Wells Fargo 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management - Asset/Liability Management (continued)

We access domestic and international capital markets for

long-term funding (generally greater than one year) through

issuances of registered debt securities, private placements and

asset-backed secured funding. Investors in the long-term capital

markets, as well as other market participants, generally will

consider, among other factors, a company’s debt rating in

making investment decisions. Rating agencies base their ratings

on many quantitative and qualitative factors, including capital

adequacy, liquidity, asset quality, business mix, the level and

quality of earnings, and rating agency assumptions regarding the

probability and extent of federal financial assistance or support

for certain large financial institutions. Adverse changes in these

factors could result in a reduction of our credit rating; however,

our debt securities do not contain credit rating covenants.

In light of industry changes and regulatory developments

related to the Title II Orderly Liquidation Authority of the Dodd-

Frank Act, rating agencies have proposed changes to various

aspects of their ratings methodologies. Moody’s Investors

Service has proposed significant revisions to its rating

methodology, with a focus on how each type of creditor would be

affected in any bank failure. Standard and Poor’s Ratings

Services (S&P) is continuing its reassessment of whether to

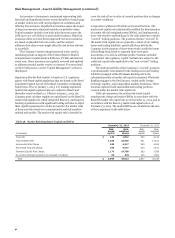

Table 57: Credit Ratings as of December 31, 2014

incorporate the likelihood of extraordinary government support

into the ratings of certain bank holding companies, including the

Parent. In addition, S&P has recently issued a proposal to

incorporate into its bank-level rating methodology an

assessment of additional capital available to absorb losses to

reduce default risk. During fourth quarter 2014, our ratings were

affirmed by Fitch Ratings and formally reviewed by S&P, with no

changes. Both the Parent and Wells Fargo Bank, N.A. remain

among the top-rated financial firms in the U.S.

See the “Risk Management – Asset/Liability Management”

and “Risk Factors” sections in this Report for additional

information regarding our credit ratings as of

December 31, 2014, and the potential impact a credit rating

downgrade would have on our liquidity and operations, as well

as Note 16 (Derivatives) to Financial Statements in this Report

for information regarding additional collateral and funding

obligations required for certain derivative instruments in the

event our credit ratings were to fall below investment grade.

The credit ratings of the Parent and Wells Fargo Bank, N.A.

as of December 31, 2014, are presented in Table 57.

Wells Fargo & Company Wells Fargo Bank, N.A.

Senior debt Short-term

borrowings Long-term

deposits Short-term

borrowings

Moody's A2 P-1 Aa3 P-1

S&P A+ A-1 AA- A-1+

Fitch, Inc. AA- F1+ AA F1+

DBRS AA R-1* AA** R-1**

* middle **high

On September 3, 2014, the FRB, OCC and FDIC issued a

final rule that implements a quantitative liquidity requirement

consistent with the liquidity coverage ratio (LCR) established by

the Basel Committee on Banking Supervision (BCBS). The rule

requires banking institutions, such as Wells Fargo, to hold

high-quality liquid assets, such as central bank reserves and

government and corporate debt that can be converted easily

and quickly into cash, in an amount equal to or greater than its

projected net cash outflows during a 30-day stress period. The

final LCR rule will be phased-in beginning January 1, 2015,

and requires full compliance with a minimum 100% LCR by

January 1, 2017. The FRB also recently finalized rules imposing

enhanced liquidity management standards on large bank

holding companies (BHC) such as Wells Fargo. We will continue

to analyze these recently finalized rules and other regulatory

proposals that may affect liquidity risk management to

determine the level of operational or compliance impact to

Wells Fargo. For additional information see the “Capital

Management” and “Regulatory Reform” sections in this Report.

Parent Under SEC rules, our Parent is classified as a “well-

known seasoned issuer,” which allows it to file a registration

statement that does not have a limit on issuance capacity. In

May 2014, the Parent filed a registration statement with the SEC

for the issuance of senior and subordinated notes, preferred

stock and other securities. The Parent’s ability to issue debt and

other securities under this registration statement is limited by

the debt issuance authority granted by the Board. The Parent is

currently authorized by the Board to issue $60 billion in

outstanding short-term debt and $170 billion in outstanding

long-term debt. At December 31, 2014, the Parent had available

$42.3 billion in short-term debt issuance authority and

$67.8 billion in long-term debt issuance authority. The Parent’s

debt issuance authority granted by the Board includes short-

term and long-term debt issued to affiliates. During 2014, the

Parent issued $18.1 billion of senior notes, of which $11.5 billion

were registered with the SEC. In addition, during 2014, the

Parent issued $4.5 billion of subordinated notes, all of which

were registered with the SEC. Additionally, in February 2015, the

Parent issued $5.2 billion of registered senior notes.

The Parent’s proceeds from securities issued were used for

general corporate purposes, and, unless otherwise specified in

the applicable prospectus or prospectus supplement, we expect

the proceeds from securities issued in the future will be used for

the same purposes. Depending on market conditions, we may

purchase our outstanding debt securities from time to time in

privately negotiated or open market transactions, by tender

offer, or otherwise.

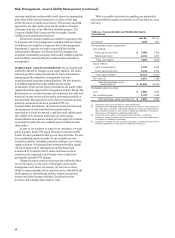

Table 58 provides information regarding the Parent’s

medium-term note (MTN) programs. The Parent may issue

senior and subordinated debt securities under Series L & M,

Series N & O, and the European and Australian programmes.

Under Series K, the Parent may issue senior debt securities

linked to one or more indices or bearing interest at a fixed or

floating rate.

98