Wells Fargo 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

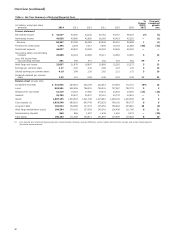

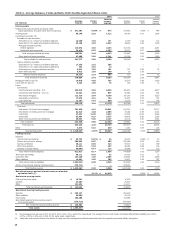

Noninterest Income

Table 7: Noninterest Income

Year ended December 31,

(in millions) 2014 2013 2012

Service charges on deposit accounts $ 5,050 5,023 4,683

Trust and investment fees:

Brokerage advisory, commissions

and other fees 9,183 8,395 7,524

Trust and investment management 3,387 3,289 3,080

Investment banking 1,710 1,746 1,286

Total trust and investment fees 14,280 13,430 11,890

Card fees 3,431 3,191 2,838

Other fees:

Charges and fees on loans 1,316 1,540 1,746

Merchant processing fees 726 669 583

Cash network fees 507 493 470

Commercial real estate

brokerage commissions 469 338 307

Letters of credit fees 390 410 441

All other fees 941 890 972

Total other fees 4,349 4,340 4,519

Mortgage banking:

Servicing income, net 3,337 1,920 1,378

Net gains on mortgage loan

origination/sales activities 3,044 6,854 10,260

Total mortgage banking 6,381 8,774 11,638

Insurance 1,655 1,814 1,850

Net gains from trading activities 1,161 1,623 1,707

Net gains (losses) on debt securities 593 (29) (128)

Net gains from equity investments 2,380 1,472 1,485

Lease income 526 663 567

Life insurance investment income 558 566 757

All other 456 113 1,050

Total $ 40,820 40,980 42,856

Noninterest income of $40.8 billion represented 48% of revenue

for 2014 compared with $41.0 billion, or 49%, for 2013 and

$42.9 billion, or 50%, for 2012. The decrease in noninterest

income in 2014 was primarily due to a decline in mortgage

banking, partially offset by growth in many of our other

businesses including debit card, corporate banking, principal

investments, asset-backed finance, equipment finance,

international, venture capital, wealth management and retail

brokerage. Excluding mortgage banking, noninterest income

increased $2.2 billion from a year ago.

Service charges on deposit accounts increased $27 million

from 2013 due to account growth, new commercial product sales

and commercial product re-pricing, partially offset by changes

we implemented in early October 2014 designed to provide

customers with more real time information to manage their

deposit accounts and avoid overdrafts. Service charges on

deposit accounts in 2013 increased $340 million, or 7%, from

2012 due to primary consumer checking customer growth,

product changes and customer adoption of overdraft services.

Brokerage advisory, commissions and other fees are

received for providing services to full-service and discount

brokerage customers. Income from these brokerage-related

activities include asset-based fees, which are based on the

market value of the customer’s assets, and transactional

commissions based on the number and size of transactions

executed at the customer’s direction. These fees increased to

$9.2 billion in 2014, from $8.4 billion and $7.5 billion in 2013

and 2012, respectively. The increase in brokerage income was

predominantly due to higher asset-based fees as a result of

higher market values and growth in assets under management,

partially offset by a decrease in brokerage transaction revenue.

Retail brokerage client assets totaled $1.42 trillion at

December 31, 2014, up 4% from $1.36 trillion at

December 31, 2013, which was up 12% from $1.22 trillion at

December 31, 2012.

We earn trust and investment management fees from

managing and administering assets, including mutual funds,

corporate trust, personal trust, employee benefit trust and

agency assets. Trust and investment management fees are

largely based on a tiered scale relative to the market value of the

assets under management or administration. These fees

increased to $3.4 billion in 2014 from $3.3 billion in 2013 and

$3.1 billion in 2012, primarily due to growth in assets under

management reflecting higher market values. At

December 31, 2014, these assets totaled $2.5 trillion, an increase

from $2.4 trillion and $2.2 trillion at December 31, 2013 and

2012, respectively.

We earn investment banking fees from underwriting debt

and equity securities, arranging loan syndications, and

performing other related advisory services. Investment banking

fees remained unchanged at $1.7 billion in 2014 compared with

2013 as higher advisory services results were offset by lower loan

syndication and origination fees. Investment banking fees

increased $460 million in 2013 compared with 2012, primarily

due to increased loan syndication volume and equity

originations.

Card fees were $3.4 billion in 2014, compared with

$3.2 billion in 2013 and $2.8 billion in 2012. Card fees increased

in 2014 and 2013 primarily due to account growth and increased

purchase activity.

Other fees of $4.3 billion in 2014 were unchanged compared

with 2013 as a decline in charges and fees on loans was offset by

an increase in commercial real estate brokerage commissions.

Other fees in 2013 declined $179 million compared with 2012

due to a decline in charges and fees on loans. Charges and fees

on loans decreased to $1.3 billion in 2014 compared with

$1.5 billion and $1.7 billion in 2013 and 2012, respectively,

primarily due to the phase out of the direct deposit advance

product during the first half of 2014. Commercial real estate

brokerage commissions increased to $469 million in 2014

compared with $338 million in 2013 and $307 million in 2012,

driven by increased sales and other property-related activities

including financing and advisory services.

Mortgage banking income, consisting of net servicing

income and net gains on loan origination/sales activities, totaled

$6.4 billion in 2014, compared with $8.8 billion in 2013 and

$11.6 billion in 2012.

In addition to servicing fees, net mortgage loan servicing

income includes amortization of commercial mortgage servicing

rights (MSRs), changes in the fair value of residential MSRs

during the period, as well as changes in the value of derivatives

(economic hedges) used to hedge the residential MSRs. Net

servicing income of $3.3 billion for 2014 included a $1.4 billion

net MSR valuation gain ($2.1 billion decrease in the fair value of

the MSRs offset by a $3.5 billion hedge gain). Net servicing

income of $1.9 billion for 2013 included a $489 million net MSR

valuation gain ($3.4 billion increase in the fair value of the MSRs

offset by a $2.9 billion hedge loss), and net servicing income of

$1.4 billion for 2012 included a $681 million net MSR valuation

gain ($2.9 billion decrease in the fair value of MSRs offset by a

$3.6 billion hedge gain). The lower net MSR valuation gain in

2013, compared with 2014, was attributable to MSR valuation

adjustments associated with higher prepayments and increases

in servicing and foreclosure costs.

Our portfolio of loans serviced for others was $1.86 trillion

at December 31, 2014, $1.90 trillion at December 31, 2013, and

$1.91 trillion at December 31, 2012. At December 31, 2014, the

ratio of MSRs to related loans serviced for others was 0.75%,

41