Wells Fargo 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Earnings Performance (continued)

Operating Segments

We are organized for management reporting purposes into three

operating segments: Community Banking; Wholesale Banking;

and Wealth, Brokerage and Retirement (WBR). These segments

are defined by product type and customer segment and their

results are based on our management accounting process, for

which there is no comprehensive, authoritative financial

accounting guidance equivalent to generally accepted accounting

principles (GAAP). In addition to measuring financial

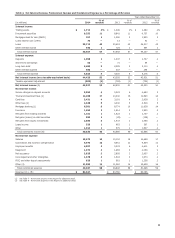

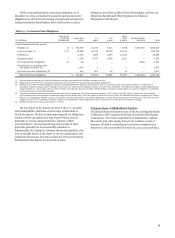

Table 9: Operating Segment Results – Highlights

performance, each of our operating segments monitors cross-sell

metrics to measure the extent they are satisfying our customers’

financial needs. The following discussion presents our

methodology for measuring cross-sell for each of our operating

segments, and along with Tables 9, 9a, 9b and 9c, presents our

results by operating segment. For additional financial

information and the underlying management accounting

process, see Note 24 (Operating Segments) to Financial

Statements in this Report.

Year ended December 31,

Wealth,

(in millions, except average balances which are in billions) Community

Banking Wholesale

Banking

Brokerage

and

Retirement Other (1) Consolidated

Company

2014

Revenue $ 50,862 23,482 14,218 (4,215) 84,347

Provision (reversal of provision) for credit losses 1,681 (266) (50) 30 1,395

Net income (loss) 14,180 7,584 2,083 (790) 23,057

Average loans $ 503.2 313.4 52.1 (34.3) 834.4

Average core deposits 642.3 274.0 154.9 (67.6) 1,003.6

2013

Revenue $ 50,339 24,064 13,203 (3,826) 83,780

Provision (reversal of provision) for credit losses 2,755 (445) (16) 15 2,309

Net income (loss) 12,732 8,133 1,712 (699) 21,878

Average loans $ 499.3 287.7 46.1 (30.4) 802.7

Average core deposits 620.1 237.2 150.1 (65.3) 942.1

2012

Revenue $ 53,405 24,092 12,160 (3,571) 86,086

Provision (reversal of provision) for credit losses 6,835 286 125 (29) 7,217

Net income (loss) 10,492 7,774 1,328 (697) 18,897

Average loans $ 487.1 273.8 42.7 (28.4) 775.2

Average core deposits 591.2 227.0 137.5 (61.8) 893.9

(1) Includes items not assigned to a specific business segment and elimination of certain items that are included in more than one business segment, substantially all of which

represents products and services for wealth management customers provided in Community Banking stores.

Cross-sell Our cross-sell strategy is to increase the number of

products our customers use by offering them all of the financial

products that satisfy their financial needs. We track our cross-

sell activities based on whether the customer is a retail banking

household or has a wholesale banking relationship. A retail

banking household is a household that uses at least one of the

following retail products - a demand deposit account, savings

account, savings certificate, individual retirement account (IRA)

certificate of deposit, IRA savings account, personal line of

credit, personal loan, home equity line of credit or home equity

loan. A household is determined based on aggregating all

accounts with the same address. For our wholesale banking

relationships, we aggregate all related entities under common

ownership or control.

We report cross-sell metrics for our Community Banking

and WBR operating segments based on the average number of

retail products used per retail banking household. For

Community Banking the cross-sell metric represents the

relationship of all retail products used by customers in retail

banking households. For WBR the cross-sell metric represents

the relationship of all retail products used by customers in retail

banking households who are also WBR customers.

Products included in our retail banking household cross-sell

metrics must be retail products and have the potential for

revenue generation and long-term viability. Products and

services that generally do not meet these criteria - such as ATM

cards, online banking and direct deposit - are not included. In

addition, multiple holdings by a brokerage customer within an

investment category, such as common stock, mutual funds or

bonds, are counted as a single product. We may periodically

update the products included in our cross-sell metrics to

account for changes in our product offerings.

For our Wholesale Banking operating segment cross-sell

represents the average number of Wholesale Banking (non-

retail) products used per Wholesale Banking customer

relationship. What we include as products in the cross-sell

metric comes from a defined set of revenue generating products

within the following product families: credit, treasury

management, deposits, risk management, foreign exchange,

capital markets and advisory, investments, insurance, trade

financing, and trust and servicing. The number of customer

relationships is based on tax identification numbers adjusted to

combine those entities under common ownership or another

structure indicative of a single relationship and includes only

relationships that produced revenue for the period of

measurement.

44