Wells Fargo 2014 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

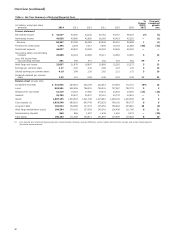

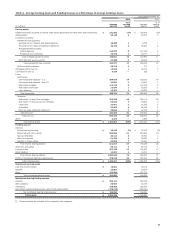

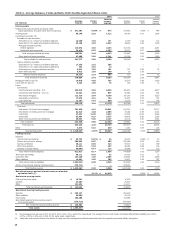

Table 5: Average Balances, Yields and Rates Paid (Taxable-Equivalent Basis) (1)(2)

2014 2013

Interest Interest

Average Yields/ income/ Average Yields/ income/

(in millions) balance rates expense balance rates expense

Earning assets

Federal funds sold, securities purchased under

resale agreements and other short-term investments $ 241,282 0.28% $ 673 154,902 0.32% $ 489

Trading assets 55,140 3.10 1,712 44,745 3.14 1,406

Investment securities (3):

Available-for-sale securities:

Securities of U.S. Treasury and federal agencies 10,400 1.64 171 6,750 1.66 112

Securities of U.S. states and political subdivisions 43,138 4.29 1,852 39,922 4.38 1,748

Mortgage-backed securities:

Federal agencies 114,076 2.84 3,235 107,148 2.83 3,031

Residential and commercial 26,475 6.03 1,597 30,717 6.47 1,988

Total mortgage-backed securities 140,551 3.44 4,832 137,865 3.64 5,019

Other debt and equity securities 47,488 3.66 1,741 55,002 3.53 1,940

Total available-for-sale securities 241,577 3.56 8,596 239,539 3.68 8,819

Held-to-maturity securities:

Securities of U.S. Treasury and federal agencies 17,239 2.23 385 — — —

Securities of U.S. states and political subdivisions 246 4.93 12 — — —

Federal agency mortgage-backed securities 5,921 2.55 151 701 3.09 22

Other debt securities 5,913 1.85 109 16 1.99 —

Held-to-maturity securities 29,319 2.24 657 717 3.06 22

Total investment securities 270,896 3.42 9,253 240,256 3.68 8,841

Mortgages held for sale (4) 19,018 4.03 767 35,273 3.66 1,290

Loans held for sale (4) 4,226 1.85 78 163 7.95 13

Loans:

Commercial:

Commercial and industrial - U.S. 204,819 3.35 6,869 185,813 3.66 6,807

Commercial and industrial - non U.S. 42,661 2.03 867 40,987 2.03 832

Real estate mortgage 112,710 3.64 4,100 107,316 3.94 4,233

Real estate construction 17,676 4.21 744 16,537 4.76 787

Lease financing 12,257 5.63 690 12,373 6.10 755

Total commercial 390,123 3.40 13,270 363,026 3.70 13,414

Consumer:

Real estate 1-4 family first mortgage 261,620 4.19 10,961 254,012 4.22 10,717

Real estate 1-4 family junior lien mortgage 62,510 4.30 2,686 70,264 4.29 3,014

Credit card 27,491 11.98 3,294 24,757 12.46 3,084

Automobile 53,854 6.27 3,377 48,476 6.94 3,365

Other revolving credit and installment 38,834 5.48 2,127 42,135 4.80 2,024

Total consumer 444,309 5.05 22,445 439,644 5.05 22,204

Total loans (4) 834,432 4.28 35,715 802,670 4.44 35,618

Other 4,673 5.54 259 4,354 5.39 235

Total earning assets $ 1,429,667 3.39% $ 48,457 1,282,363 3.73% $ 47,892

Funding sources

Deposits:

Interest-bearing checking $ 39,729 0.07% $ 26 35,570 0.06% $ 22

Market rate and other savings 585,854 0.07 403 550,394 0.08 450

Savings certificates 38,111 0.85 323 49,510 1.13 559

Other time deposits 51,434 0.40 207 28,090 0.69 194

Deposits in foreign offices 95,889 0.14 137 76,894 0.15 112

Total interest-bearing deposits 811,017 0.14 1,096 740,458 0.18 1,337

Short-term borrowings 60,111 0.10 62 54,716 0.13 71

Long-term debt 167,420 1.49 2,488 134,937 1.92 2,585

Other liabilities 14,401 2.65 382 12,471 2.46 307

Total interest-bearing liabilities 1,052,949 0.38 4,028 942,582 0.46 4,300

Portion of noninterest-bearing funding sources 376,718 — — 339,781 — —

Total funding sources $ 1,429,667 0.28 4,028 1,282,363 0.33 4,300

Net interest margin and net interest income on a taxable-

equivalent basis (5) 3.11% $ 44,429 3.40% $ 43,592

Noninterest-earning assets

Cash and due from banks $ 16,361 16,272

Goodwill 25,687 25,637

Other 121,634 121,711

Total noninterest-earning assets $ 163,682 163,620

Noninterest-bearing funding sources

Deposits $ 303,127 280,229

Other liabilities 56,985 58,178

Total equity 180,288 164,994

Noninterest-bearing funding sources used to

fund earning assets (376,718) (339,781)

Net noninterest-bearing funding sources $ 163,682 163,620

Total assets $ 1,593,349 1,445,983

(1) Our average prime rate was 3.25% for 2014, 2013, 2012, 2011, and 2010, respectively. The average three-month London Interbank Offered Rate (LIBOR) was 0.23%,

0.27%, 0.43%, 0.34%, and 0.34% for the same years, respectively.

(2) Yield/rates and amounts include the effects of hedge and risk management activities associated with the respective asset and liability categories.

38