Wells Fargo 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management - Asset/Liability Management (continued)

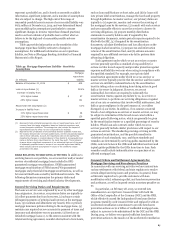

Economic hedges and other Economic hedges in trading are not

designated in a hedge accounting relationship and exclude

economic hedging related to our asset/liability risk management

and substantially all mortgage banking risk management

activities. Economic hedging activities include the use of trading

securities to economically hedge risk exposures related to non-

trading activities or derivatives to hedge risk exposures related

to trading assets or trading liabilities. Economic hedges are

unrelated to our customer accommodation activities. Other

activities include financial assets held for investment purposes

that we elected to carry at fair value with changes in fair value

recorded to earnings in order to mitigate accounting

measurement mismatches or avoid embedded derivative

accounting complexities.

Proprietary trading Proprietary trading consists of security or

derivative positions executed for our own account based upon

market expectations or to benefit from price differences between

financial instruments and markets. Proprietary trading activity

has been substantially restricted by the Dodd-Frank Act

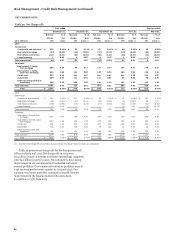

Table 46: Distribution of Daily Trading-Related Revenues

provisions known as the “Volcker Rule.” Accordingly, we

reduced and are exiting certain business activities in anticipation

of the rule’s compliance date. As discussed within this section

and the noninterest income section of our financial results,

proprietary trading activity is insignificant to our business and

financial results. For more details on the Volcker Rule, see the

“Regulatory Reform” section in this Report.

Daily Trading-Related Revenue Table 46 provides information

on the distribution of daily trading-related revenues for the

Company’s trading portfolio. This trading-related revenue is

defined as the change in value of the trading assets and trading

liabilities, trading-related net interest income, and trading-

related intra-day gains and losses. Net trading-related revenue

does not include activity related to long-term positions held for

economic hedging purposes, period-end adjustments, and other

activity not representative of daily price changes driven by

market factors.

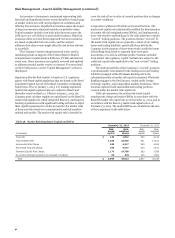

Market Risk is the risk of adverse changes in the fair value of the

trading portfolios and financial instruments held by the

Company due to changes in market risk factors such as interest

rates, credit spreads, foreign exchange rates, equity, and

commodity prices. Market risk is intrinsic to the Company’s

sales and trading, market making, investing, and risk

management activities.

The Company uses Value-at-Risk (VaR) metrics

complemented with sensitivity analysis and stress testing in

measuring and monitoring market risk. These market risk

measures are monitored at both the business unit level and at

aggregated levels on a daily basis. Our corporate market risk

management function aggregates and monitors all exposures to

ensure risk measures are within our established risk appetite.

Changes to the market risk profile are analyzed and reported on

a daily basis. The Company monitors various market risk

exposure measures from a variety of perspectives, which include

line of business, product, risk type, and legal entity.

90