Wells Fargo 2014 Annual Report Download - page 44

Download and view the complete annual report

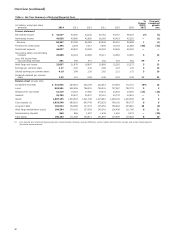

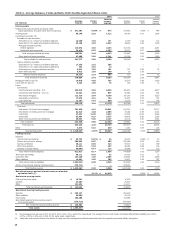

Please find page 44 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Earnings Performance (continued)

compared with 0.88% at December 31, 2013 and 0.67% at

December 31, 2012. See the “Risk Management – Asset/Liability

Management – Mortgage Banking Interest Rate and Market

Risk” section in this Report for additional information regarding

our MSRs risks and hedging approach.

Net gains on mortgage loan origination/sale activities were

$3.0 billion in 2014, compared with $6.9 billion in 2013 and

$10.3 billion in 2012. The decrease from 2013 and 2012 was

primarily driven by lower origination volume and margins.

Mortgage loan originations were $175 billion in 2014, of which

68% were for home purchases, compared with $351 billion and

47%, respectively, for 2013 and $524 billion and 35%,

respectively, for 2012. Mortgage applications were $262 billion

in 2014, compared with $438 billion in 2013 and $736 billion in

2012. The 1-4 family first mortgage unclosed pipeline was

$26 billion at December 31, 2014, compared with $25 billion at

December 31, 2013 and $81 billion at December 31, 2012. For

additional information about our mortgage banking activities

and results, see the “Risk Management – Asset/Liability

Management – Mortgage Banking Interest Rate and Market

Risk” section and Note 9 (Mortgage Banking Activities) and

Note 17 (Fair Values of Assets and Liabilities) to Financial

Statements in this Report.

Net gains on mortgage loan origination/sales activities

include adjustments to the mortgage repurchase liability.

Mortgage loans are repurchased from third parties based on

standard representations and warranties, and early payment

default clauses in mortgage sale contracts. For 2014, we released

a net $140 million from the repurchase liability, compared with

a provision of $428 million for 2013 and $1.9 billion for 2012.

For additional information about mortgage loan repurchases, see

the “Risk Management – Credit Risk Management – Liability for

Mortgage Loan Repurchase Losses” section and Note 9

(Mortgage Banking Activities) to Financial Statements in this

Report.

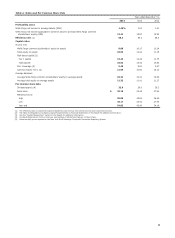

We engage in trading activities primarily to accommodate

the investment activities of our customers, execute economic

hedging to manage certain of our balance sheet risks and for a

very limited amount of proprietary trading for our own account.

Net gains (losses) from trading activities, which reflect

unrealized changes in fair value of our trading positions and

realized gains and losses, were $1.2 billion in 2014, $1.6 billion

in 2013 and $1.7 billion in 2012. The year-over-year decrease in

2014 was driven by lower trading from customer

accommodation activity within our capital markets business and

lower deferred compensation gains (offset in employee benefits

expense), and the decrease in 2013 from 2012 was largely driven

by lower results in customer accommodation activity. Net gains

from trading activities do not include interest and dividend

income and expense on trading securities. Those amounts are

reported within interest income from trading assets and other

interest expense from trading liabilities. Interest and fees related

to proprietary trading are reported in their corresponding

income statement line items. Proprietary trading activities are

not significant to our client-focused business model. For

additional information about proprietary and other trading, see

the “Risk Management – Asset/Liability Management – Market

Risk – Trading Activities” section in this Report.

Net gains on debt and equity securities totaled $3.0 billion

for 2014 and $1.4 billion for both 2013 and 2012, after other-

than-temporary impairment (OTTI) write-downs of

$322 million, $344 million and $416 million, respectively, for

the same periods. The increase in net gains on debt and equity

securities reflected the benefit of strong public and private equity

markets.

All other income was $456 million for 2014 compared with

$113 million in 2013 and $1.1 billion in 2012. All other income

includes ineffectiveness recognized on derivatives that qualify

for hedge accounting, losses on low-income housing tax credit

investments, foreign currency adjustments and income from

investments accounted for under the equity method, any of

which can cause decreases and net losses in other income.

Higher other income for 2014 compared with a year ago

primarily reflected larger ineffectiveness gains on derivatives

that qualify for hedge accounting, a gain on sale of government-

guaranteed student loans in fourth quarter 2014, and a gain on

sale of 40 insurance offices in second quarter 2014. These were

partially offset by lower income from equity method

investments.

42