Wells Fargo 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management - Credit Risk Management (continued)

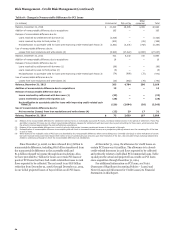

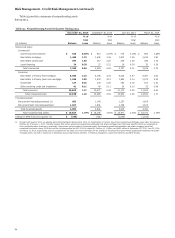

Table 27: Pick-a-Pay Portfolio (1)

December 31, 2014

PCI loans All other loans

Ratio of Ratio of

Adjusted carrying carrying

unpaid Current value to value to

principal LTV Carrying current Carrying current

(in millions) balance (2) ratio (3) value (4) value (5) value (4) value (5)

California $ 18,257 77% $ 15,001 62% $ 11,426 57%

Florida 2,108 87 1,523 59 2,375 71

New Jersey 890 83 768 65 1,527 70

New York 564 77 522 64 714 67

Texas 233 62 206 54 920 50

Other states 4,252 82 3,493 65 6,527 69

Total Pick-a-Pay loans $ 26,304 $ 21,513 $ 23,489

(1) The individual states shown in this table represent the top five states based on the total net carrying value of the Pick-a-Pay loans at the beginning of 2014.

(2) Adjusted unpaid principal balance includes write-downs taken on loans where severe delinquency (normally 180 days) or other indications of severe borrower financial

stress exist that indicate there will be a loss of contractually due amounts upon final resolution of the loan.

(3) The current LTV ratio is calculated as the adjusted unpaid principal balance divided by the collateral value. Collateral values are generally determined using automated

valuation models (AVM) and are updated quarterly. AVMs are computer-based tools used to estimate market values of homes based on processing large volumes of market

data including market comparables and price trends for local market areas.

(4) Carrying value, which does not reflect the allowance for loan losses, includes remaining purchase accounting adjustments, which, for PCI loans may include the

nonaccretable difference and the accretable yield and, for all other loans, an adjustment to mark the loans to a market yield at date of merger less any subsequent charge-

offs.

(5) The ratio of carrying value to current value is calculated as the carrying value divided by the collateral value.

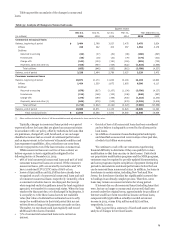

To maximize return and allow flexibility for customers to

avoid foreclosure, we have in place several loss mitigation

strategies for our Pick-a-Pay loan portfolio. We contact

customers who are experiencing financial difficulty and may in

certain cases modify the terms of a loan based on a customer’s

documented income and other circumstances.

We also have taken steps to work with customers to refinance

or restructure their Pick-a-Pay loans into other loan products.

For customers at risk, we offer combinations of term extensions

of up to 40 years (from 30 years), interest rate reductions,

forbearance of principal, and, in certain cases we may offer

principal forgiveness to customers with substantial property

value declines based on affordability needs.

In 2014, we completed more than 5,300 proprietary and

Home Affordability Modification Program (HAMP) Pick-a-Pay

loan modifications. We have completed nearly 130,000

modifications since the Wachovia acquisition, resulting in $6.0

billion of principal forgiveness to our Pick-a-Pay customers.

There remains $30 million of conditional forgiveness that can be

earned by borrowers through performance over a three year

period.

Due to better than expected performance observed on the

Pick-a-Pay PCI portfolio compared with the original acquisition

estimates, we have reclassified $6.0 billion from the

nonaccretable difference to the accretable yield since acquisition.

Our cash flows expected to be collected have been favorably

affected by lower expected defaults and losses as a result of

observed and forecasted economic strengthening, particularly in

housing prices, and our loan modification efforts. These factors

are expected to reduce the frequency and severity of defaults and

keep these loans performing for a longer period, thus increasing

future principal and interest cash flows. The resulting increase in

the accretable yield will be realized over the remaining life of the

portfolio, which is estimated to have a weighted-average

remaining life of approximately 11.7 years at December 31, 2014,

down from 12.7 years at December 31, 2013, primarily reflecting

the passage of time. The accretable yield percentage at

December 31, 2014 was 6.15%, up from 4.98% at the end of 2013

due to favorable changes in the expected timing and composition

of cash flows resulting from improving credit and prepayment

expectations. Fluctuations in the accretable yield are driven by

changes in interest rate indices for variable rate PCI loans,

prepayment assumptions, and expected principal and interest

payments over the estimated life of the portfolio, which will be

affected by the pace and degree of improvements in the U.S.

economy and housing markets and projected lifetime

performance resulting from loan modification activity. Changes

in the projected timing of cash flow events, including loan

liquidations, modifications and short sales, can also affect the

accretable yield rate and the estimated weighted-average life of

the portfolio.

The predominant portion of our PCI loans is included in the

Pick-a-Pay portfolio. For further information on the judgment

involved in estimating expected cash flows for PCI loans, see the

“Critical Accounting Policies – Purchased Credit-Impaired

Loans” section and Note 1 (Summary of Significant Accounting

Policies) to Financial Statements in this Report.

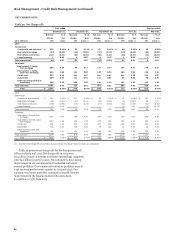

Junior Lien Mortgage Portfolio The junior lien mortgage

portfolio consists of residential mortgage lines and loans that are

subordinate in rights to an existing lien on the same property. It

is not unusual for these lines and loans to have draw periods,

interest only payments, balloon payments, adjustable rates and

similar features. The majority of our junior lien loan products

are amortizing payment loans with fixed interest rates and

repayment periods between five to 30 years.

We continuously monitor the credit performance of our

junior lien mortgage portfolio for trends and factors that

influence the frequency and severity of loss. We have observed

that the severity of loss for junior lien mortgages is high and

generally not affected by whether we or a third party own or

service the related first mortgage, but the frequency of

delinquency is typically lower when we own or service the first

lien mortgage. In general, we have limited information available

on the delinquency status of the third party owned or serviced

senior lien where we also hold a junior lien. To capture this

inherent loss content, we use the experience of our junior lien

mortgages behind delinquent first liens that are owned or

70