Wells Fargo 2014 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Loan Concentrations

Loan concentrations may exist when there are amounts loaned

to borrowers engaged in similar activities or similar types of

loans extended to a diverse group of borrowers that would cause

them to be similarly impacted by economic or other conditions.

At December 31, 2014 and 2013, we did not have concentrations

representing 10% or more of our total loan portfolio in domestic

commercial and industrial loans and lease financing by industry

or CRE loans (real estate mortgage and real estate construction)

by state or property type. Our real estate 1-4 family mortgage

loans to borrowers in the state of California represented

approximately 13% of total loans at both December 31, 2014

and 2013, of which 2% were PCI loans in both years. These

California loans are generally diversified among the larger

metropolitan areas in California, with no single area consisting

of more than 4% of total loans. We continuously monitor

changes in real estate values and underlying economic or market

conditions for all geographic areas of our real estate 1-4 family

mortgage portfolio as part of our credit risk management

process.

Some of our real estate 1-4 family first and junior lien

mortgage loans include an interest-only feature as part of the

loan terms. These interest-only loans were approximately 12% of

total loans at December 31, 2014, and 15% at December 31, 2013.

Substantially all of these interest-only loans at origination were

considered to be prime or near prime. We do not offer option

adjustable-rate mortgage (ARM) products, nor do we offer

variable-rate mortgage products with fixed payment amounts,

commonly referred to within the financial services industry as

negative amortizing mortgage loans. We acquired an option

payment loan portfolio (Pick-a-Pay) from Wachovia at

December 31, 2008. A majority of the portfolio was identified as

PCI loans. Since the acquisition, we have reduced our exposure

to the option payment portion of the portfolio through our

modification efforts and loss mitigation actions. At

December 31, 2014, approximately 2% of total loans remained

with the payment option feature compared with 10% at

December 31, 2008.

Our first and junior lien lines of credit products generally

have a draw period of 10 years (with some up to 15 or 20 years)

with variable interest rate and payment options during the draw

period of (1) interest only or (2) 1.5% of total outstanding

balance plus accrued interest. During the draw period, the

borrower has the option of converting all or a portion of the line

from a variable interest rate to a fixed rate with terms including

interest-only payments for a fixed period between three to seven

years or a fully amortizing payment with a fixed period between

five to 30 years. At the end of the draw period, a line of credit

generally converts to an amortizing payment schedule with

repayment terms of up to 30 years based on the balance at time

of conversion. At December 31, 2014, our lines of credit portfolio

had an outstanding balance of $69.7 billion, of which

$6.2 billion, or 9%, is in its amortization period, another

$13.3 billion, or 19%, of our total outstanding balance, will reach

their end of draw period during 2015 through 2016,

$14.2 billion, or 20%, during 2017 through 2019, and

$36.0 billion, or 52%, will convert in subsequent years. This

portfolio had unfunded credit commitments of $70.1 billion at

December 31, 2014. The lines that enter their amortization

period may experience higher delinquencies and higher loss

rates than the ones in their draw period. At December 31, 2014,

$425 million, or 7%, of outstanding lines of credit that are in

their amortization period were 30 or more days past due,

compared with $1.3 billion, or 2%, for lines in their draw period.

We have considered this increased inherent risk in our allowance

for credit loss estimate. In anticipation of our borrowers

reaching the end of their contractual commitment, we have

created a program to inform, educate and help these borrowers

transition from interest-only to fully-amortizing payments or full

repayment. We monitor the performance of the borrowers

moving through the program in an effort to refine our ongoing

program strategy.

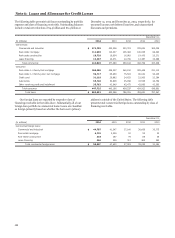

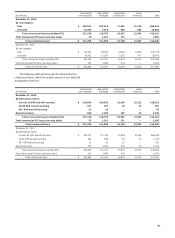

Loan Purchases, Sales, and Transfers

The following table summarizes the proceeds paid or received for

purchases and sales of loans and transfers from loans held for

investment to mortgages/loans held for sale at lower of cost or

fair value. This loan activity primarily includes loans purchased

and sales of whole loan or participating interests, whereby we

receive or transfer a portion of a loan after origination. The table

excludes PCI loans and loans recorded at fair value, including

loans originated for sale because their loan activity normally

does not impact the allowance for credit losses.

Year ended December 31,

2014 2013

(in millions) Commercial Consumer Total Commercial Consumer Total

Purchases (1) $ 4,952 1,365 6,317 10,914 581 11,495

Sales (1,706) (152) (1,858) (6,740) (514) (7,254)

Transfers to MHFS/LHFS (1) (99) (9,778) (9,877) (258) (11) (269)

(1) The “Purchases” and “Transfers to MHFS/LHFS" categories exclude activity in government insured/guaranteed real estate 1-4 family first mortgage loans. As servicer, we

are able to buy delinquent insured/guaranteed loans out of the Government National Mortgage Association (GNMA) pools. These loans have different risk characteristics

from the rest of our consumer portfolio, whereby this activity does not impact the allowance for loan losses in the same manner because the loans are predominantly

insured by the Federal Housing Administration (FHA) or guaranteed by the Department of Veterans Affairs (VA). Such purchases net of transfers to MHFS were $2.9 billion

and $8.2 billion for the year ended 2014 and 2013, respectively.

161