Wells Fargo 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

serviced by us adjusted for any observed differences in but are in their revolving period, reflects the inherent loss where

delinquency and loss rates associated with junior lien mortgages the borrower is delinquent on the corresponding first lien

behind third party first mortgages. We incorporate this inherent mortgage loans.

loss content into our allowance for loan losses. Our allowance Table 28 summarizes delinquency and loss rates for our

process for junior liens ensures consideration of the relative junior lien mortgages by the holder of the first lien.

difference in loss experience for junior liens behind first lien

mortgage loans we own or service, compared with those behind

first lien mortgage loans owned or serviced by third parties. In

addition, our allowance process for junior liens that are current,

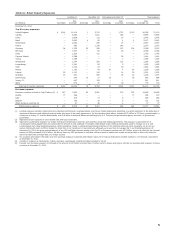

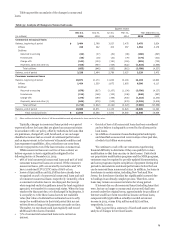

Table 28: Junior Lien Mortgage Portfolios Performance by Holder of 1st Lien (1)

% of loans

two payments

Outstanding balance or more past due

Dec 31, Dec 31, Dec 31, Dec 31, Dec 31, Sep 30,

(in millions) 2014 2013 2014 2013 2014 2014

Junior lien mortgages behind:

Wells Fargo owned or serviced first

lien $ 29,483 32,695 2.39% 2.37 0.89 0.86

Third party first lien 30,133 33,132 2.58 2.53 0.88 0.94

Total junior lien mortgages $ 59,616 65,827 2.49% 2.45 0.88 0.90

Jun 30,

2014

1.08

0.96

1.02

Loss rate

(annualized)

quarter ended

Mar 31, Dec 31,

2014 2013

1.16 1.34

1.23 1.35

1.20 1.35

(1) Excludes PCI loans because their losses were generally reflected in PCI accounting adjustments at the date of acquisition.

We monitor the number of borrowers paying the minimum

amount due on a monthly basis. In December 2014,

approximately 94% of our borrowers with a junior lien mortgage

outstanding balance paid the minimum amount due or more,

including approximately 47% who paid only the minimum

amount due.

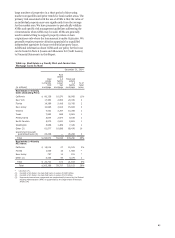

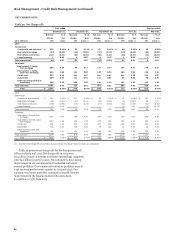

Table 29 shows the credit attributes of the core and

liquidating junior lien mortgage portfolios and lists the top five

states by outstanding balance for the core portfolio. Loans to

California borrowers represent the largest state concentration in

each of these portfolios. The decrease in outstanding balances

since December 31, 2013 predominantly reflects loan paydowns.

As of December 31, 2014, 20% of the outstanding balance of the

junior lien mortgage portfolio was associated with loans that had

Table 29: Junior Lien Mortgage Portfolios (1)

a combined loan to value (CLTV) ratio in excess of 100%. Of

those junior mortgage liens with a CLTV ratio in excess of 100%,

3.03% were two payments or more past due as of

December 31, 2014. CLTV means the ratio of the total loan

balance of first mortgages and junior lien mortgages (including

unused line amounts for credit line products) to property

collateral value. The unsecured portion (the outstanding amount

that was in excess of the most recent property collateral value) of

the outstanding balances of these loans totaled 8% of the junior

lien mortgage portfolio at December 31, 2014.

% of loans

Outstanding balance

two payments

or more past due Loss rate

(in millions)

Core portfolio

California

Florida

New Jersey

Virginia

Pennsylvania

Other

$

Dec 31,

2014

15,535

5,283

4,705

3,160

2,942

25,006

Dec 31,

2013

17,003

5,811

5,019

3,378

3,137

27,689

Dec 31,

2014

2.07%

2.96

3.43

2.18

2.72

2.20

Dec 31,

2013

2.03

3.16

3.43

2.02

2.64

2.18

Year ended December 31,

2014 2013

0.48 1.52

1.40 2.60

1.42 1.79

0.84 1.19

1.11 1.29

0.95 1.69

Total 56,631 62,037 2.36 2.35 0.90 1.69

Liquidating portfolio 2,985 3,790 4.77 4.10 2.74 4.50

Total core and liquidating portfolios $ 59,616 65,827 2.49% 2.45 1.00 1.86

(1) Excludes PCI loans because their losses were generally reflected in PCI accounting adjustments at the date of acquisition.

Our junior lien, as well as first lien, lines of credit products the draw period of (1) interest only or (2) 1.5% of outstanding

generally have a draw period of 10 years (with some up to 15 or principal balance plus accrued interest. During the draw period,

20 years) with variable interest rate and payment options during the borrower has the option of converting all or a portion of the

71