Wells Fargo 2014 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

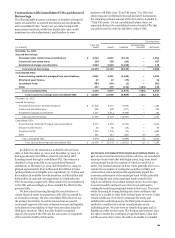

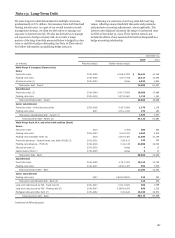

Note 13: Long-Term Debt (continued)

(continued from previous page)

(in millions) Maturity date(s) Stated interest rate(s)

Other consolidated subsidiaries

Senior

Fixed-rate notes 2015-2023 2.774-4.38% 6,317 6,543

FixFloat notes 2020 6.795% through 2015, Varies 20 20

Structured notes (1) 2021 Varies 1 —

Total senior debt - Other consolidated subsidiaries 6,338 6,563

Junior subordinated

Floating-rate notes 2027 0.733% 155 155

Total junior subordinated debt - Other consolidated

subsidiaries (3) 155 155

Long-term debt issued by VIE - Fixed rate (6) 2015 5.16% 23 18

Long-term debt issued by VIE - Floating rate (6) — 10

Mortgage notes and other (7) 2015-2022 1.563-5.920 175 173

Total long-term debt - Other consolidated subsidiaries 6,691 6,919

Total long-term debt $ 183,943 152,998

December 31,

2014 2013

(1) Predominantly consists of long-term notes where the performance of the note is linked to an embedded equity, commodity, or currency index, or basket of indices

accounted for separately from the note as a free-standing derivative. For information on embedded derivatives, see the "Derivatives Not Designated as Hedging

Instruments" section in Note 16 (Derivatives). In addition, a major portion consists of zero coupon callable notes where interest is paid as part of the final redemption

amount.

(2) Includes fixed-rate subordinated notes issued by the Parent at a discount of $139 million and $140 million in 2014 and 2013, respectively, to effect a modification of

Wells Fargo Bank, NA notes. These notes are carried at their par amount on the balance sheet of the Parent presented in Note 25 (Parent-Only Financial Statements).

(3) Represents junior subordinated debentures held by unconsolidated wholly-owned trusts formed for the sole purpose of issuing trust preferred securities. See Note 8

(Securitizations and Variable Interest Entities) for additional information on our trust preferred security structures.

(4) Represents floating-rate extendible notes where holders of the notes may elect to extend the contractual maturity of all or a portion of the principal amount on a periodic

basis.

(5) At December 31, 2014, Federal Home Loan Bank advances were secured by investment securities and residential loan collateral. Outstanding advances at

December 31, 2013, were secured by residential loan collateral.

(6) For additional information on VIEs, see Note 8 (Securitizations and Variable Interest Entities).

(7) Predominantly related to securitizations and secured borrowings, see Note 8 (Securitizations and Variable Interest Entities).

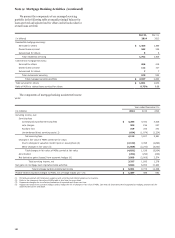

The aggregate carrying value of long-term debt that matures

(based on contractual payment dates) as of December 31, 2014,

in each of the following five years and thereafter, is presented in

the following table.

(in millions) Parent Company

2015 $ 9,014 16,606

2016 15,238 32,920

2017 13,215 17,870

2018 8,312 27,029

2019 6,480 25,190

Thereafter 44,877 64,328

Total $ 97,136 183,943

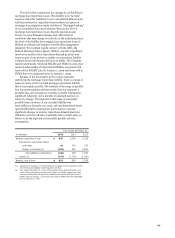

As part of our long-term and short-term borrowing

arrangements, we are subject to various financial and

operational covenants. Some of the agreements under which

debt has been issued have provisions that may limit the merger

or sale of certain subsidiary banks and the issuance of capital

stock or convertible securities by certain subsidiary banks. At

December 31, 2014, we were in compliance with all the

covenants.

198