Wells Fargo 2014 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

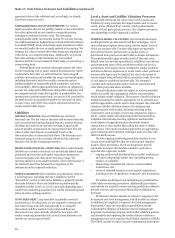

Note 15: Legal Actions (continued)

judgment was entered in Gutierrez. On October 28, 2010,

Wells Fargo appealed to the U.S. Court of Appeals for the Ninth

Circuit. On December 26, 2012, the Ninth Circuit reversed the

order requiring Wells Fargo to change its order of posting and

vacated the portion of the order granting remediation of

approximately $203 million on the grounds of federal

preemption. The Ninth Circuit affirmed the District Court’s

finding that Wells Fargo violated a California state law

prohibition on fraudulent representations and remanded the

case to the District Court for further proceedings. On

August 5, 2013, the District Court entered a judgment against

Wells Fargo in the approximate amount of $203 million,

together with post-judgment interest thereon from

October 25, 2010, and, effective as of July 15, 2013, enjoined

Wells Fargo from making or disseminating additional

misrepresentations about its order of posting of transactions. On

August 7, 2013, Wells Fargo appealed the judgment to the Ninth

Circuit. On October 29, 2014, the Ninth Circuit affirmed the trial

court’s judgment against Wells Fargo for approximately

$203 million, but limited the injunction to debit card

transactions. Wells Fargo is presently considering its options.

SECURITIES LENDING LITIGATION Wells Fargo Bank, N.A. is

involved in four separate actions brought by securities lending

customers of Wells Fargo and Wachovia Bank in various courts.

In general, each of the cases alleges losses based on claims that

Wells Fargo violated fiduciary and contractual duties in its

investment of collateral for loaned securities. Blue Cross/Blue

Shield of Minnesota, et al., v. Wells Fargo Bank, N.A. resulted in

verdicts dismissing the claims against Wells Fargo. Plaintiffs

have appealed the verdicts. The remaining cases are scheduled

for trial in 2015.

OUTLOOK When establishing a liability for contingent litigation

losses, the Company determines a range of potential losses for

each matter that is both probable and estimable, and records the

amount it considers to be the best estimate within the range. The

high end of the range of reasonably possible potential litigation

losses in excess of the Company’s liability for probable and

estimable losses was $1.1 billion as of December 31, 2014. For

these matters and others where an unfavorable outcome is

reasonably possible but not probable, there may be a range of

possible losses in excess of the established liability that cannot

be estimated. Based on information currently available, advice of

counsel, available insurance coverage and established reserves,

Wells Fargo believes that the eventual outcome of the actions

against Wells Fargo and/or its subsidiaries, including the

matters described above, will not, individually or in the

aggregate, have a material adverse effect on Wells Fargo’s

consolidated financial position. However, in the event of

unexpected future developments, it is possible that the ultimate

resolution of those matters, if unfavorable, may be material to

Wells Fargo’s results of operations for any particular period.

204