Wells Fargo 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

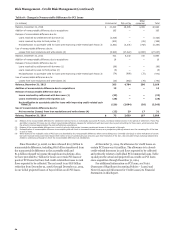

Pick-a-Pay Portfolio The Pick-a-Pay portfolio was one of the

consumer residential first mortgage portfolios we acquired from

Wachovia and a majority of the portfolio was identified as PCI

loans.

The Pick-a-Pay portfolio includes loans that offer payment

options (Pick-a-Pay option payment loans), and also includes

loans that were originated without the option payment feature,

loans that no longer offer the option feature as a result of our

modification efforts since the acquisition, and loans where the

customer voluntarily converted to a fixed-rate product. The Pick-

a-Pay portfolio is included in the consumer real estate 1-4 family

first mortgage class of loans throughout this Report. Table 26

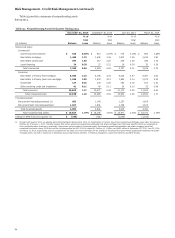

Table 26: Pick-a-Pay Portfolio - Comparison to Acquisition Date

provides balances by types of loans as of December 31, 2014, as a

result of modification efforts, compared to the types of loans

included in the portfolio at acquisition. Total adjusted unpaid

principal balance of PCI Pick-a-Pay loans was $26.3 billion at

December 31, 2014, compared with $61.0 billion at acquisition.

Primarily due to modification efforts, the adjusted unpaid

principal balance of option payment PCI loans has declined to

16% of the total Pick-a-Pay portfolio at December 31, 2014,

compared with 51% at acquisition.

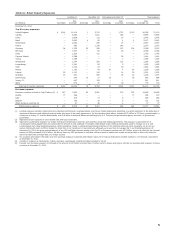

December 31, December 31,

2014 2008

Adjusted Adjusted

unpaid unpaid

principal principal

(in millions) balance (1) % of total balance (1) % of total

Option payment loans $ 20,258 41% $ 99,937 86%

Non-option payment adjustable-rate and fixed-rate loans 6,776 14 15,763 14

Full-term loan modifications 22,674 45 — —

Total adjusted unpaid principal balance $ 49,708 100% $ 115,700 100%

Total carrying value $ 45,002 $ 95,315

(1) Adjusted unpaid principal balance includes write-downs taken on loans where severe delinquency (normally 180 days) or other indications of severe borrower financial

stress exist that indicate there will be a loss of contractually due amounts upon final resolution of the loan.

Pick-a-Pay loans may have fixed or adjustable rates with

payment options that include a minimum payment, an interest-

only payment or fully amortizing payment (both 15 and 30 year

options). Total interest deferred due to negative amortization on

Pick-a-Pay loans was $606 million at December 31, 2014, and

$902 million at December 31, 2013. Approximately 95% of the

Pick-a-Pay customers making a minimum payment in

December 2014 did not defer interest, compared with 93% in

December 2013.

Deferral of interest on a Pick-a-Pay loan may continue as

long as the loan balance remains below a pre-defined principal

cap, which is based on the percentage that the current loan

balance represents to the original loan balance. A significant

portion of the Pick-a-Pay portfolio has a cap of 125% of the

original loan balance. Most of the Pick-a-Pay loans on which

there is a deferred interest balance re-amortize (the monthly

payment amount is reset or “recast”) on the earlier of the date

when the loan balance reaches its principal cap, or generally the

10-year anniversary of the loan. After a recast, the customers’

new payment terms are reset to the amount necessary to repay

the balance over the remainder of the original loan term.

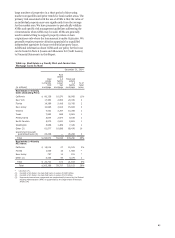

Due to the terms of the Pick-a-Pay portfolio, any remaining

recast risk is covered through our allowance for credit losses and

nonaccretable difference. Based on assumptions of a flat rate

environment, if all eligible customers elect the minimum

payment option 100% of the time and no balances prepay, we

would expect the following balances of loans to recast based on

reaching the principal cap and also experiencing a payment

change over the annual 7.5% reset: $56 million in 2015,

$29 million in 2016, $26 million in 2017, $0.4 million in 2018

and $0.2 million in 2019. In addition, in a flat rate environment,

we would expect the following balances of loans to start fully

amortizing due to reaching their recast anniversary date and also

having a payment change over the annual 7.5% reset:

$339 million in 2015, $395 million in 2016, $1,496 million in

2017, $208 million in 2018 and $4 million in 2019. In 2014, the

amount of loans reaching their recast anniversary date and also

having a payment change over the annual 7.5% reset was

$96 million.

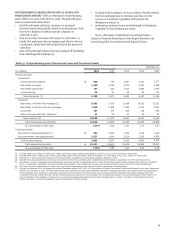

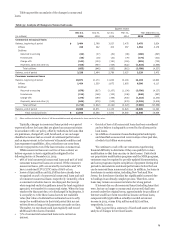

Table 27 reflects the geographic distribution of the Pick-a-

Pay portfolio broken out between PCI loans and all other loans.

The LTV ratio is a useful metric in predicting future real estate

1-4 family first mortgage loan performance, including potential

charge-offs. Because PCI loans were initially recorded at fair

value, including write-downs for expected credit losses, the ratio

of the carrying value to the current collateral value will be lower

compared with the LTV based on the adjusted unpaid principal

balance. For informational purposes, we have included both

ratios for PCI loans in the following table.

69