Wells Fargo 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

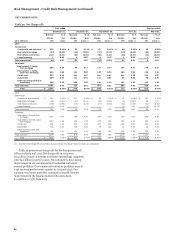

Table 44: Earnings Sensitivity Over 24 Month Horizon

Relative to Most Likely Earnings Plan

Most Lower rates Higher rates

likely Scenario 1 Scenario 2 Scenario 3 Scenario 4

Ending rates:

Federal funds 1.87 % 0.25 1.61 2.10 5.00

10-year

treasury (1) 3.76 1.70 3.26 4.26 6.01

Earnings relative

to most likely N/A (2)-(3) % (1)-(2) 0 - 5 >5

(1) U.S. Constant Maturity Treasury Rate

We use the investment securities portfolio and exchange-

traded and over-the-counter (OTC) interest rate derivatives to

hedge our interest rate exposures. See the “Balance Sheet

Analysis - Investment Securities” section in this Report for more

information on the use of the available-for-sale and held-to-

maturity securities portfolios. The notional or contractual

amount, credit risk amount and fair value of the derivatives used

to hedge our interest rate risk exposures as of

December 31, 2014, and December 31, 2013, are presented in

Note 16 (Derivatives) to Financial Statements in this Report. We

use derivatives for asset/liability management in two main ways:

• to convert the cash flows from selected asset and/or liability

instruments/portfolios, including investments, commercial

loans and long-term debt, from fixed-rate payments to

floating-rate payments, or vice versa; and

• to economically hedge our mortgage origination pipeline,

funded mortgage loans and MSRs using interest rate swaps,

swaptions, futures, forwards and options.

MORTGAGE BANKING INTEREST RATE AND MARKET RISK

We originate, fund and service mortgage loans, which subjects

us to various risks, including credit, liquidity and interest rate

risks. Based on market conditions and other factors, we reduce

credit and liquidity risks by selling or securitizing some or all of

the long-term fixed-rate mortgage loans we originate and most

of the ARMs we originate. On the other hand, we may hold

originated ARMs and fixed-rate mortgage loans in our loan

portfolio as an investment for our growing base of core deposits.

We determine whether the loans will be held for investment or

held for sale at the time of commitment. We may subsequently

change our intent to hold loans for investment and sell some or

all of our ARMs or fixed-rate mortgages as part of our corporate

asset/liability management. We may also acquire and add to our

securities available for sale a portion of the securities issued at

the time we securitize MHFS.

As expected, with the increase in average mortgage interest

rates in 2014, our mortgage banking revenue declined as the

level of mortgage loan refinance activity decreased compared

with 2013. The decline in mortgage loan origination income

(primarily driven by the decline in mortgage loan refinancing

volume) more than offset the increase in net servicing income.

Despite the increase in average mortgage interest rates, the slow

recovery in the housing sector, and the continued lack of

liquidity in the nonconforming secondary markets, our mortgage

banking revenue was strong in 2014, reflecting the

complementary origination and servicing strengths of the

business. The secondary market for agency-conforming

mortgages functioned well during 2014.

Interest rate and market risk can be substantial in the

mortgage business. Changes in interest rates may potentially

reduce total origination and servicing fees, the value of our

residential MSRs measured at fair value, the value of MHFS and

the associated income and loss reflected in mortgage banking

noninterest income, the income and expense associated with

instruments (economic hedges) used to hedge changes in the fair

value of MSRs and MHFS, and the value of derivative loan

commitments (interest rate “locks”) extended to mortgage

applicants.

Interest rates affect the amount and timing of origination

and servicing fees because consumer demand for new mortgages

and the level of refinancing activity are sensitive to changes in

mortgage interest rates. Typically, a decline in mortgage interest

rates will lead to an increase in mortgage originations and fees

and may also lead to an increase in servicing fee income,

depending on the level of new loans added to the servicing

portfolio and prepayments. Given the time it takes for consumer

behavior to fully react to interest rate changes, as well as the

time required for processing a new application, providing the

commitment, and securitizing and selling the loan, interest rate

changes will affect origination and servicing fees with a lag. The

amount and timing of the impact on origination and servicing

fees will depend on the magnitude, speed and duration of the

change in interest rates.

We measure originations of MHFS at fair value where an

active secondary market and readily available market prices exist

to reliably support fair value pricing models used for these loans.

Loan origination fees on these loans are recorded when earned,

and related direct loan origination costs are recognized when

incurred. We also measure at fair value certain of our other

interests held related to residential loan sales and

securitizations. We believe fair value measurement for MHFS

and other interests held, which we hedge with free-standing

derivatives (economic hedges) along with our MSRs measured at

fair value, reduces certain timing differences and better matches

changes in the value of these assets with changes in the value of

derivatives used as economic hedges for these assets. During

2014 and 2013, in response to continued secondary market

illiquidity, we continued to originate certain prime non-agency

loans to be held for investment for the foreseeable future rather

than to be held for sale. In addition, in 2013, we originated

certain prime agency-eligible loans to be held for investment as

part of our asset/liability management strategy.

We initially measure all of our MSRs at fair value and carry

substantially all of them at fair value depending on our strategy

for managing interest rate risk. Under this method, the MSRs

are recorded at fair value at the time we sell or securitize the

related mortgage loans. The carrying value of MSRs carried at

fair value reflects changes in fair value at the end of each quarter

and changes are included in net servicing income, a component

of mortgage banking noninterest income. If the fair value of the

MSRs increases, income is recognized; if the fair value of the

MSRs decreases, a loss is recognized. We use a dynamic and

sophisticated model to estimate the fair value of our MSRs and

periodically benchmark our estimates to independent appraisals.

The valuation of MSRs can be highly subjective and involve

complex judgments by management about matters that are

inherently unpredictable. See “Critical Accounting Policies -

Valuation of Residential Mortgage Servicing Rights” section in

this Report for additional information. Changes in interest rates

influence a variety of significant assumptions included in the

periodic valuation of MSRs, including prepayment speeds,

expected returns and potential risks on the servicing asset

portfolio, the value of escrow balances and other servicing

valuation elements.

A decline in interest rates generally increases the propensity

for refinancing, reduces the expected duration of the servicing

portfolio and therefore reduces the estimated fair value of MSRs.

This reduction in fair value causes a charge to income for MSRs

carried at fair value, net of any gains on free-standing derivatives

87