Wells Fargo 2014 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 1: Summary of Significant Accounting Policies (continued)

enforceability of the arrangement, it is our policy to present

derivatives balances and related cash collateral amounts net on

the balance sheet. Counterparty credit risk related to derivatives

is considered in determining fair value and our assessment of

hedge effectiveness.

Private Share Repurchases

During 2014 and 2013, we repurchased approximately

66 million shares and 40 million shares of our common stock,

respectively, under private forward repurchase contracts. We

enter into these transactions with unrelated third parties to

complement our open-market common stock repurchase

strategies, to allow us to manage our share repurchases in a

manner consistent with our capital plans, currently submitted

under the 2014 Comprehensive Capital Analysis and Review

(CCAR), and to provide an economic benefit to the Company.

Our payments to the counterparties for these private share

repurchase contracts are recorded in permanent equity in the

quarter paid and are not subject to re-measurement. The

classification of the up-front payments as permanent equity

assures that we have appropriate repurchase timing consistent

with our 2014 capital plan, which contemplated a fixed dollar

amount available per quarter for share repurchases pursuant to

Federal Reserve Board (FRB) supervisory guidance. In return,

the counterparty agrees to deliver a variable number of shares

based on a per share discount to the volume-weighted average

stock price over the contract period. There are no scenarios

where the contracts would not either physically settle in shares

or allow us to choose the settlement method.

In fourth quarter 2014, we entered into a private forward

repurchase contract and paid $750 million to an unrelated third

party. This contract settled in first quarter 2015 for 14.3 million

shares of common stock. At December 31, 2013, we had a

$500 million private forward repurchase contract outstanding

that settled in first quarter 2014 for 11.1 million shares of

common stock. Our total number of outstanding shares of

common stock is not reduced until settlement of the private

share repurchase contract.

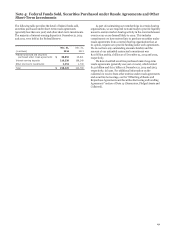

SUPPLEMENTAL CASH FLOW INFORMATION Noncash

activities are presented below, including information on

transfers affecting MHFS, LHFS, and MSRs.

Year ended December 31,

(in millions) 2014 2013 2012

Trading assets retained from securitizations of MHFS

Capitalization of MSRs from sale of MHFS

Transfers from loans to MHFS

Transfers from loans to LHFS

Transfers from loans to foreclosed and other assets (1)

Transfers from available-for-sale to held-to-maturity securities

$ 28,604

1,302

11,021

9,849

4,094

1,810

47,198

3,616

7,610

274

4,470

6,042

85,108

4,988

7,584

143

6,114

—

(1) Includes $2.5 billion, $2.7 billion and $3.5 billion in transfers of government insured/guaranteed loans for the years ended December 31, 2014, 2013 and 2012,

respectively. During fourth quarter 2014, we adopted Accounting Standards Update (ASU) 2014-14, Classification of Certain Government-Guaranteed Mortgage Loans Upon

Foreclosure, effective as of January 1, 2014, resulting in the transfer of these loans to accounts receivables for the year ended December 31, 2014.

SUBSEQUENT EVENTS We have evaluated the effects of events

that have occurred subsequent to December 31, 2014, and there

have been no material events that would require recognition in

our 2014 consolidated financial statements or disclosure in the

Notes to the consolidated financial statements.

148