Wells Fargo 2014 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

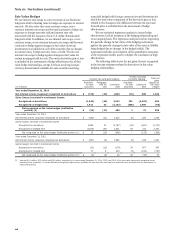

Cash Flow Hedges

We use interest rate swaps to hedge the variability in interest

payments received on certain floating-rate commercial loans and

paid on certain floating-rate debt due to changes in the

benchmark interest rate. Gains and losses on derivatives that are

reclassified from OCI to interest income (for loans) and interest

expense (for debt) in the current period are included in the line

item in which the hedged item’s effect on earnings is recorded.

All parts of gain or loss on these derivatives are included in the

assessment of hedge effectiveness. We assess hedge effectiveness

using regression analysis, both at inception of the hedging

relationship and on an ongoing basis. The regression analysis

involves regressing the periodic changes in cash flows of the

hedging instrument against the periodic changes in cash flows of

the forecasted transaction being hedged due to changes in the

hedged risk(s). The assessment includes an evaluation of the

quantitative measures of the regression results used to validate

the conclusion of high effectiveness.

Based upon current interest rates, we estimate that

$758 million (pre tax) of deferred net gains on derivatives in OCI

at December 31, 2014, will be reclassified into net interest

income during the next twelve months. Future changes to

interest rates may significantly change actual amounts

reclassified to earnings. We are hedging our exposure to the

variability of future cash flows for all forecasted transactions for

a maximum of 7 years.

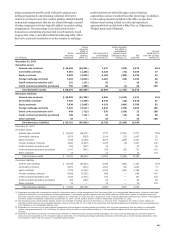

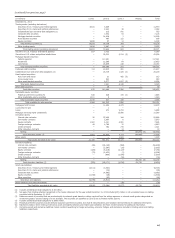

The following table shows the net gains (losses) recognized

related to derivatives in cash flow hedging relationships.

Year ended December 31,

(in millions) 2014 2013 2012

Gains (losses) (pre tax) recognized in OCI on derivatives

Gains (pre tax) reclassified from cumulative OCI into net income (1)

Gains (losses) (pre tax) recognized in noninterest income for hedge ineffectiveness (2)

$ 952

545

2

(32)

296

1

52

388

(1)

(1) See Note 23 (Other Comprehensive Income) for detail on components of net income.

(2) None of the change in value of the derivatives was excluded from the assessment of hedge effectiveness.

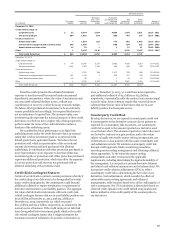

Derivatives Not Designated as Hedging Instruments

We use economic hedge derivatives primarily to hedge the risk of

changes in the fair value of certain residential MHFS, certain

loans held for investment, residential MSRs measured at fair

value, derivative loan commitments and other interests held.

The resulting gain or loss on these economic hedge derivatives is

reflected in mortgage banking noninterest income, net gains

(losses) from equity investments and other noninterest income.

The derivatives used to hedge MSRs measured at fair value,

which include swaps, swaptions, constant maturity mortgages,

forwards, Eurodollar and Treasury futures and options

contracts, resulted in net derivative gains of $3.5 billion in 2014,

net derivative losses of $2.9 billion in 2013 and net derivative

gains of $3.6 billion in 2012, which are included in mortgage

banking noninterest income. The aggregate fair value of these

derivatives was a net asset of $492 million at December 31, 2014

and a net liability of $531 million at December 31, 2013. The

change in fair value of these derivatives for each period end is

due to changes in the underlying market indices and interest

rates as well as the purchase and sale of derivative financial

instruments throughout the period as part of our dynamic MSR

risk management process.

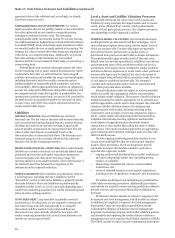

Interest rate lock commitments for mortgage loans that we

intend to sell are considered derivatives. Our interest rate

exposure on these derivative loan commitments, as well as

substantially all residential MHFS, is hedged with economic

hedge derivatives such as swaps, forwards and options,

Eurodollar futures and options, and Treasury futures, forwards

and options contracts. The derivative loan commitments,

economic hedge derivatives and residential MHFS are carried at

fair value with changes in fair value included in mortgage

banking noninterest income. For the fair value measurement of

interest rate lock commitments we include, at inception and

during the life of the loan commitment, the expected net future

cash flows related to the associated servicing of the loan. Fair

value changes subsequent to inception are based on changes in

fair value of the underlying loan resulting from the exercise of

the commitment and changes in the probability that the loan will

not fund within the terms of the commitment (referred to as a

fall-out factor). The value of the underlying loan is affected

primarily by changes in interest rates and the passage of time.

However, changes in investor demand can also cause changes in

the value of the underlying loan value that cannot be hedged.

The aggregate fair value of derivative loan commitments on the

balance sheet was a net asset of $98 million and a net liability of

$26 million at December 31, 2014 and December 31, 2013,

respectively, and is included in the caption “Interest rate

contracts” under “Customer accommodation, trading and other

derivatives” in the first table in this Note.

We also enter into various derivatives primarily to provide

derivative products to customers. These derivatives are not

linked to specific assets and liabilities on the balance sheet or to

forecasted transactions in an accounting hedge relationship and,

therefore, do not qualify for hedge accounting. We also enter

into derivatives for risk management that do not otherwise

qualify for hedge accounting. They are carried at fair value with

changes in fair value recorded as other noninterest income.

Customer accommodation, trading and other derivatives

also include embedded derivatives that are required to be

accounted for separately from their host contract. We

periodically issue hybrid long-term notes and CDs where the

performance of the hybrid instrument notes is linked to an

equity, commodity or currency index, or basket of such indices.

These notes contain explicit terms that affect some or all of the

cash flows or the value of the note in a manner similar to a

derivative instrument and therefore are considered to contain an

“embedded” derivative instrument. The indices on which the

performance of the hybrid instrument is calculated are not

clearly and closely related to the host debt instrument. The

“embedded” derivative is separated from the host contract and

accounted for as a derivative. Additionally, we may invest in

hybrid instruments that contain embedded derivatives, such as

credit derivatives, that are not clearly and closely related to the

host contract. In such instances, we either elect fair value option

for the hybrid instrument or separate the embedded derivative

from the host contract and account for the host contract and

derivative separately.

209