Wells Fargo 2014 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

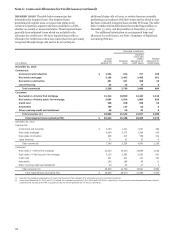

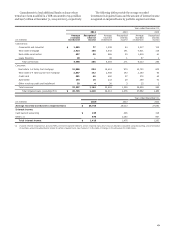

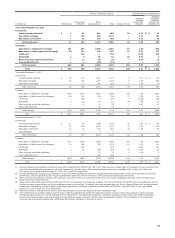

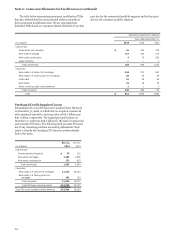

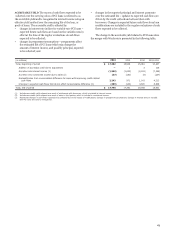

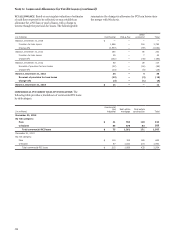

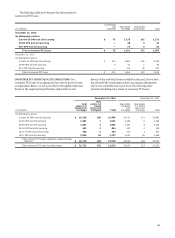

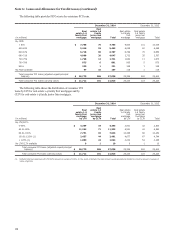

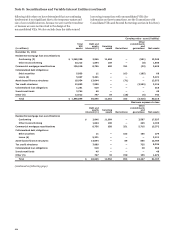

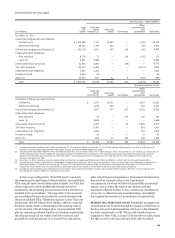

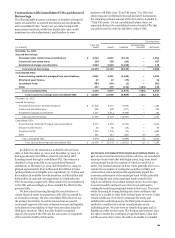

Note 8: Securitizations and Variable Interest Entities

Involvement with SPEs

In the normal course of business, we enter into various types of

on- and off-balance sheet transactions with special purpose

entities (SPEs), which are corporations, trusts or partnerships

that are established for a limited purpose. Generally, SPEs are

formed in connection with securitization transactions. In a

securitization transaction, assets from our balance sheet are

transferred to an SPE, which then issues to investors various

forms of interests in those assets and may also enter into

derivative transactions. In a securitization transaction, we

typically receive cash and/or other interests in an SPE as

proceeds for the assets we transfer. Also, in certain transactions,

we may retain the right to service the transferred receivables and

to repurchase those receivables from the SPE if the outstanding

balance of the receivables falls to a level where the cost exceeds

the benefits of servicing such receivables. In addition, we may

purchase the right to service loans in an SPE that were

transferred to the SPE by a third party.

In connection with our securitization activities, we have

various forms of ongoing involvement with SPEs, which may

include:

• underwriting securities issued by SPEs and subsequently

making markets in those securities;

• providing liquidity facilities to support short-term

obligations of SPEs issued to third party investors;

• providing credit enhancement on securities issued by SPEs

or market value guarantees of assets held by SPEs through

the use of letters of credit, financial guarantees, credit

default swaps and total return swaps;

• entering into other derivative contracts with SPEs;

• holding senior or subordinated interests in SPEs;

• acting as servicer or investment manager for SPEs; and

• providing administrative or trustee services to SPEs.

SPEs are generally considered variable interest entities

(VIEs). A VIE is an entity that has either a total equity

investment that is insufficient to finance its activities without

additional subordinated financial support or whose equity

investors lack the ability to control the entity’s activities or lack

the ability to receive expected benefits or absorb obligations in a

manner that’s consistent with their investment in the entity. A

VIE is consolidated by its primary beneficiary, the party that has

both the power to direct the activities that most significantly

impact the VIE and a variable interest that could potentially be

significant to the VIE. A variable interest is a contractual,

ownership or other interest that changes with changes in the fair

value of the VIE’s net assets. To determine whether or not a

variable interest we hold could potentially be significant to the

VIE, we consider both qualitative and quantitative factors

regarding the nature, size and form of our involvement with the

VIE. We assess whether or not we are the primary beneficiary of

a VIE on an on-going basis.

We have segregated our involvement with VIEs between

those VIEs which we consolidate, those which we do not

consolidate and those for which we account for the transfers of

financial assets as secured borrowings. Secured borrowings are

transactions involving transfers of our financial assets to third

parties that are accounted for as financings with the assets

pledged as collateral. Accordingly, the transferred assets remain

recognized on our balance sheet. Subsequent tables within this

Note further segregate these transactions by structure type.

180