Wells Fargo 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management - Credit Risk Management (continued)

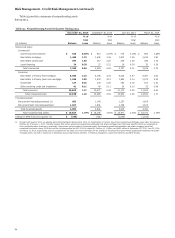

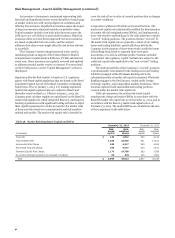

Table 41: Unresolved Repurchase Demands and Mortgage Insurance Rescissions

Government Mortgage insurance

rescissions with no demand

sponsored entities (1) Private (2) Total

($ in millions) Number of

loans Original loan

balance (3) Number of

loans Original loan

balance (3) Number of

loans Original loan

balance (3) Number of

loans Original loan

balance (3)

2014

December 31, 546 $ 118 173 $ 34 120 $ 31 839 $ 183

September 30, 426 93 322 75 233 52 981 220

June 30, 678 149 362 80 305 66 1,345 295

March 31, 599 126 391 89 409 90 1,399 305

2013

December 31, 674 124 2,260 497 394 87 3,328 708

September 30, 4,422 958 1,240 264 385 87 6,047 1,309

June 30, 6,313 1,413 1,206 258 561 127 8,080 1,798

March 31, 5,910 1,371 1,278 278 652 145 7,840 1,794

(1) Includes unresolved repurchase demands of 4 and $1 million, 7 and $1 million, 14 and $3 million, 25 and $3 million, 42 and $6 million, 1,247 and $225 million, 942 and

$190 million and 674 and $147 million at December 31, September 30, June 30 and March 31, 2014, and December 31, September 30, June 30 and March 31, 2013,

respectively, received from investors on mortgage servicing rights acquired from other originators. We generally have the right of recourse against the seller and may be

able to recover losses related to such repurchase demands subject to counterparty risk associated with the seller.

(2) As part of our representations and warranties in our loan sales contracts, we typically represent to GSEs and private investors that certain loans have mortgage insurance

to the extent there are loans that have loan to value ratios in excess of 80% that require mortgage insurance. To the extent the mortgage insurance is rescinded by the

mortgage insurer due to a claim of breach of a contractual representation or warranty, the lack of insurance may result in a repurchase demand from an investor. Similar to

repurchase demands, we evaluate mortgage insurance rescission notices for validity and appeal for reinstatement if the rescission was not based on a contractual breach.

When investor demands are received due to lack of mortgage insurance, they are reported as unresolved repurchase demands based on the applicable investor category

for the loan (GSE or private).

(3) While the original loan balances related to these demands are presented above, the establishment of the repurchase liability is based on a combination of factors, such as

our appeals success rates, reimbursement by correspondent and other third party originators, and projected loss severity, which is driven by the difference between the

current loan balance and the estimated collateral value less costs to sell the property.

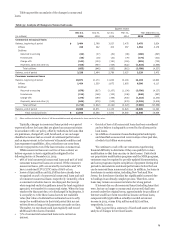

Table 42 summarizes the changes in our mortgage $746 million and the $508 million cash payments for the

repurchase liability. We incurred net losses on repurchased FHLMC and FNMA settlement agreements, respectively.

