Wells Fargo 2014 Annual Report Download - page 234

Download and view the complete annual report

Please find page 234 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

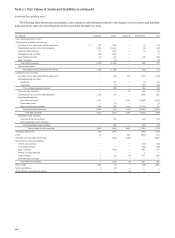

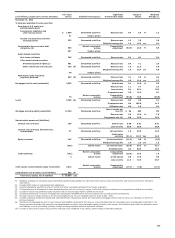

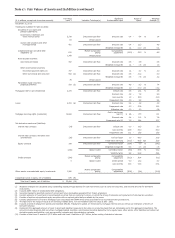

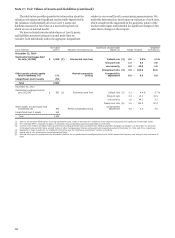

Note 17: Fair Values of Assets and Liabilities (continued)

Fair Value Option

The fair value option is an irrevocable election, generally only

permitted upon initial recognition of financial assets or

liabilities, to measure eligible financial instruments at fair value

with changes in fair value reflected in earnings. We may elect the

fair value option to align the measurement model with how the

financial assets or liabilities are managed or to reduce

complexity or accounting asymmetry. Following is a discussion

of the portfolios for which we elected the fair value option.

TRADING ASSETS - LOANS We engage in holding loans for

market-making purposes to support the buying and selling

demands of our customers. These loans are generally held for a

short period of time and managed within parameters of

internally approved market risk limits. We have elected to

measure and carry them at fair value, which best aligns with our

risk management practices. Fair value for these loans is

primarily determined using readily available market data based

on recent transaction prices for similar loans.

MORTGAGES HELD FOR SALE (MHFS) We measure MHFS at

fair value for MHFS originations for which an active secondary

market and readily available market prices exist to reliably

support fair value pricing models used for these loans. Loan

origination fees on these loans are recorded when earned, and

related direct loan origination costs are recognized when

incurred. We also measure at fair value certain of our other

interests held related to residential loan sales and

securitizations. We believe fair value measurement for MHFS

and other interests held, which we hedge with economic hedge

derivatives along with our MSRs measured at fair value, reduces

certain timing differences and better matches changes in the

value of these assets with changes in the value of derivatives

used as economic hedges for these assets.

LOANS HELD FOR SALE (LHFS) We elected to measure certain

LHFS portfolios at fair value in conjunction with customer

accommodation activities, which better aligns the measurement

basis of the assets held with our management objectives given

the trading nature of these portfolios.

LOANS Loans that we measure at fair value consist

predominantly of reverse mortgage loans previously transferred

under a GNMA reverse mortgage securitization program

accounted for as a secured borrowing. Before the transfer, they

were classified as MHFS measured at fair value and, as such,

remain carried on our balance sheet under the fair value option.

OTHER FINANCIAL INSTRUMENTS We elected to measure at

fair value certain letters of credit and nonmarketable equity

securities that are hedged with derivative instruments to better

reflect the economics of the transactions. The letters of credit are

included in trading account assets or liabilities, and the

nonmarketable equity securities are included in other assets.

Similarly, we may elect fair value option for the assets and

liabilities of certain consolidated VIEs. This option is generally

elected for newly consolidated VIEs for which predominantly all

of our interests, prior to consolidation, are carried at fair value

with changes in fair value recorded to earnings. Accordingly,

such an election allows us to continue fair value accounting

through earnings for those interests and eliminate income

statement mismatch otherwise caused by differences in the

measurement basis of the consolidated VIEs assets and

liabilities.

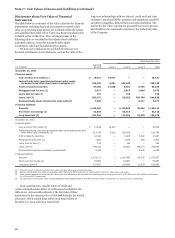

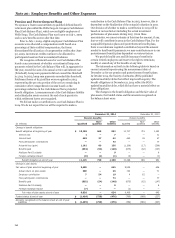

The following table reflects differences between the fair

value carrying amount of certain assets and liabilities for which

we have elected the fair value option and the contractual

aggregate unpaid principal amount at maturity.

December 31, 2014 December 31, 2013

Fair value Fair value

carrying carrying

amount less amount less

Fair value Aggregate aggregate Fair value Aggregate aggregate

carrying unpaid unpaid carrying unpaid unpaid

(in millions) amount principal principal amount principal principal

Trading assets - loans:

Total loans $ 1,387 1,410 (23) 2,360 2,385 (25)

Nonaccrual loans — 1 (1) 26 32 (6)

Mortgages held for sale:

Total loans 15,565 15,246 319 13,879 13,966 (87)

Nonaccrual loans 160 252 (92) 205 359 (154)

Loans 90 days or more past due and still accruing 27 30 (3) 39 46 (7)

Loans held for sale:

Total loans 1 10 (9) 1 9 (8)

Nonaccrual loans 1 10 (9) 1 9 (8)

Loans:

Total loans 5,788 5,527 261 5,995 5,674 321

Nonaccrual loans 367 376 (9) 188 188 —

Other assets (1) 2,512 n/a n/a 1,386 n/a n/a

Long-term debt — — — — (199) 199 (2)

(1) Consists of nonmarketable equity investments carried at fair value. See Note 7 (Premises, Equipment, Lease Commitments and Other Assets) for more information.

(2) Represents collateralized, non-recourse debt securities issued by certain of our consolidated securitization VIEs that are held by third party investors. To the extent cash

flows from the underlying collateral are not sufficient to pay the unpaid principal amount of the debt, those third party investors absorb losses.

232