Wells Fargo 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VaR is a statistical risk measure used to estimate the potential

loss from adverse moves in the financial markets. The VaR

measures assume that historical changes in market values

(historical simulation analysis) are representative of the

potential future outcomes and measure the expected loss over a

given time interval (for example, 1 day or 10 days) within a given

confidence level. Our historical simulation analysis approach

uses historical observations of daily changes of each of the

market risk factors from each trading day in the previous

12 months. The risk drivers of each market risk exposure are

updated on a daily basis. We measure and report VaR for a 1-day

holding period at a 99% confidence level. This means that we

would expect to incur single day losses greater than predicted by

VaR estimates for the measured positions one time in every

100 trading days. We treat data from all historical periods as

equally relevant and consider using data for the previous 12

months as appropriate for determining VaR. We believe using a

12-month look back period helps ensure the Company’s VaR is

responsive to current market conditions.

VaR measurement between different financial institutions

is not readily comparable due to modeling and assumption

differences from company to company. VaR measures are more

useful when interpreted as an indication of trends rather than an

absolute measure to be compared across financial institutions.

VaR models are subject to limitations which include, but are

not limited to, the use of historical changes in market factors

that may not accurately reflect future changes in market factors,

and the inability to predict market liquidity in extreme market

conditions. All limitations such as model inputs, model

assumptions, and calculation methodology risk are monitored by

the Corporate Market Risk Group and the Corporate Model Risk

Group.

The VaR models measure exposure to the following

categories:

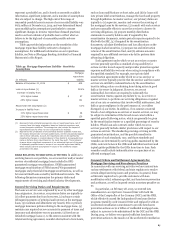

Table 47: Trading 1-Day 99% General VaR Risk Category

• credit risk - exposures from corporate credit spreads, asset-

backed security spreads, and mortgage prepayments.

• interest rate risk - exposures from changes in the level,

scope, and curvature of interest rate curves and the volatility

of interest rates.

• equity risk - exposures to changes in equity prices and

volatilities of single name, index, and basket exposure.

• commodity risk - exposures to changes in commodity prices

and volatilities.

• foreign exchange risk - exposures to changes in foreign

exchange rates and volatilities.

VaR is the primary market risk management measure for

the assets and liabilities classified as trading and is used as a

supplemental analysis tool to monitor exposures classified as

available for sale (AFS) and other exposures that we carry at fair

value.

Trading VaR is the measure used to provide insight into the

market risk exhibited by the Company’s trading positions. The

Company calculates Trading VaR for risk management purposes

to establish line of business and Company-wide risk limits.

Trading VaR is calculated based on all trading positions

classified as trading assets or trading liabilities on our balance

sheet.

Table 47 shows the results of the Company’s Trading VaR by

risk category. As presented in the table, average Trading VaR

was $21 million for the quarter ended December 31, 2014,

compared with $17 million for the quarter ended

September 30, 2014. The increase was primarily driven by

changes in portfolio composition.

Quarter ended

(in millions) Period

end Average

December 31, 2014

Low High Period

end Average

September 30, 2014

Low High

General VaR Risk Categories

Credit $ 10 14 10 19 17 16 12 20

Interest rate 24 27 19 37 29 30 25 39

Equity

Commodity

Foreign exchange

Diversification benefit (1)

9

1

1

(23)

8

1

1

(30)

6

1

—

12

2

1

8

1

—

(37)

7

1

1

(38)

6

1

—

9

1

1

Total VaR 22 21 18 17

(1) The period-end VaR was less than the sum of the VaR components described above, which is due to portfolio diversification. The diversification effect arises because the

risks are not perfectly correlated causing a portfolio of positions to usually be less risky than the sum of the risks of the positions alone. The diversification benefit is not

meaningful for low and high metrics since they may occur on different days.

Sensitivity Analysis Given the inherent limitations of the VaR Stress Testing While VaR captures the risk of loss due to adverse

models, the Company uses other measures, including sensitivity changes in markets using recent historical market data, stress

analysis, to measure and monitor risk. Sensitivity analysis is the testing captures the Company’s exposure to extreme but low

measure of exposure to a single risk factor, such as a 0.01% probability market movements. Stress scenarios estimate the

increase in interest rates or a 1% increase in equity prices. We risk of losses based on management’s assumptions of abnormal

conduct and monitor sensitivity on interest rates, credit spreads, but severe market movements such as severe credit spread

volatility, equity, commodity, and foreign exchange exposure. widening or a large decline in equity prices. These scenarios

Sensitivity analysis complements VaR as it provides an assume that the market moves happen instantaneously and no

indication of risk relative to each factor irrespective of historical repositioning or hedging activity takes place to mitigate losses as

market moves. events unfold (a conservative approach since experience

demonstrates otherwise).

91