Wells Fargo 2014 Annual Report Download - page 247

Download and view the complete annual report

Please find page 247 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

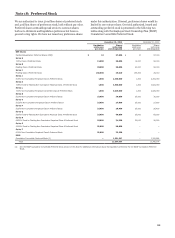

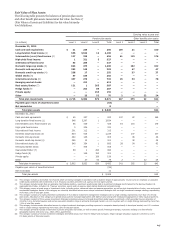

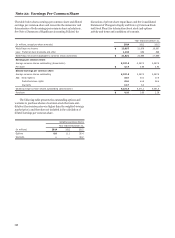

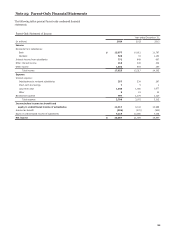

Fair Value of Plan Assets

The following table presents the balances of pension plan assets

and other benefit plan assets measured at fair value. See Note 17

(Fair Values of Assets and Liabilities) for fair value hierarchy

level definitions.

Carrying value at year end

Pension plan assets Other benefits plan assets

(in millions) Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

December 31, 2014

Cash and cash equivalents $ 31 224 — 255 139 21 — 160

Long duration fixed income (1) 556 3,622 12 4,190 — — — —

Intermediate (core) fixed income (2) 127 329 — 456 61 115 — 176

High-yield fixed income 1 321 5 327 — — — —

International fixed income 53 284 — 337 — — — —

Domestic large-cap stocks (3) 833 375 — 1,208 — 102 — 102

Domestic mid-cap stocks 252 140 — 392 — 47 — 47

Domestic small-cap stocks (4) 238 17 — 255 — 37 — 37

Global stocks (5) 47 155 — 202 — — — —

International stocks (6) 457 276 — 733 25 53 — 78

Emerging market stocks — 412 — 412 — — — —

Real estate/timber (7) 121 1 265 387 — — — —

Hedge funds (8) — 203 84 287 — — — —

Private equity — — 155 155 — — — —

Other — 23 52 75 2 — 22 24

Total plan investments $ 2,716 6,382 573 9,671 227 375 22 624

Payable upon return of securities loaned (53) —

Net receivables 8 —

Total plan assets $ 9,626 624

December 31, 2013

Cash and cash equivalents $ 65 357 — 422 147 22 — 169

Long duration fixed income (1) 546 3,287 1 3,834 — — — —

Intermediate (core) fixed income (2) 86 339 — 425 64 115 — 179

High-yield fixed income 5 326 — 331 — — — —

International fixed income 201 112 — 313 — — — —

Domestic large-cap stocks (3) 824 415 — 1,239 — 107 — 107

Domestic mid-cap stocks 260 145 — 405 — 46 — 46

Domestic small-cap stocks (4) 286 15 — 301 — 38 — 38

International stocks (6) 540 354 1 895 28 54 — 82

Emerging market stocks — 405 — 405 — — — —

Real estate/timber (7) 89 1 294 384 — — — —

Hedge funds (8) — 149 152 301 — — — —

Private equity — — 158 158 — — — —

Other — 27 52 79 2 — 22 24

Total plan investments $ 2,902 5,932 658 9,492 241 382 22 645

Payable upon return of securities loaned (94) —

Net receivables 11 —

Total plan assets $ 9,409

(1) This category includes a diversified mix of assets which are being managed in accordance with a duration target of approximately 10 years and an emphasis on corporate

credit bonds combined with investments in U.S. Treasury securities and other U.S. agency and non-agency bonds.

(2) This category includes assets that are primarily intermediate duration, investment grade bonds held in investment strategies benchmarked to the Barclays Capital U.S.

Aggregate Bond Index. Includes U.S. Treasury securities, agency and non-agency asset-backed bonds and corporate bonds.

(3) This category covers a broad range of investment styles, including active, enhanced index and passive approaches, as well as style characteristics of value, core and growth

emphasized strategies. Assets in this category are currently diversified across seven unique investment strategies with no single investment manager strategy representing

more than 2.5% of total plan assets.

(4) This category consists of a highly diversified combination of four distinct investment management strategies with no single strategy representing more than 2% of total

plan assets. Allocations in this category are spread across actively managed approaches with distinct value and growth emphasized approaches in fairly equal proportions.

(5) This category consists of three unique investment strategies providing exposure to broadly diversified, global equity investments, which generally have an allocation of

40-60% in U.S. domiciled equities and and an equivalent allocation range in primarily developed market, non-U.S. equities, with no single strategy representing more than

1.5% of total Plan assets.

(6) This category includes assets diversified across six unique investment strategies providing exposure to companies based primarily in developed market, non-U.S. countries

with no single strategy representing more than 2.5% of total plan assets.

(7) This category primarily includes investments in private and public real estate, as well as timber specific limited partnerships; real estate holdings are diversified by

geographic location and sector (e.g., retail, office, apartments).

(8) This category consists of several investment strategies diversified across more than 30 hedge fund managers. Single manager allocation exposure is limited to 0.15%

(15 basis points) of total plan assets.

645

245