Wells Fargo 2014 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

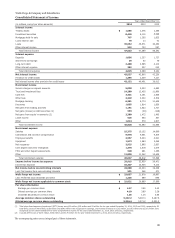

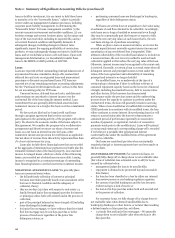

Wells Fargo & Company and Subsidiaries

Consolidated Statement of Cash Flows

Year ended December 31,

(in millions) 2014 2013 2012

Cash flows from operating activities:

Net income before noncontrolling interests $ 23,608 22,224 19,368

Adjustments to reconcile net income to net cash provided by operating activities:

Provision for credit losses 1,395 2,309 7,217

Changes in fair value of MSRs, MHFS and LHFS carried at fair value 1,820 (3,229) (2,307)

Depreciation, amortization and accretion 2,515 3,293 2,807

Other net gains (3,760) (9,384) (3,661)

Stock-based compensation 1,912 1,920 1,698

Excess tax benefits related to stock incentive compensation (453) (271) (226)

Originations of MHFS (144,812) (317,054) (483,835)

Proceeds from sales of and principal collected on mortgages originated for sale 117,097 311,431 421,623

Originations of LHFS — — (15)

Proceeds from sales of and principal collected on LHFS 207 575 9,383

Purchases of LHFS (154) (291) (7,975)

Net change in:

Trading assets 11,186 43,638 105,440

Deferred income taxes 2,354 4,977 (1,297)

Accrued interest receivable (372) (13) 293

Accrued interest payable 119 (32) (84)

Other assets (10,681) 4,693 2,064

Other accrued expenses and liabilities 15,548 (7,145) (11,953)

Net cash provided by operating activities 17,529 57,641 58,540

Cash flows from investing activities:

Net change in:

Federal funds sold, securities purchased under resale agreements and other short-term investments (41,778) (78,184) (92,946)

Available-for-sale securities:

Sales proceeds 6,089 2,837 5,210

Prepayments and maturities 37,257 50,737 59,712

Purchases (44,807) (89,474) (64,756)

Held-to-maturity securities:

Paydowns and maturities 5,168 30 —

Purchases (47,012) (5,782) —

Nonmarketable equity investments:

Sales proceeds 3,161 2,577 2,279

Purchases (3,087) (3,273) (2,619)

Loans:

Loans originated by banking subsidiaries, net of principal collected (65,162) (43,744) (53,381)

Proceeds from sales (including participations) of loans originated for investment 21,564 7,694 6,811

Purchases (including participations) of loans (6,424) (11,563) (9,040)

Principal collected on nonbank entities' loans 13,589 19,955 25,080

Loans originated by nonbank entities (13,570) (17,311) (23,555)

Net cash paid for acquisitions (174) — (4,322)

Proceeds from sales of foreclosed assets and short sales (1) 7,697 11,021 12,690

Net cash from purchases and sales of MSRs (150) 407 116

Other, net (741) 581 (1,169)

Net cash used by investing activities (128,380) (153,492) (139,890)

Cash flows from financing activities:

Net change in:

Deposits 89,133 76,342 82,762

Short-term borrowings 8,035 (3,390) 7,699

Long-term debt:

Proceeds from issuance 42,154 53,227 27,695

Repayment (15,829) (25,423) (28,093)

Preferred stock:

Proceeds from issuance 2,775 3,145 1,377

Cash dividends paid (1,235) (1,017) (892)

Common stock:

Proceeds from issuance 1,840 2,224 2,091

Repurchased (9,414) (5,356) (3,918)

Cash dividends paid (6,908) (5,953) (4,565)

Common stock warrants repurchased — — (1)

Excess tax benefits related to stock incentive compensation 453 271 226

Net change in noncontrolling interests (552) (296) (611)

Other, net 51 136 —

Net cash provided by financing activities 110,503 93,910 83,770

Net change in cash due from banks (348) (1,941) 2,420

Cash and due from banks at beginning of year 19,919 21,860 19,440

Cash and due from banks at end of year $ 19,571 19,919 21,860

Supplemental cash flow disclosures:

Cash paid for interest $ 3,906 4,321 5,245

Cash paid for income taxes 8,808 7,132 8,024

(1) Includes proceeds received for the settlement of claims on certain government guaranteed residential real estate mortgage loans in foreclosure that are reported as

accounts receivables. During fourth quarter 2014, we adopted Accounting Standards Update (ASU) 2014-14, Classification of Certain Government-Guaranteed Mortgage

Loans Upon Foreclosure, effective as of January 1, 2014. This ASU requires that certain government guaranteed residential real estate mortgage loans be recognized as

other receivables upon foreclosure; previously, these were included in foreclosed assets.

The accompanying notes are an integral part of these statements. See Note 1 (Summary of Significant Accounting Policies) for noncash activities.

138