Wells Fargo 2014 Annual Report Download - page 103

Download and view the complete annual report

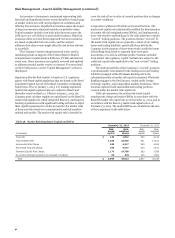

Please find page 103 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• comply with the Dodd-Frank Act provision prohibiting the

reliance on external credit ratings.

We were required to comply with the final Basel III capital

rules beginning January 2014, with certain provisions subject to

phase-in periods. The Basel III capital rules are scheduled to be

fully phased in by January 1, 2022. Based on the final capital

rules, we estimate that our CET1 ratio under the final Basel III

capital rules using the Advanced Approach (fully phased-in)

exceeded the minimum of 7.0% by 343 basis points at

December 31, 2014.

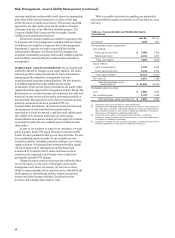

Consistent with the Collins Amendment to the Dodd-Frank

Act, banking organizations that have completed their parallel

run process and have been approved by the FRB to use the

Advanced Approach methodology to determine applicable

minimum risk-weighted capital ratios and additional buffers,

must use the higher of their RWA as calculated under (i) the

Advanced Approach rules, and (ii) from January 1, 2014, to

December 31, 2014, the general approach under Basel III capital

rules and, commencing on January 1, 2015, and thereafter, the

risk weightings under the standardized approach.

In April 2014, federal banking regulators finalized a rule

that enhances the supplementary leverage ratio requirements for

large BHCs, like Wells Fargo, and their insured depository

institutions. The rule, which becomes effective on January 1,

2018, will require a covered BHC to maintain a supplementary

leverage ratio of at least 5% to avoid restrictions on capital

distributions and discretionary bonus payments. The rule will

also require that all of our insured depository institutions

maintain a supplementary leverage ratio of 6% in order to be

considered well capitalized. Based on our review, our current

leverage levels would exceed the applicable requirements for the

holding company and each of our insured depository

institutions. Federal banking regulators, however, recently

finalized additional changes to the supplementary leverage ratio

requirements to implement revisions to the Basel III leverage

framework finalized by the BCBS in January 2014. These

additional changes, among other things, modify the

methodology for including off-balance sheet items, including

credit derivatives, repo-style transactions and lines of credit, in

the denominator of the supplementary leverage ratio, and will

become effective on January 1, 2018. In addition, as discussed in

the “Risk Management - Asset/Liability Management - Liquidity

and Funding” section in this Report, a final rule regarding the

U.S. implementation of the Basel III LCR was issued by the FRB,

OCC and FDIC in September 2014.

The FRB has also indicated that it is in the process of

considering new rules to address the amount of equity and

unsecured debt a company must hold to facilitate its orderly

liquidation, often referred to as Total Loss Absorbing Capacity

(TLAC). In November 2014, the Financial Stability Board (FSB)

issued for public consultation policy proposals on TLAC. Under

the FSB’s TLAC proposal, global systemically important banks

(G-SIBs) would be required to hold loss absorbing equity and

unsecured debt of 16-20% of RWAs, with at least 33% of this

total being unsecured debt rather than equity. The FRB will

likely propose related rules sometime after the FSB’s public

consultation on the TLAC proposal ends.

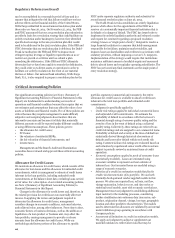

In addition, in December 2014, the FRB proposed rules to

implement an additional CET1 capital surcharge on those U.S.

banking organizations, such as the Company, that have been

designated by the FSB as G-SIBs. The G-SIB surcharge would be

in addition to the minimum Basel III 7.0% CET1 requirement.

Under the FRB proposal, a G-SIB would calculate its surcharge

under two methods and use the higher of the two surcharges.

The first method would consider the G-SIB’s size,

interconnectedness, cross-jurisdictional activity, substitutability,

and complexity, consistent with a methodology developed by the

BCBS and FSB. The second would use similar inputs, but would

replace substitutability with use of short-term wholesale funding

and would generally result in higher surcharges than the BCBS

methodology. Under the FRB proposal, estimated surcharges for

G-SIBs would range from 1.0 to 4.5 percent of a firm’s RWAs.

The G-SIB surcharge would be phased in beginning on

January 1, 2016 and become fully effective on January 1, 2019.

The FSB, in an updated listing published in November 2014

based on year-end 2013 data, identified the Company as one of

the 30 G-SIBs.

Capital Planning and Stress Testing

Under the FRB’s capital plan rule, large BHCs are required to

submit capital plans annually for review to determine if the FRB

has any objections before making any capital distributions. The

rule requires updates to capital plans in the event of material

changes in a BHC’s risk profile, including as a result of any

significant acquisitions. The FRB assesses the overall financial

condition, risk profile, and capital adequacy of BHCs while

considering both quantitative and qualitative factors when

evaluating capital plans.

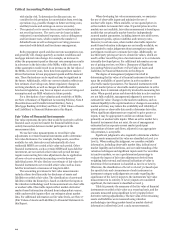

On March 26, 2014, the FRB notified us that it did not

object to our 2014 capital plan included in the 2014 CCAR. Since

the FRB notification, the Company took several capital actions

during 2014, including increasing its quarterly common stock

dividend rate to $0.35 per share and repurchasing shares of our

common stock.

Our 2015 CCAR, which was submitted on January 2, 2015,

included a comprehensive capital plan supported by an

assessment of expected uses and sources of capital over a given

planning horizon under a range of expected and stress scenarios,

similar to the process the FRB used to conduct the CCAR in

2014. As part of the 2015 CCAR, the FRB also generated a

supervisory stress test, which assumed a sharp decline in the

economy and significant decline in asset pricing using the

information provided by the Company to estimate performance.

The FRB is expected to review the supervisory stress results both

as required under the Dodd-Frank Act using a common set of

capital actions for all large BHCs and by taking into account the

Company’s proposed capital actions. The FRB has indicated that

it will publish its supervisory stress test results as required under

the Dodd-Frank Act, and the related CCAR results taking into

account the Company’s proposed capital actions, in March 2015.

In addition to CCAR, federal banking regulators also require

stress tests to evaluate whether an institution has sufficient

capital to continue to operate during periods of adverse

economic and financial conditions. These stress testing

requirements set forth the timing and type of stress test activities

large BHCs and banks must undertake as well as rules governing

stress testing controls, oversight and disclosure requirements.

The FRB recently finalized rules amending the existing capital

plan and stress testing rules to modify the start date of capital

plan and stress testing cycles and to limit a large BHC’s ability to

make capital distributions to the extent its actual capital

issuances were less than amounts indicated in its capital plan. As

required under the FRB’s stress testing rule, we completed a

mid-cycle stress test based on March 31, 2014, data and

scenarios developed by the Company. We submitted the results

of the mid-cycle stress test to the FRB in July 2014 and disclosed

a summary of the results in September 2014.

101