (losses) from loan resolutions and write-downs (4) (15) 29 17 31

Balance, December 31, 2014 $ 73 2,639 197 2,909

(1) Release of the nonaccretable difference for settlement with borrower, on individually accounted PCI loans, increases interest income in the period of settlement. Pick-a-Pay

and Other consumer PCI loans do not reflect nonaccretable difference releases for settlements with borrowers due to pool accounting for those loans, which assumes that

the amount received approximates the pool performance expectations.

(2) Release of the nonaccretable difference as a result of sales to third parties increases noninterest income in the period of the sale.

(3) Reclassification of nonaccretable difference to accretable yield will result in increased interest income as a prospective yield adjustment over the remaining life of the loan

or pool of loans.

(4) Write-downs to net realizable value of PCI loans are absorbed by the nonaccretable difference when severe delinquency (normally 180 days) or other indications of severe

borrower financial stress exist that indicate there will be a loss of contractually due amounts upon final resolution of the loan. Also includes foreign exchange adjustments

related to underlying principal for which the nonaccretable difference was established.

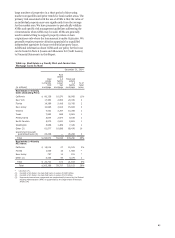

Since December 31, 2008, we have released $10.5 billion in At December 31, 2014, the allowance for credit losses on

nonaccretable difference, including $8.6 billion transferred from certain PCI loans was $11 million. The allowance is to absorb

the nonaccretable difference to the accretable yield and credit-related decreases in cash flows expected to be collected

$1.9 billion released to income through loan resolutions. Also, and primarily relates to individual PCI commercial loans. Table

we have provided $1.7 billion for losses on certain PCI loans or 19 analyzes the actual and projected loss results on PCI loans

pools of PCI loans that have had credit-related decreases to cash since acquisition through December 31, 2014.

flows expected to be collected. The net result is an $8.8 billion For additional information on PCI loans, see Note 1

reduction from December 31, 2008, through December 31, 2014, (Summary of Significant Accounting Policies – Loans) and

in our initial projected losses of $41.0 billion on all PCI loans. Note 6 (Loans and Allowance for Credit Losses) to Financial

Statements in this Report.

18

60