loans and investor reimbursements totaling $144 million in

2014, compared with $481 million in 2013, excluding the

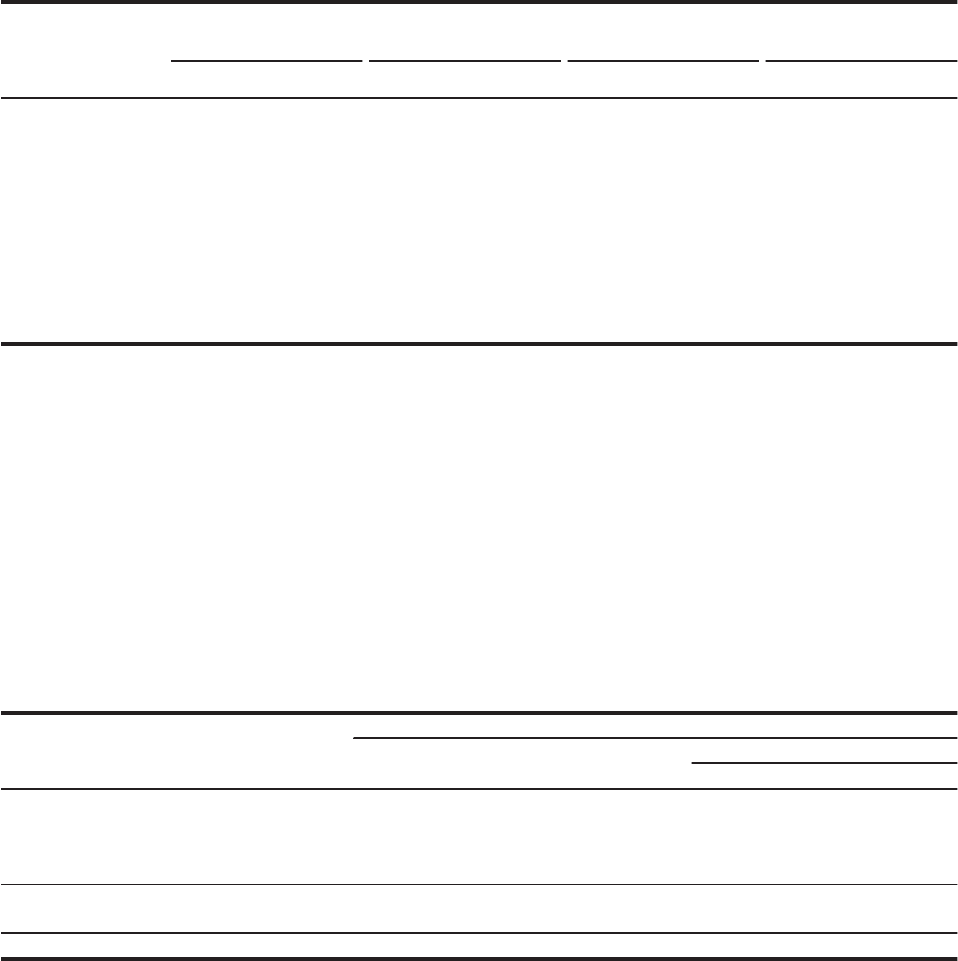

Table 42: Changes in Mortgage Repurchase Liability

Quarter ended

Dec 31, Sep 30, Jun 30, Mar 31, Year ended Dec. 31,

(in millions) 2014 2014 2014 2014 2014 2013 2012

Balance, beginning of period $ 669 766 799 899 899 2,206 1,326

Provision for repurchase losses:

Loan sales 10 12 12 10 44 143 275

Change in estimate (1) (49) (93) (38) (4) (184) 285 1,665

Total additions (reductions) (39) (81) (26) 6 (140) 428 1,940

Losses (2) (15) (16) (7) (106) (144) (1,735) (1,060)

Balance, end of period $ 615 669 766 799 615 899 2,206

(1) Results from changes in investor demand and mortgage insurer practices, credit deterioration and changes in the financial stability of correspondent lenders.

(2) Year ended December 31, 2013, reflects $746 million as a result of the agreement with FHLMC that resolves substantially all repurchase liabilities related to loans sold to

FHLMC prior to January 1, 2009. Year ended December 31, 2013, reflects $508 million as a result of the agreement with FNMA that resolves substantially all repurchase

liabilities related to loans sold to FNMA that were originated prior to January 1, 2009.

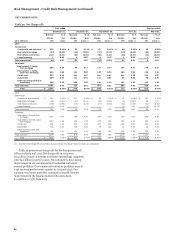

Our liability for mortgage repurchases, included in “Accrued

expenses and other liabilities” in our consolidated balance sheet,

represents our best estimate of the probable loss that we expect

to incur for various representations and warranties in the

contractual provisions of our sales of mortgage loans. The

mortgage repurchase liability estimation process requires

management to make difficult, subjective and complex

judgments about matters that are inherently uncertain,

including demand expectations, economic factors, and the

specific characteristics of the loans subject to repurchase. Our

evaluation considers all vintages and the collective actions of the

GSEs and their regulator, the Federal Housing Finance Agency

(FHFA), mortgage insurers and our correspondent lenders. We

maintain regular contact with the GSEs, the FHFA, and other

significant investors to monitor their repurchase demand

practices and issues as part of our process to update our

repurchase liability estimate as new information becomes

available. The liability was $615 million at December 31, 2014,

and $899 million at December 31, 2013. In 2014, we released

$140 million, which increased net gains on mortgage loan

origination/sales activities, compared with a provision of

$428 million in 2013. The release in 2014 was primarily due to a

re-estimation of our liability based on recently observed trends.

Because of the uncertainty in the various estimates

underlying the mortgage repurchase liability, there is a range of

losses in excess of the recorded mortgage repurchase liability

that are reasonably possible. The estimate of the range of

possible loss for representations and warranties does not

84