Wells Fargo 2014 Annual Report Download - page 250

Download and view the complete annual report

Please find page 250 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

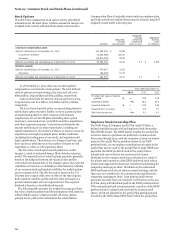

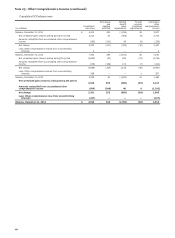

Note 21: Income Taxes

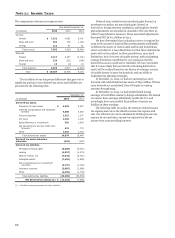

The components of income tax expense were:

Year ended December 31,

(in millions) 2014 2013 2012

Current:

Federal $ 7,321 4,601 9,141

State and local 520 736 1,198

Foreign 112 91 61

Total current 7,953 5,428 10,400

Deferred:

Federal 2,117 4,457 (1,151)

State and local 224 522 (166)

Foreign 13 (2) 20

Total deferred 2,354 4,977 (1,297)

Total $ 10,307 10,405 9,103

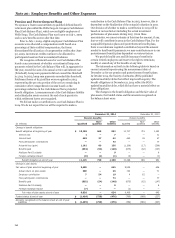

The tax effects of our temporary differences that gave rise to

significant portions of our deferred tax assets and liabilities are

presented in the following table.

December 31,

(in millions) 2014 2013

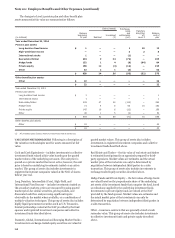

Deferred tax assets

Allowance for loan losses $ 4,592 5,227

Deferred compensation and employee

benefits 4,608 4,283

Accrued expenses 1,213 1,247

PCI loans 1,935 2,150

Basis difference in investments 382 1,084

Net operating loss and tax credit carry

forwards 631 773

Other 1,318 1,720

Total deferred tax assets 14,679 16,484

Deferred tax assets valuation

allowance (426) (457)

Deferred tax liabilities

Mortgage servicing rights (5,860) (6,657)

Leasing (4,057) (4,274)

Mark to market, net (7,635) (5,761)

Intangible assets (1,494) (1,885)

Net unrealized gains on investment

securities (2,737) (1,155)

Insurance reserves (2,087) (2,068)

Other (1,635) (1,733)

Total deferred tax liabilities (25,505) (23,533)

Net deferred tax liability (1) $ (11,252) (7,506)

(1) Included in accrued expenses and other liabilities.

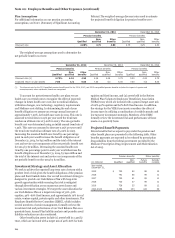

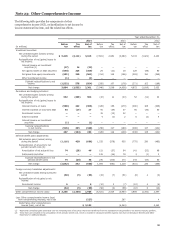

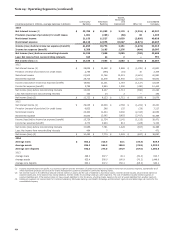

Deferred taxes related to net unrealized gains (losses) on

investment securities, net unrealized gains (losses) on

derivatives, foreign currency translation, and employee benefit

plan adjustments are recorded in cumulative OCI (see Note 23

(Other Comprehensive Income)). These associated adjustments

decreased OCI by $1.3 billion in 2014.

We have determined that a valuation reserve is required for

2014 in the amount of $426 million predominantly attributable

to deferred tax assets in various state and foreign jurisdictions

where we believe it is more likely than not that these deferred tax

assets will not be realized. In these jurisdictions, carry back

limitations, lack of sources of taxable income, and tax planning

strategy limitations contributed to our conclusion that the

deferred tax assets would not be realizable. We have concluded

that it is more likely than not that the remaining deferred tax

assets will be realized based on our history of earnings, sources

of taxable income in carry back periods, and our ability to

implement tax planning strategies.

At December 31, 2014, we had net operating loss carry

forwards with related deferred tax assets of $631 million. If these

carry forwards are not utilized, they will expire in varying

amounts through 2034.

At December 31, 2014, we had undistributed foreign

earnings of $1.8 billion related to foreign subsidiaries. We intend

to reinvest these earnings indefinitely outside the U.S. and

accordingly have not provided $513 million of income tax

liability on these earnings.

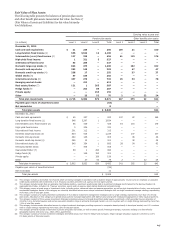

The following table reconciles the statutory federal income

tax expense and rate to the effective income tax expense and

rate. Our effective tax rate is calculated by dividing income tax

expense by income before income tax expense less the net

income from noncontrolling interests.

248